Answered step by step

Verified Expert Solution

Question

1 Approved Answer

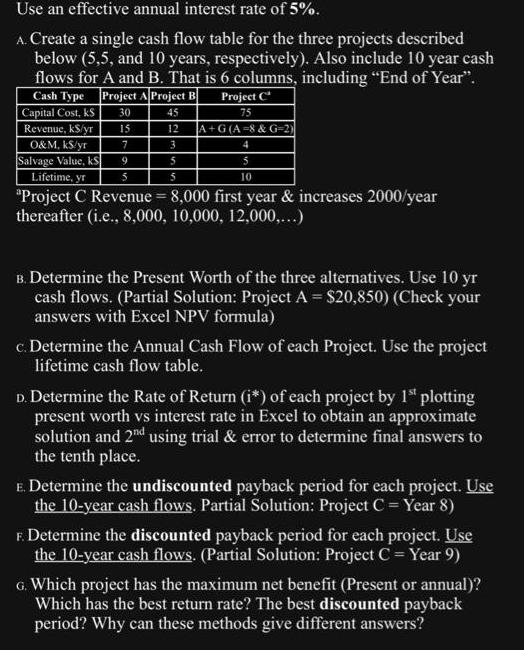

Use an effective annual interest rate of 5%. A. Create a single cash flow table for the three projects described below (5,5, and 10

Use an effective annual interest rate of 5%. A. Create a single cash flow table for the three projects described below (5,5, and 10 years, respectively). Also include 10 year cash flows for A and B. That is 6 columns, including "End of Year". Cash Type Project A Project B Project C Capital Cost, KS 30 45 75 Revenue, kS/yr 15 12 7 3 5 5 O&M, KS/yr Salvage Value, kS A+G(A-8 & G-2) 4 5 10 9 Lifetime, yr 5 "Project C Revenue = 8,000 first year & increases 2000/year thereafter (i.e., 8,000, 10,000, 12,000,...) B. Determine the Present Worth of the three alternatives. Use 10 yr cash flows. (Partial Solution: Project A = $20,850) (Check your answers with Excel NPV formula) c. Determine the Annual Cash Flow of each Project. Use the project lifetime cash flow table. D. Determine the Rate of Return (i*) of each project by 1st plotting present worth vs interest rate in Excel to obtain an approximate solution and 2nd using trial & error to determine final answers to the tenth place. E. Determine the undiscounted payback period for each project. Use the 10-year cash flows. Partial Solution: Project C = Year 8) F. Determine the discounted payback period for each project. Use the 10-year cash flows. (Partial Solution: Project C = Year 9) G. Which project has the maximum net benefit (Present or annual)? Which has the best return rate? The best discounted payback period? Why can these methods give different answers?

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

A Cash Type Project A Project B Project C Capital Cost KS 30 45 75 Revenue kSyr 15 12 AGA8 G2 OM kSyr 7 3 4 Salvage Value KS 9 5 5 Lifetime yr 5 5 10 Project C Revenue 8000 first year increases 2000ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started