Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Individual Assignment 1 (30% of the final marks) Based on the above information prepare an academic report that should answer the following questions: Answer

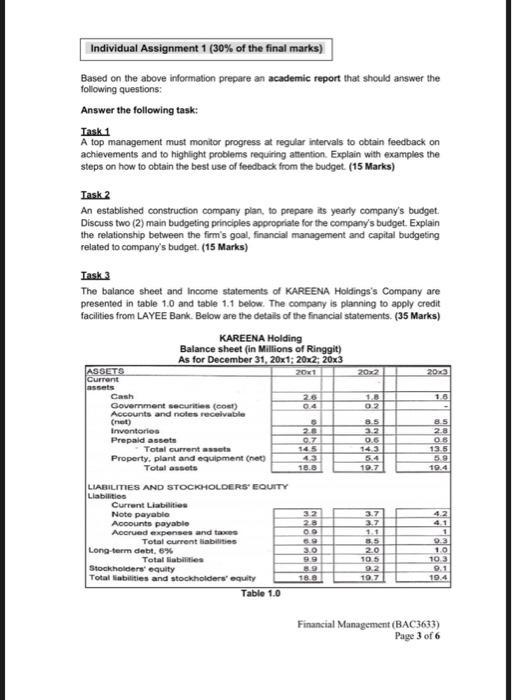

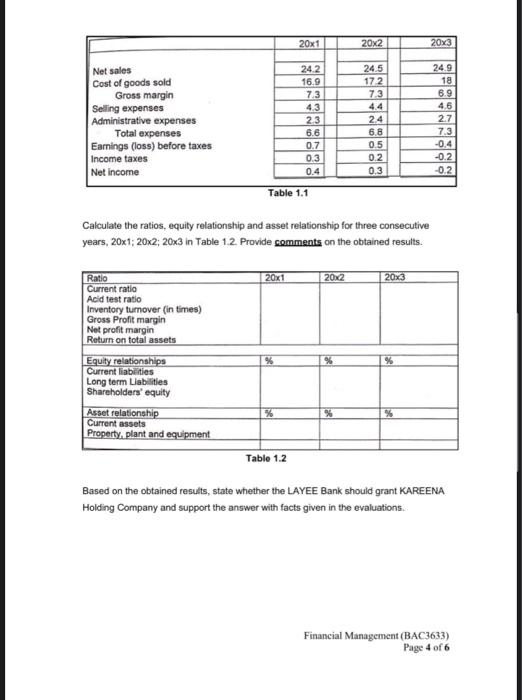

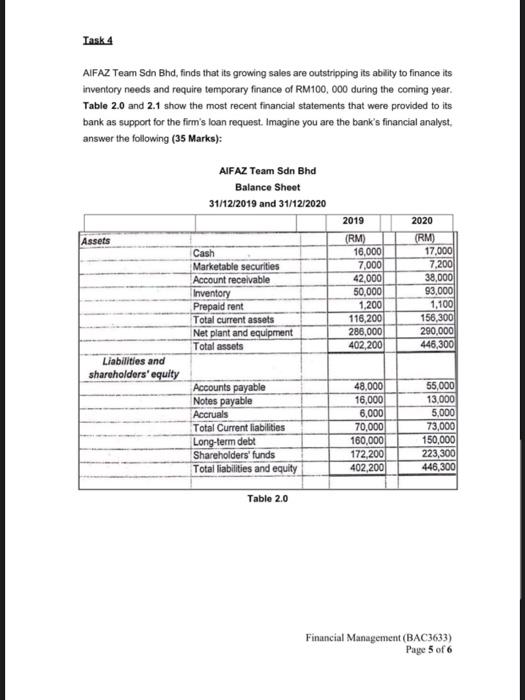

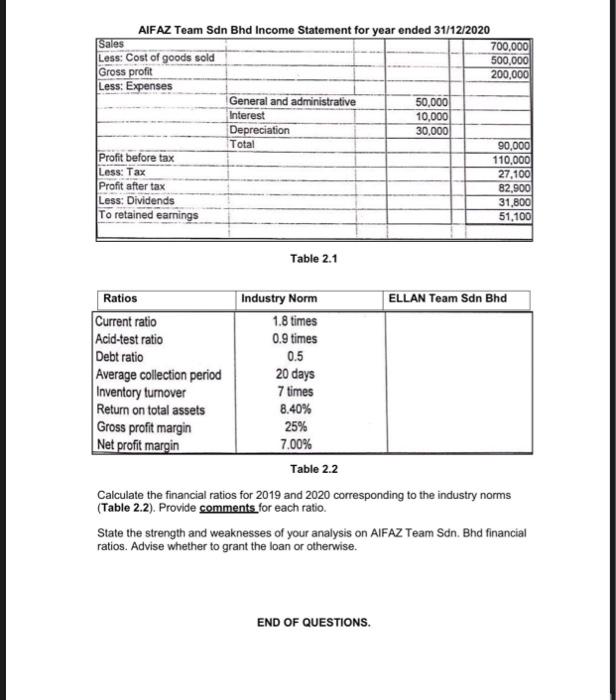

Individual Assignment 1 (30% of the final marks) Based on the above information prepare an academic report that should answer the following questions: Answer the following task: Task 1 A top management must monitor progress at regular intervals to obtain feedback on achievements and to highlight problems requiring attention. Explain with examples the steps on how to obtain the best use of feedback from the budget. (15 Marks) Task 2 An established construction company plan, to prepare its yearly company's budget. Discuss two (2) main budgeting principles appropriate for the company's budget. Explain the relationship between the firm's goal, financial management and capital budgeting related to company's budget. (15 Marks) Task 3 The balance sheet and Income statements of KAREENA Holdings's Company are presented in table 1.0 and table 1.1 below. The company is planning to apply credit facilities from LAYEE Bank. Below are the details of the financial statements. (35 Marks) ASSETS Current assets Cash KAREENA Holding Balance sheet (in Millions of Ringgit) As for December 31, 20x1; 20x2; 20x3 20x1 Government securities (cost) Accounts and notes receivable (net) Inventories Prepaid assets Total current assets Property, plant and equipment (net) Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities Current Liabilities Note payable Accounts payable Accrued expenses and taxes Total current liabilities Long-term debt, 6% Total liabilities Stockholders' equity Total liabilities and stockholders' equity Table 1.0 26 04 6 28 0.7 14.5 43 32 2.8 09 6.9 3.0 99 8.9 18.8 20x2 1.8 02 8.5 3.2 0.6 14.3 54 19.7 3.7 3.7 1.1 8.5 2.0 10.5 9.2 19.7 20x3 1.8 8.5 2.8 08 13.5 5.9 19.4 4.2 4.1 1 9.3 1.0 10.3 9.1 19.4 Financial Management (BAC3633) Page 3 of 6 Net sales Cost of goods sold Gross margin Selling expenses Administrative expenses Total expenses Earnings (loss) before taxes Income taxes Net income Ratio Current ratio Acid test ratio Inventory turnover (in times) Gross Profit margin Net profit margin Return on total assets Equity relationships Current liabilities Long term Liabilities Shareholders' equity Asset relationship Current assets Property, plant and equipment 20x1 % 20x1 % 24.2 16.9 Calculate the ratios, equity relationship and asset relationship for three consecutive years, 20x1; 20x2; 20x3 in Table 1.2. Provide comments on the obtained results. Table 1.2 7.3 4.3 Table 1.1 2.3 6.6 DO 0.7 0.3 0.4 20x2 % 20x2 % 24.5 17/2 7.3 4.4 2.4 6.8 0.5 0.2 0.3 20x3 % % 20x3 24.9 18 6.9 4.6 2.7 7.3 -0.4 -0.2 -0.2 Based on the obtained results, state whether the LAYEE Bank should grant KAREENA Holding Company and support the answer with facts given in the evaluations. Financial Management (BAC3633) Page 4 of 6 Task 4 AIFAZ Team Sdn Bhd, finds that its growing sales are outstripping its ability to finance its inventory needs and require temporary finance of RM100, 000 during the coming year. Table 2.0 and 2.1 show the most recent financial statements that were provided to its bank as support for the firm's loan request. Imagine you are the bank's financial analyst, answer the following (35 Marks): Assets Liabilities and shareholders' equity AIFAZ Team Sdn Bhd Balance Sheet 31/12/2019 and 31/12/2020 Cash Marketable securities Account receivable Inventory Prepaid rent Total current assets Net plant and equipment Total assets Accounts payable Notes payable Accruals Total Current liabilities Long-term debt Shareholders' funds Total liabilities and equity Table 2.0 2019 (RM) 16,000 7,000 42,000 50,000 1,200 116,200 286,000 402,200 48,000 16,000 6,000 70,000 160,000 172,200 402,200 2020 (RM) 17,000 7,200 38,000 93,000 1,100 156,300 290,000 446,300 55,000 13,000 5,000 73,000 150,000 223,300 446,300 Financial Management (BAC3633) Page 5 of 6 AIFAZ Team Sdn Bhd Income Statement for year ended 31/12/2020 Sales Less: Cost of goods sold Gross profit Less: Expenses Profit before tax Less: Tax Profit after tax Less: Dividends To retained earnings Ratios Current ratio Acid-test ratio Debt ratio Average collection period Inventory turnover Return on total assets Gross profit margin Net profit margin General and administrative Interest Depreciation Total Table 2.1 Industry Norm 1.8 times 0.9 times 0.5 20 days 7 times 8.40% 25% 7.00% Table 2.2 50,000 10,000 30,000 700,000 500,000 200,000 END OF QUESTIONS. 90,000 110,000 27,100 82,900 31,800 51,100 ELLAN Team Sdn Bhd Calculate the financial ratios for 2019 and 2020 corresponding to the industry norms (Table 2.2). Provide comments for each ratio. State the strength and weaknesses of your analysis on AIFAZ Team Sdn. Bhd financial ratios. Advise whether to grant the loan or otherwise.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Task 1 There are a few steps that can be taken in order to obtain the best use of feedback from the budget Firstly it is important to ensure that the budget is realistic and achievable If the budget i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started