Answered step by step

Verified Expert Solution

Question

1 Approved Answer

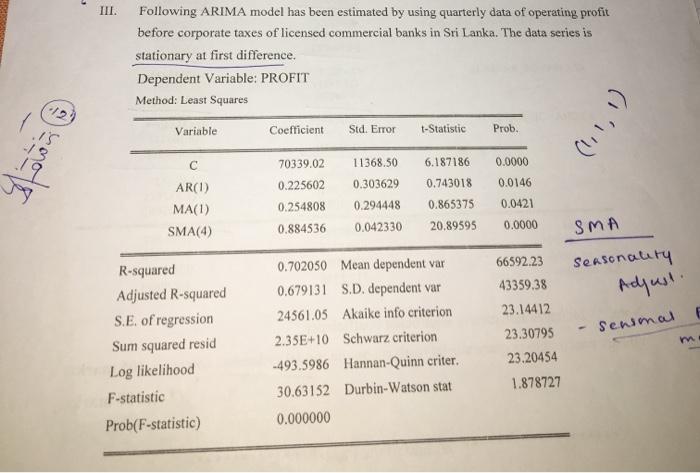

(12) is 13 III. Following ARIMA model has been estimated by using quarterly data of operating profit before corporate taxes of licensed commercial banks

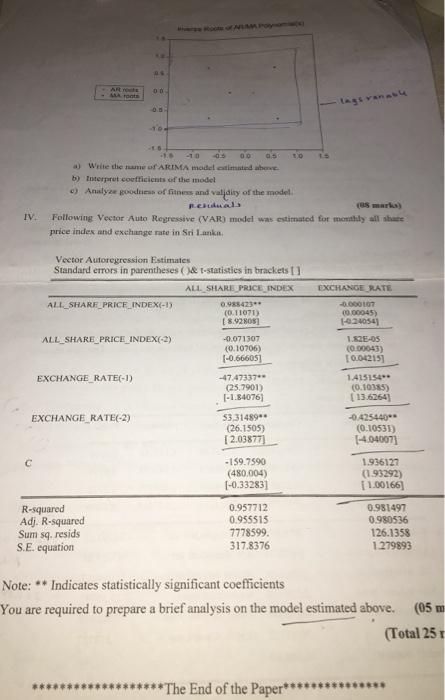

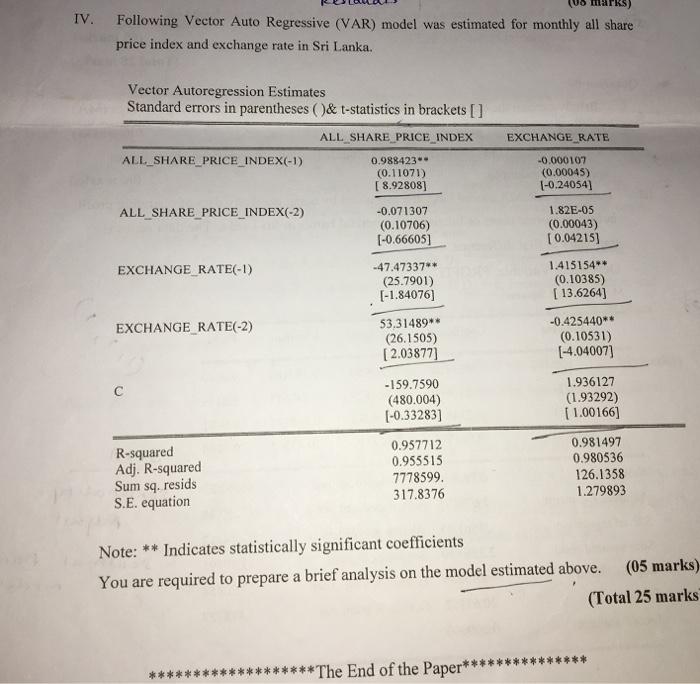

(12) is 13 III. Following ARIMA model has been estimated by using quarterly data of operating profit before corporate taxes of licensed commercial banks in Sri Lanka. The data series is stationary at first difference. Dependent Variable: PROFIT Method: Least Squares Variable C AR(1) MA(1) SMA(4) R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood F-statistic Prob(F-statistic) Coefficient, 70339.02 0.225602 0.254808 0.884536 Std. Error t-Statistic Prob. 11368.50 6.187186 0.0000 0.303629 0.743018 0.0146 0.294448 0.865375 0.0421 0.042330 20.89595 0.0000 0.702050 Mean dependent var 0.679131 S.D. dependent var 24561.05 Akaike info criterion . 2.35E+10 Schwarz criterion -493.5986 Hannan-Quinn criter.. 30.63152 Durbin-Watson stat 0.000000 66592.23 43359.38 23.14412 23.30795 23.20454 1.878727 (1, 1, 1) SMA Seasonality Adjust. - Sensmal m IV. AR res MA roots as 00 -1.6 -10 -0.5 00 0.5 a) Write the name of ARIMA model estimated above. b) Interpret coefficients of the model e) Analyze goodness of fitness and validity of the model. 40- EXCHANGE RATE(-1) Residuals (85 marks) Following Vector Auto Regressive (VAR) model was estimated for monthly all share price index and exchange rate in Sri Lanka. Vector Autoregression Estimates Standard errors in parentheses ()& t-statistics in brackets [] ALL SHARE PRICE INDEX ALL_SHARE_PRICE_INDEX(-1) EXCHANGE RATE(-2) R-squared Adj. R-squared Sum sq. resids S.E. equation ALL SHARE_PRICE_INDEX(-2) Roots of ALAM Poyom 0.988423** (0.11071) [8.92808] -0.071307 (0.10706) [-0.66605] -47.47337** (25.7901) [-1.84076) 53,31489** (26.1505) [2.03877] -159.7590 (480.004) [-0.33283] 0.957712 0.955515 7778599. 317.8376 lags vanable *********The End of the Paper*** EXCHANGE RATE -0.000107 (0.00045) (-0.24054) 1.82E-05 (0.00043) [0.04215] 1.415154** (0.10385) [13.6264] -0.425440 (0.10531) [4.04007] 1.936127 (1.93292) [1.00166] 0.981497 0.980536 126.1358 1.279893 Note: Indicates statistically significant coefficients You are required to prepare a brief analysis on the model estimated above. (05 m (Total 25 r IV. Following Vector Auto Regressive (VAR) model was estimated for monthly all share price index and exchange rate in Sri Lanka. Vector Autoregression Estimates Standard errors in parentheses ()& t-statistics in brackets [] ALL SHARE_PRICE_INDEX(-1) ALL SHARE_PRICE_INDEX(-2) EXCHANGE RATE(-1) EXCHANGE RATE(-2) R-squared Adj. R-squared Sum sq. resids S.E. equation ALL SHARE PRICE INDEX 0.988423** (0.11071) [8.92808] -0.071307 (0.10706) [-0.66605] -47.47337** (25.7901) [-1.84076] 53,31489** (26.1505) [2.03877] -159.7590 (480.004) [-0.33283] 0.957712 0.955515 7778599. 317.8376 EXCHANGE RATE *The End of the Paper** -0.000107 (0.00045) [-0.24054] 1.82E-05 (0.00043) [0.04215] 1.415154** (0.10385) [ 13.6264] -0.425440** (0.10531) [-4.04007] 1.936127 (1.93292) [1.00166] 0.981497 0.980536 126.1358 1.279893 Note: ** Indicates statistically significant coefficients You are required to prepare a brief analysis on the model estimated above. (05 marks) (Total 25 marks

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

analysis of the ARIMA and VAR models ARIMA Model The ARIMA model is a statistical model that is used to forecast time series data The model is based on the autoregressive AR and moving average MA mode...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started