Answered step by step

Verified Expert Solution

Question

1 Approved Answer

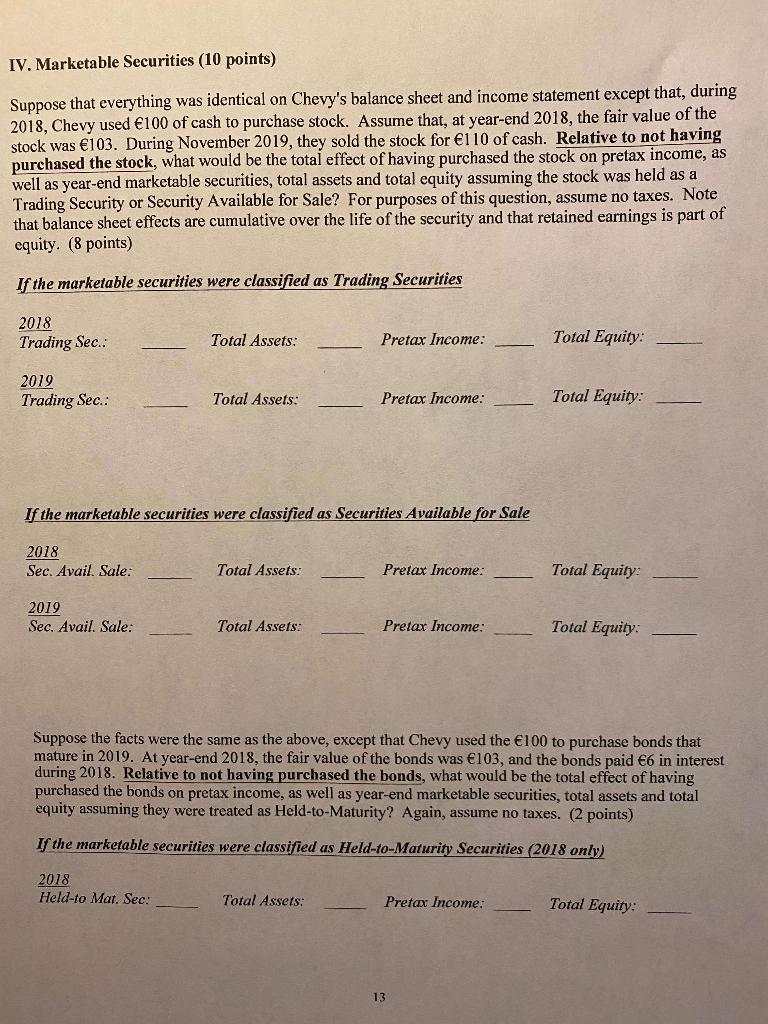

IV. Marketable Securities (10 points) Suppose that everything was identical on Chevy's balance sheet and income statement except that, during 2018, Chevy used 100

IV. Marketable Securities (10 points) Suppose that everything was identical on Chevy's balance sheet and income statement except that, during 2018, Chevy used 100 of cash to purchase stock. Assume that, at year-end 2018, the fair value of the stock was 103. During November 2019, they sold the stock for 110 of cash. Relative to not having purchased the stock, what would be the total effect of having purchased the stock on pretax income, as well as year-end marketable securities, total assets and total equity assuming the stock was held as a Trading Security or Security Available for Sale? For purposes of this question, assume no taxes. Note that balance sheet effects are cumulative over the life of the security and that retained earnings is part of equity. (8 points) If the marketable securities were classified as Trading Securities 2018 Trading Sec.: 2019 Trading Sec.: 2018 Sec. Avail. Sale: 2019 Sec. Avail. Sale: Total Assets: Total Assets: If the marketable securities were classified as Securities Available for Sale 2018 Held-to Mat. Sec: Total Assets: Total Assets: Pretax Income: Pretax Income: Total Assets: Pretax Income: Pretax Income: Pretax Income: Total Equity: Suppose the facts were the same as the above, except that Chevy used the 100 to purchase bonds that mature in 2019. At year-end 2018, the fair value of the bonds was 103, and the bonds paid 6 in interest during 2018. Relative to not having purchased the bonds, what would be the total effect of having purchased the bonds on pretax income, as well as year-end marketable securities, total assets and total equity assuming they were treated as Held-to-Maturity? Again, assume no taxes. (2 points) If the marketable securities were classified as Held-to-Maturity Securities (2018 only) 13 Total Equity: Total Equity: Total Equity: Total Equity:

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

If the marketable securities were classified as Trading Securities 2018 Trading Sec 100 Total Assets 103 Pretax Income 0 Total Equity 103 2019 Trading ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started