Question

The JTP Company, located in Jenkintown, PA, is a small manufacturer and distributor of custom machined components. Because of some successful new products marketed to

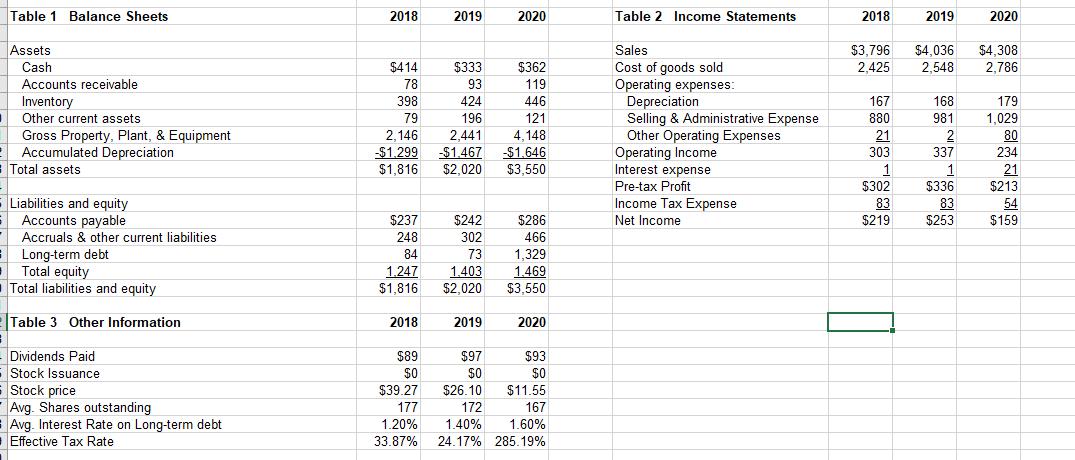

The JTP Company, located in Jenkintown, PA, is a small manufacturer and distributor of custom machined components. Because of some successful new products marketed to tool and die manufacturers, the firm has seen steady revenue growth. Expecting sales growth to continue, the company expanded operations in 2020 through significant investments in property, plant, and equipment. However, the growth has been accompanied by a precipitous drop in the company’s stock price.

You are a financial consultant who has been retained to analyze the company’s performance. Your investigative plan involves a series of in-depth interviews with management and doing some independent research on the industry. However, before starting, you want to focus your thinking to be sure you can ask the right questions. You begin by analyzing the firm’s financials over the last three years, which are presented in the supplemental datasheet. As part of your discovery process, you learn that the company sold no property, plant, or equipment during the time periods presented. Also, the company did not repay any long-term debt in 2020. The account balance of the common stock account (part of equity) did not change. And finally, the company’s normal credit terms extended to its customers are net 15.

Required Submission

Complete the following using Microsoft Excel and Word. All quantitative analysis will be done in Excel, while all qualitative analysis will be completed in Word. You must use formulas for all computations.

In Microsoft Excel:

1. Construct horizontal analysis (year-over-year growth) on the provided financial statements for 2019 and 2020.

2. Build common size balance sheets for 2018 - 2020, respectively, and common size income statements for 2018 - 2020, respectively.

3. Create Statements of Cash Flows for 2019 and 2020 using the indirect method. Also compute Free Cash Flow for each year.

4. Calculate all the financial ratios discussed in chapter 16 (use exhibit 16-6 as a guide) for 2019 and 2020.

The example didn't give much guidance only this chart.

The example didn't give much guidance only this chart.

In Microsoft Word:

1. Based on all of your financial statement analysis, what do you think is causing the decline in the company’s stock price? In other words, why might the market not be reacting favorably to JTP’s growth?

2. In light of your response above, what two (or more) specific actionable items could the company do to improve its situation? Be specific in your response, justifying your statements.

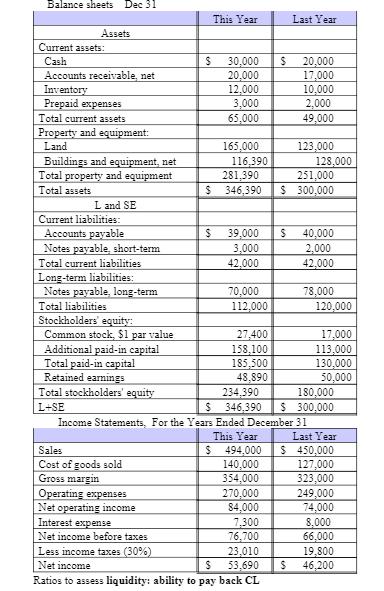

Balance sheets Dec 31 Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment: Land Buildings and equipment, net Total property and equipment Total assets L and SE Current liabilities: Accounts payable Notes payable, short-term Total current liabilities Long-term liabilities: Notes payable, long-term Total liabilities Stockholders' equity: Common stock, $1 par value Additional paid-in capital Total paid-in capital Retained earnings Total stockholders' equity L+SE S Sales Cost of goods sold Gross margin This Year 30,000 20,000 12,000 3,000 65,000 165,000 116,390 281,390 $ 346,390. $ 39,000 3,000 42,000 70,000 112,000 27,400 158,100 185,500 48,890 $ Operating expenses Net operating income Interest expense Net income before taxes Less income taxes (30%) Net income S Ratios to assess liquidity: ability to pay back CL 270,000 $4,000 Last Year $ 7,300 76,700 23,010 53,690 20,000 17,000 10,000 2,000 49,000 123,000 251,000 $ 300,000 $ Income Statements, For the Years Ended December 31 128,000 40,000 2,000 42,000 78,000 234,390 180,000 346,390 $ 300,000 120,000 This Year $ 494,000 $ 450,000 140,000 354,000 17,000 113,000 130,000 50,000 Last Year 127,000 323,000 249,000 74,000 8,000 66,000 19,800 $ 46,200

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started