Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. After the netting process for all capital gains and losses, Jed has an overall net long-term capital gain of $_____? 2. Taxable Income/loss? Jed

1. After the netting process for all capital gains and losses, Jed has an overall net long-term capital gain of $_____?

2. Taxable Income/loss?

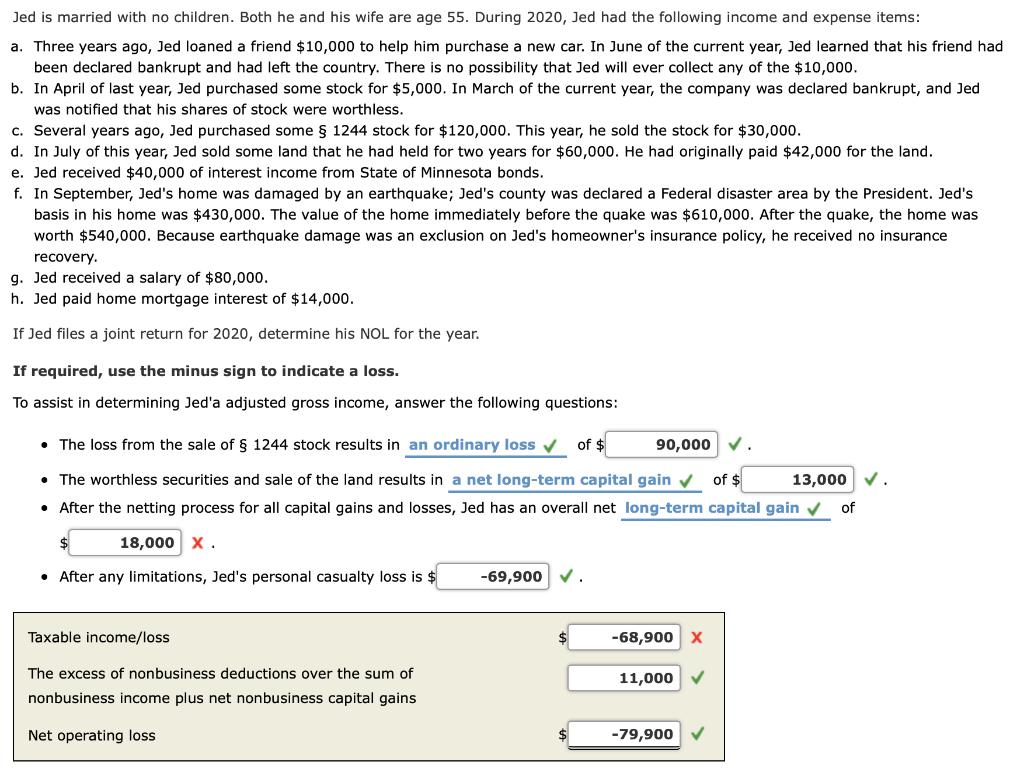

Jed is married with no children. Both he and his wife are age 55. During 2020, Jed had the following income and expense items: a. Three years ago, Jed loaned a friend $10,000 to help him purchase a new car. In June of the current year, Jed learned that his friend had been declared bankrupt and had left the country. There is no possibility that Jed will ever collect any of the $10,000. b. In April of last year, Jed purchased some stock for $5,000. In March of the current year, the company was declared bankrupt, and Jed was notified that his shares of stock were worthless. c. Several years ago, Jed purchased some 1244 stock for $120,000. This year, he sold the stock for $30,000. d. In July of this year, Jed sold some land that he had held for two years for $60,000. He had originally paid $42,000 for the land. e. Jed received $40,000 of interest income from State of Minnesota bonds. f. In September, Jed's home was damaged by an earthquake; Jed's county was declared a Federal disaster area by the President. Jed's basis in his home was $430,000. The value of the home immediately before the quake was $610,000. After the quake, the home was worth $540,000. Because earthquake damage was an exclusion on Jed's homeowner's insurance policy, he received no insurance recovery. g. Jed received a salary of $80,000. h. Jed paid home mortgage interest of $14,000. If Jed files a joint return for 2020, determine his NOL for the year. If required, use the minus sign to indicate a loss. To assist in determining Jed'a adjusted gross income, answer the following questions: The loss from the sale of 1244 stock results in an ordinary loss v of $ 90,000 The worthless securities and sale of the land results in a net long-term capital gain v of $ 13,000 v After the netting process for all capital gains and losses, Jed has an overall net long-term capital gain of 18,000 X. After any limitations, Jed's personal casualty loss is $ -69,900 v. Taxable income/loss -68,900 x The excess of nonbusiness deductions over the sum of 11,000 nonbusiness income plus net nonbusiness capital gains Net operating loss -79,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

DESCRIPTION AMOUNT AMOUNT Salary 80000 Loss on sale of stock 90000 Loss non business ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started