Answered step by step

Verified Expert Solution

Question

1 Approved Answer

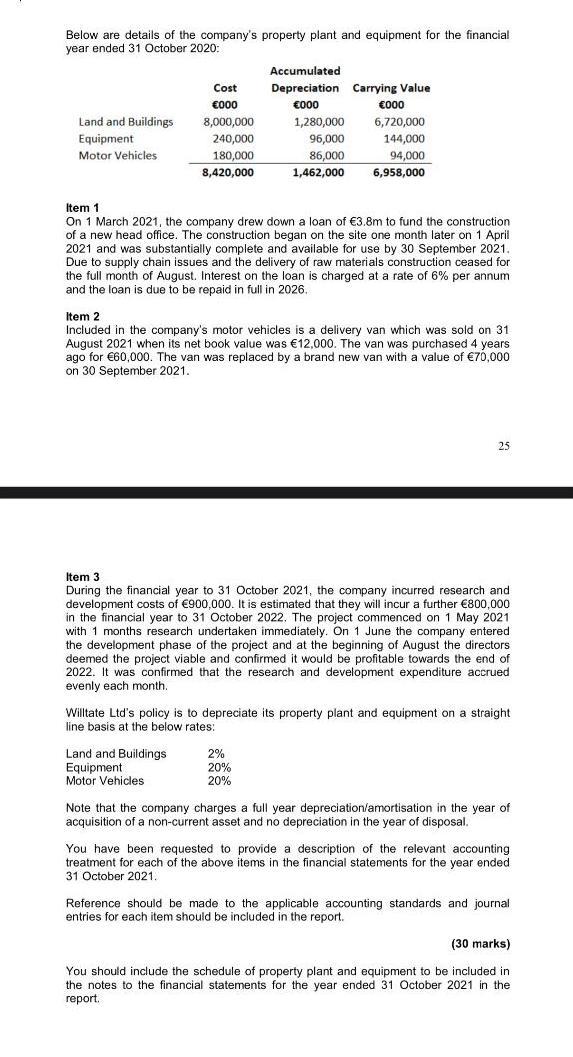

Below are details of the company's property plant and equipment for the financial year ended 31 October 2020: Land and Buildings Equipment Motor Vehicles

Below are details of the company's property plant and equipment for the financial year ended 31 October 2020: Land and Buildings Equipment Motor Vehicles Cost 000 8,000,000 240,000 180,000 8,420,000 Accumulated Depreciation Carrying Value 000 1,280,000 96,000 86,000 1,462,000 Item 1 On 1 March 2021, the company drew down a loan of 3.8m to fund the construction of a new head office. The construction began on the site one month later on 1 April 2021 and was substantially complete and available for use by 30 September 2021. Due to supply chain issues and the delivery of raw materials construction ceased for the full month of August. Interest on the loan is charged at a rate of 6% per annum and the loan is due to be repaid in full in 2026. Land and Buildings Equipment Motor Vehicles 000 6,720,000 144,000 94,000 6,958,000 Item 2 Included in the company's motor vehicles is a delivery van which was sold on 31 August 2021 when its net book value was 12,000. The van was purchased 4 years ago for 60,000. The van was replaced by a brand new van with a value of 70,000 on 30 September 2021. 2% 20% 20% Item 3 During the financial year to 31 October 2021, the company incurred research and development costs of 900,000. It is estimated that they will incur a further 800,000 in the financial year to 31 October 2022. The project commenced on 1 May 2021 with 1 months research undertaken immediately. On 1 June the company entered the development phase of the project and at the beginning of August the directors deemed the project viable and confirmed it would be profitable towards the end of 2022. It was confirmed that the research and development expenditure accrued evenly each month. 25 Willtate Ltd's policy is to depreciate its property plant and equipment on a straight. line basis at the below rates: Note that the company charges a full year depreciation/amortisation in the year of acquisition of a non-current asset and no depreciation in the year of disposal. You have been requested to provide a description of the relevant accounting treatment for each of the above items in the financial statements for the year ended 31 October 2021. Reference should be made to the applicable accounting standards and journal entries for each item should be included in the report. (30 marks) You should include the schedule of property plant and equipment to be included in the notes to the financial statements for the year ended 31 October 2021 in the report.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Accounting Treatment for Each Item Item 1 Construction of New Head Office The construction of the new head office should be recognized as Property Plant and Equipment under IAS 16 The cost of the cons...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started