Answered step by step

Verified Expert Solution

Question

1 Approved Answer

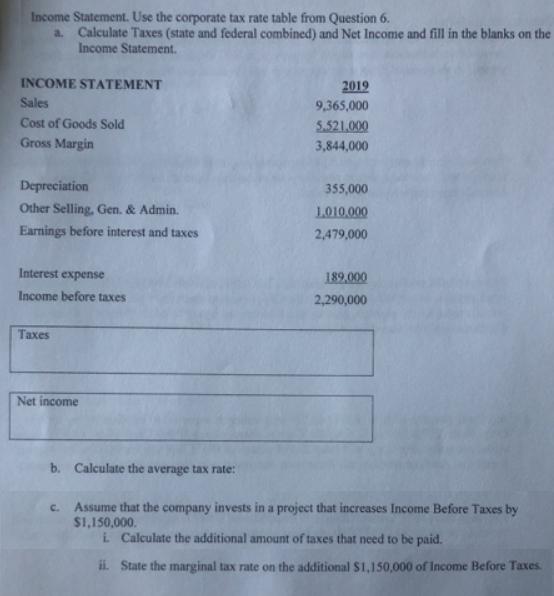

Income Statement. Use the corporate tax rate table from Question 6. a. Calculate Taxes (state and federal combined) and Net Income and fill in

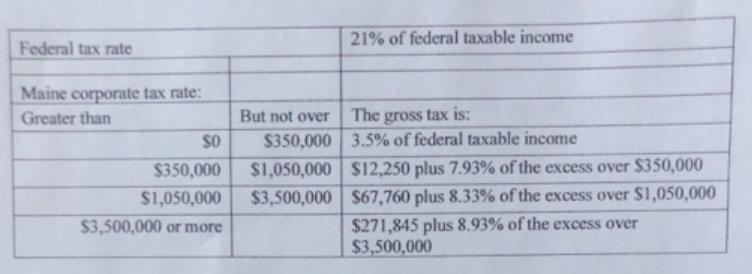

Income Statement. Use the corporate tax rate table from Question 6. a. Calculate Taxes (state and federal combined) and Net Income and fill in the blanks on the Income Statement. INCOME STATEMENT 2019 Sales 9,365,000 Cost of Goods Sold Gross Margin 5.521.000 3,844,000 Depreciation 355,000 Other Selling, Gen. & Admin. Earnings before interest and taxes L010.000 2,479,000 Interest expense 189.000 Income before taxes 2,290,000 Taxes Net income b. Calculate the average tax rate: Assume that the company invests in a project that increases Income Before Taxes by $1,150,000. C. L Calculate the additional amount of taxes that need to be paid. ii. State the marginal tax rate on the additional S1,150,000 of Income Before Taxes 21% of federal taxable income Federal tax rate Maine corporate tax rate: The gross tax is: $350,000 3.5% of federal taxable income Greater than But not over $1,050,000 $12,250 plus 7.93% of the excess over $350,000 $3,500,000 S67,760 plus 8.33% of the excess over $1,050,000 $350,000 $1,050,000 $271,845 plus 8.93% of the excess over $3,500,000 $3,500,000 or more

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Income before taxes 2290000 Taxes 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started