Answered step by step

Verified Expert Solution

Question

1 Approved Answer

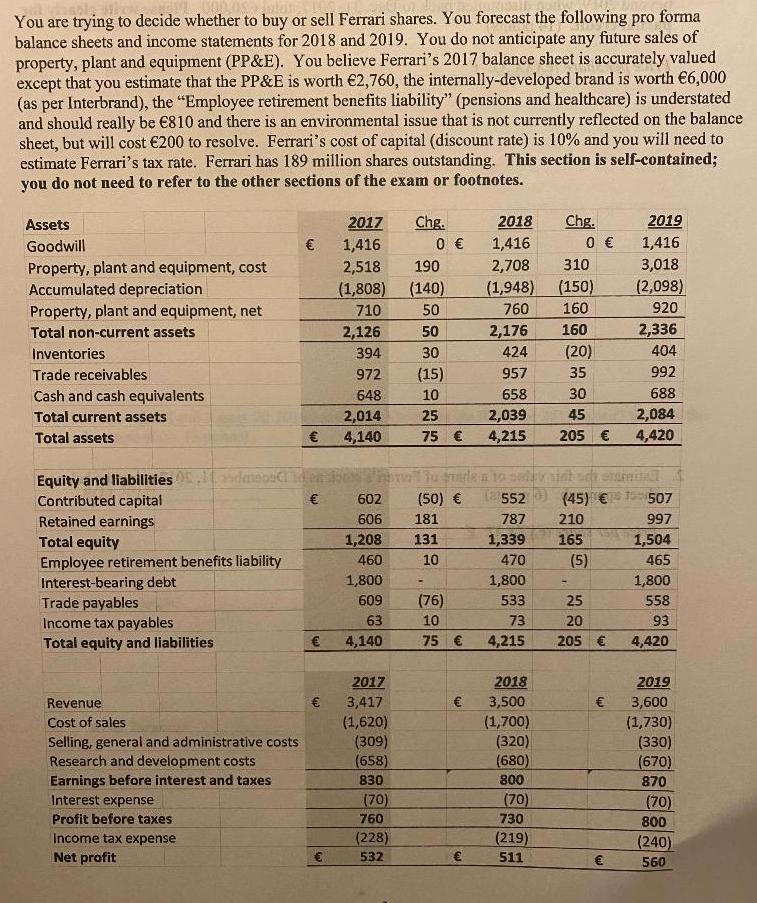

forma You are trying to decide whether to buy or sell Ferrari shares. You forecast the following pro balance sheets and income statements for

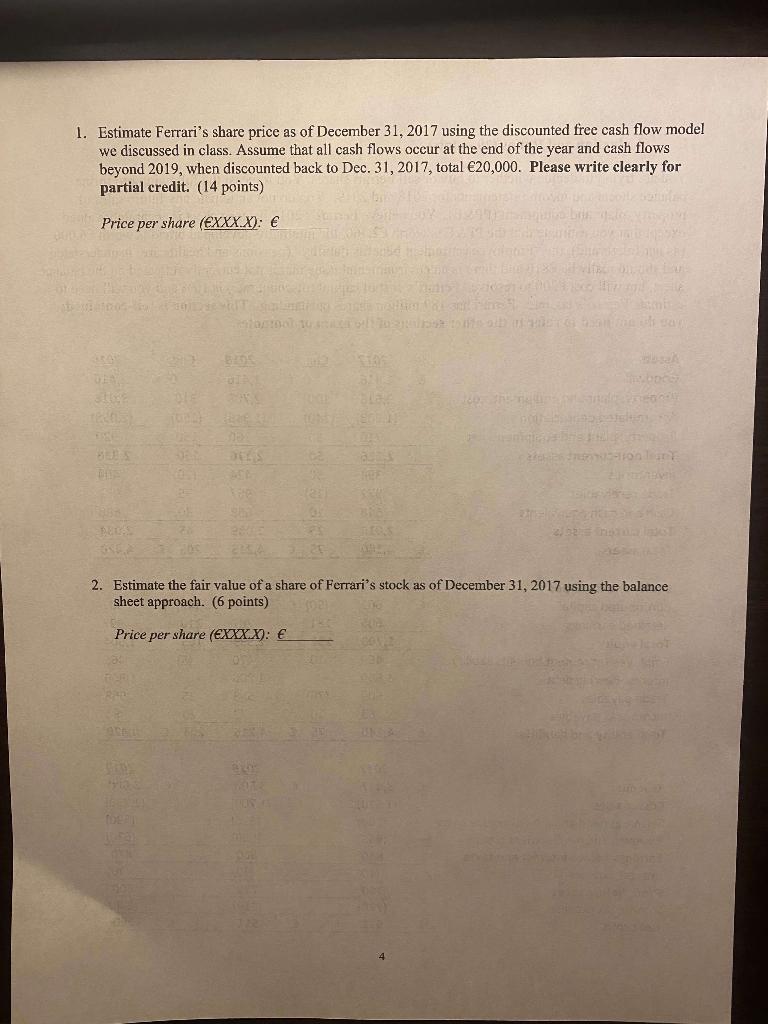

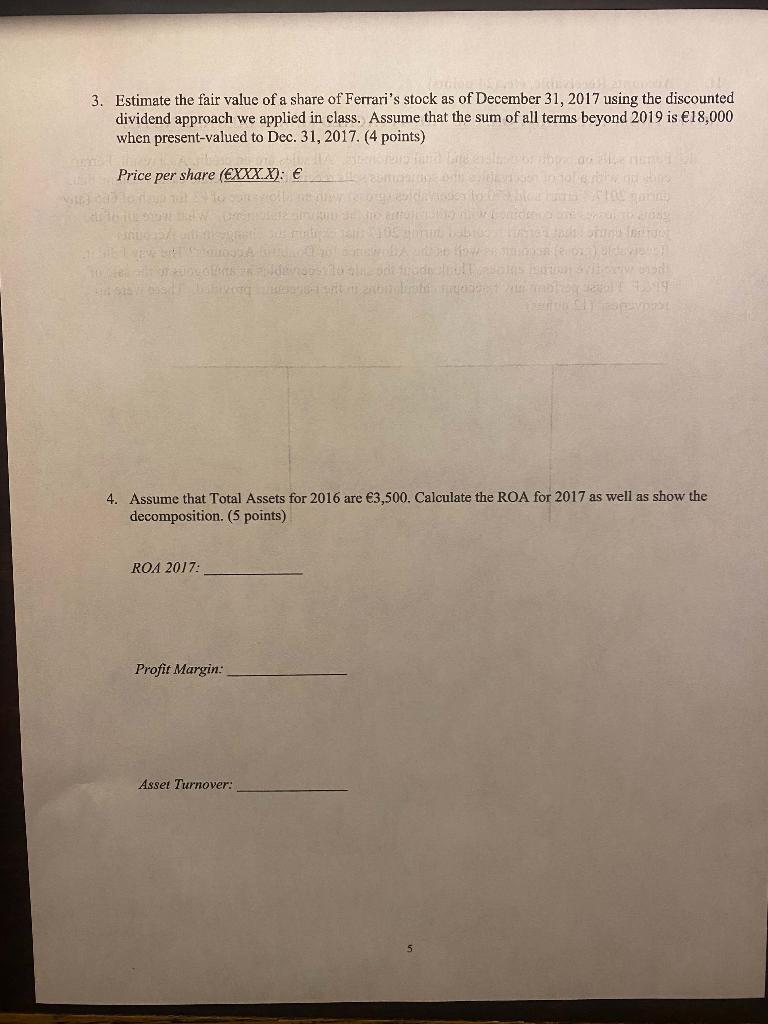

forma You are trying to decide whether to buy or sell Ferrari shares. You forecast the following pro balance sheets and income statements for 2018 and 2019. You do not anticipate any future sales of property, plant and equipment (PP&E). You believe Ferrari's 2017 balance sheet is accurately valued except that you estimate that the PP&E is worth 2,760, the internally-developed brand is worth 6,000 (as per Interbrand), the "Employee retirement benefits liability" (pensions and healthcare) is understated and should really be 810 and there is an environmental issue that is not currently reflected on the balance sheet, but will cost 200 to resolve. Ferrari's cost of capital (discount rate) is 10% and you will need to estimate Ferrari's tax rate. Ferrari has 189 million shares outstanding. This section is self-contained; you do not need to refer to the other sections of the exam or footnotes. Assets Goodwill Property, plant and equipment, cost Accumulated depreciation Property, plant and equipment, net Total non-current assets Inventories Trade receivables Cash and cash equivalents Total current assets Total assets Equity and liabilities.dmsos Contributed capital Retained earnings Total equity Employee retirement benefits liability Interest-bearing debt Trade payables Income tax payables Total equity and liabilities Revenue Cost of sales Selling, general and administrative costs Research and development costs Earnings before interest and taxes Interest expense Profit before taxes Income tax expense Net profit 2017 1,416 2,518 (1,808) 710 2,126 394 972 648 2,014 4,140 602 606 1,208 460 1,800 609 63 4,140 2017 3,417 (1,620) (309) (658) 830 (70) 760 (228) 532 Chg. 0 190 (140) 50 50 30 (15) 10 25 75 (50) 181 131 10 2018 1,416 2,708 310 (1,948) (150) 760 160 160 2,176 424 957 658 2,039 4,215 (76) 10 75 4,215 552 787 1,339 470 1,800 533 73 2018 3,500 (1,700) (320) (680) 800 (70) 730 Chg. (219) 511 0 (20) 35 30 45 205 (45) 5 210 165 (5) Starmita 25 20 205 2019 1,416 3,018 (2,098) 920 2,336 404 992 688 2,084 4,420 507 997 1,504 465 1,800 558 93 4,420 2019 3,600 (1,730) (330) (670) 870 (70) 800 (240) 560 1. Estimate Ferrari's share price as of December 31, 2017 using the discounted free cash flow model we discussed in class. Assume that all cash flows occur at the end of the year and cash flows beyond 2019, when discounted back to Dec. 31, 2017, total 20,000. Please write clearly for partial credit. (14 points) Price per share (EXXX.X): GEN, SLIVE 20 OLE DEL DINI CHS DELS 961 (21) Sept: Blue 0186 il vite on udr Lu paden of 1029 1. Um 58 seA Me bocer neurs canale Preocar DOU MENGAR CATEGORY mighaus brett prog - Franz-toneart ovire 2. Estimate the fair value of a share of Ferrari's stock as of December 31, 2017 using the balance sheet approach. (6 points) Price per share (EXXX.X): 3. Estimate the fair value of a share of Ferrari's stock as of December 31, 2017 using the discounted dividend approach we applied in class. Assume that the sum of all terms beyond 2019 is 18,000 when present-valued to Dec. 31, 2017. (4 points) Price per share (EXXX.X): nel 2416 con sol ROA 2017: Mon to garne worden and you bardag kuntien tacks orunu fer rust anosta kuunol 20 senswoba une how en Jones (e oz) oldavienoj offers Eldenors 103 odi frude Inult Boks Eirto avikoow biod Profit Margin: 4. Assume that Total Assets for 2016 are 3,500. Calculate the ROA for 2017 as well as show the decomposition. (5 points) Asset Turnover: Teich 91 PeVL

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Value 43911 474121 20000 1800 399 392 20000 1800 18991 Price 18991189 1005share 2 Price per share ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started