Answered step by step

Verified Expert Solution

Question

1 Approved Answer

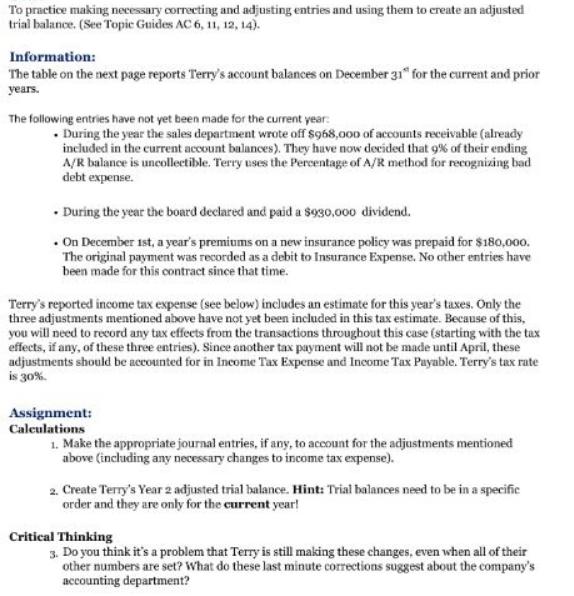

To practice making necessary correcting and adjusting entries and using them to create an adjusted trial balance. (See Topie Guides AC 6, 11, 12,

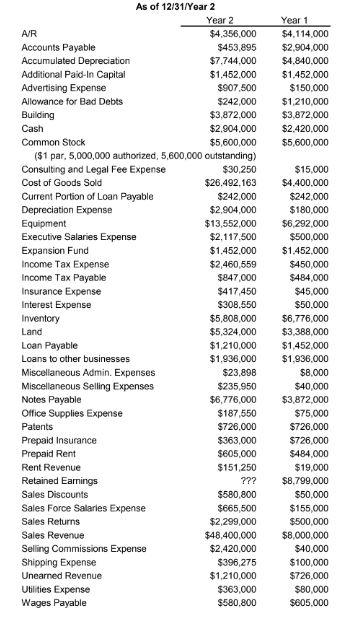

To practice making necessary correcting and adjusting entries and using them to create an adjusted trial balance. (See Topie Guides AC 6, 11, 12, 14). Information: The table on the next page reports Terry's account balances on December 31 for the current and prior years. The following entries have not yet been made for the current year: During the year the sales department wrote off $968,000 of accounts receivable (already included in the current account balances). They have now decided that 9% of their ending A/R balance is uncollectible. Terry uses the Percentage of A/R method for recognizing bad debt expense. During the year the board declared and paid a $930,000 dividend. On December 1st, a year's premiums on a new insurance policy was prepaid for $180,000. The original payment was recorded as a debit to Insurance Expense. No other entries have been made for this contract since that time. Terry's reported income tax expense (see below) includes an estimate for this year's taxes. Only the three adjustments mentioned above have not yet been included in this tax estimate. Because of this, you will need to record any tax effeets from the transactions throughout this case (starting with the tax effects, if any, of these three entries). Since another tax payment will not be made until April, these adjustments should be accounted for in Income Tax Expense and Income Tax Payable. Terry's tax rate is 30%. Assignment: Caleulations 1. Make the appropriate journal entries, if any, to account for the adjustments mentioned above (including any necessary changes to income tax expense). 2. Create Terry's Year 2 adjusted trial balance. Hint: Trial balances need to be in a specific order and they are only for the current year! Critical Thinking 3. Do you think it's a problem that Terry is still making these changes, even when all of their other numbers are set? What do these last minute corrections suggest about the company's accounting department? As of 12/31/Year 2 Year 1 Year 2 $4,356.000 A/R $4,114,000 Accounts Payable $453,895 $7,744,000 $2,904,000 Accumulated Depreciation $4,840,000 Additional Paid-In Capital Advertising Expense $1,452,000 $1,452,000 $907.500 $150,000 Allowance for Bad Debts $242,000 $1,210,000 Building $3,872,000 $3,872,000 Cash $2,904.000 $2.420,000 Common Stock $5,600,000 $5,600,000 ($1 par, 5,000,000 authorized, 5,600,000 outstanding) $30,250 Consulting and Legal Fee Expense $15,000 Cost of Goods Sold $26.492,163 $4.400.000 $242,000 Current Portion of Loan Payable Depreciation Expense $242,000 $2,904,000 $180,000 Equipment Executive Salaries Expense $13,552,000 $6,292,000 $2,117,500 $500,000 Expansion Fund Income Tax Expense $1,452.000 $1.452,000 $2,460,559 $847,000 $450,000 Income Tax Payable Insurance Expense $484,000 $417,450 $45,000 Interest Expense $308,550 $50.000 Inventory $5,808,000 $6,776,000 Land $5,324,000 $3,388,000 Loan Payable $1,210,000 $1,452,000 Loans to other businesses $1,936,000 $1,936,000 Miscellaneous Admin. Expenses $23,898 $8.000 Miscellaneous Selling Expenses Notes Payable $235,950 $6,776,000 $40,000 $3,872,000 Office Supplies Expense $187,550 $726,000 $75,000 Patents $726,000 Prepaid Insurance Prepaid Rent $363,000 $605,000 $726,000 $484,000 Rent Revenue $151,250 $19,000 Retained Earnings ??? $8,799,000 Sales Discounts $580,800 $50,000 Sales Force Salaries Expense $665,500 $155,000 $500,000 Sales Returns $2,299,000 Sales Revenue $48,400,000 $8,000,000 Selling Commissions Expense $2,420,000 $40,000 Shipping Expense $396,275 $100,000 Unearned Revenue $1,210,000 $726,000 Ubilities Expense $363,000 $80,000 Wages Payable $580,800 $605,000

Step by Step Solution

★★★★★

3.54 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 Appropriate journal entries a Retained Earnings 300000 Dividend payable 300000 b Dividend Payable 300000 Cash 300000 To record dividend declared and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started