Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Industrial Lloyds LLC are manufacturers of batteries used in the car industry. The company have started supplying batteries based on their patented technology to

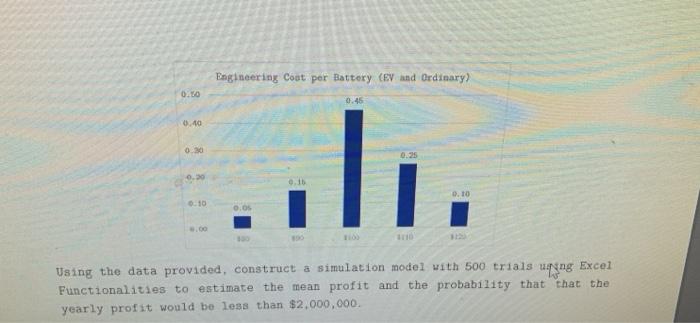

Industrial Lloyds LLC are manufacturers of batteries used in the car industry. The company have started supplying batteries based on their patented technology to companies involved in manufacturing Electric Vehicles (EV). This is in addition to their core business of supplying Ordinary Batteries to the mainstream car industry. Given a new strategic direction of the company, management seeks to gain some insight into the long-term profitability of the organization. Consequently, an analyst has been tasked with simulating the first-year profit potential of their operations. Key variables that has an impact on the profitability of Industrial Lloyds LLC includes: 4 . . . . . Selling Price of Electric Vehicles batteries (Sav) Selling Price of Ordinary Car batteries (S) Demand for Electric Vehicles batteries (Dev) Demand for Ordinary Car batteries (Do) Total Engineering Cost per unit of both Electric Vehicles battery and Ordinary Car battery (Cr) Administrative Cost (CA) Because Industrial Lloyds LLC have patented their EV battery, they expect to be able to control the market and so have set a unit price at $1,200. Since the product is new to the market, they are not sure of the exact demand, and so they have decided to model it as a normal probability distribution with a mean of 2,000 batteries for the first year and a standard deviation of 300 batteries. Due to their experience in manufacturing Ordinary Car batteries, management expect to sell 4,500 batteries. However, because of market fluctuations in price, they have decided to model the selling price as a uniform distribution between $120 and $180 per battery. Given the added EV manufacturing process, the Total Engineering Coat per unit of both Electric Vehicles battery and Ordinary Car battery is unknown. Based on industry insight and financial analysis, Industrial Lloyds LLC believes that this cost would range from $80 to $120 per unit of battery (both Electric Vehicles battery and Ordinary Car battery) and is described by the discrete probability distribution as given below. Administrative cost is fixed at $100,000. 0.50 0.40 0.30 0.30 0.10 Engineering Coat per Battery (EV and Ordinary) 0.45 0.25 ..... 100 800 800 0.10 uning Excel Using the data provided, construct a simulation model with 500 trials. Functionalities to estimate the mean profit and the probability that that the yearly profit would be less than $2,000,000.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started