Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jim and Mary Banks are married and have two children, ages 6 and 8 they fully support. In addition, Jim's mother, Tina, lived with

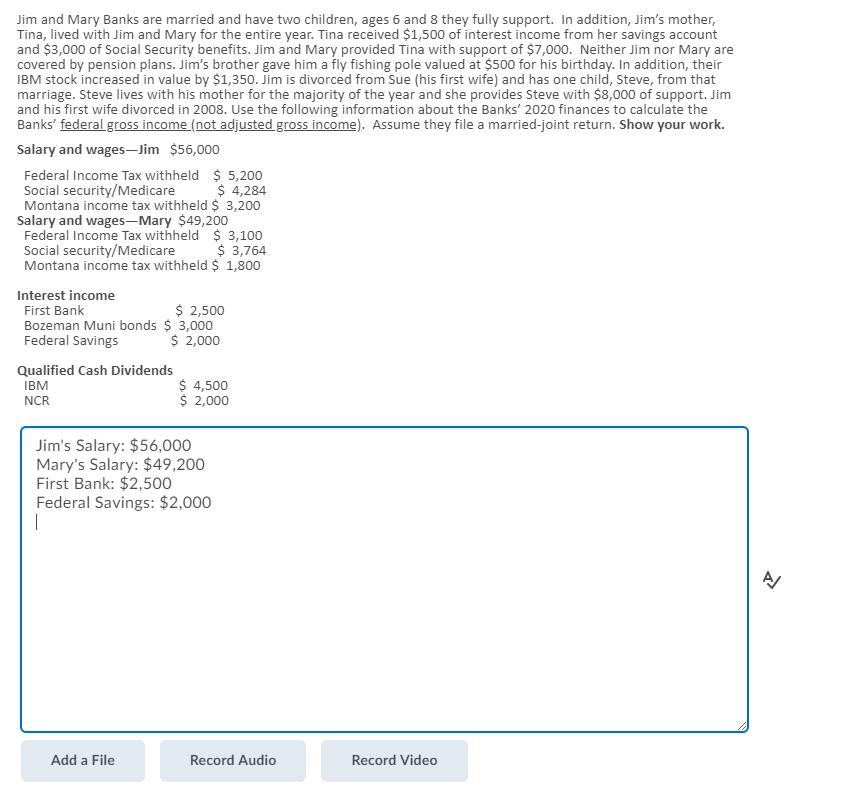

Jim and Mary Banks are married and have two children, ages 6 and 8 they fully support. In addition, Jim's mother, Tina, lived with Jim and Mary for the entire year. Tina received $1,500 of interest income from her savings account covered by pension plans. Jim's brother gave him a fly fishing pole valued at $500 for his birthday. In addition, their IBM stock increased in value by $1,350. Jim is divorced from Sue (his first wife) and has one child, Steve, from that marriage. Steve lives with his mother for the majority of the year and she provides Steve with $8,000 of support. Jim and his first wife divorced in 2008. Use the following information about the Banks' 2020 finances to calculate the Banks' federal gross income (not adjusted gross income). Assume they file a married-joint return. Show your work. Salary and wagesJim $56,000 Federal Income Tax withheld $ 5,200 Social security/Medicare Montana income tax withheld $ 3,200 Salary and wages-Mary $49,200 Federal Income Tax withheld $ 3,100 Social security/Medicare Montana income tax withheld $ 1,800 $ 4,284 $ 3,764 Interest income First Bank Bozeman Muni bonds $ 3,000 Federal Savings $ 2,500 $ 2,000 Qualified Cash Dividends $ 4,500 $ 2,000 IBM NCR Jim's Salary: $56,000 Mary's Salary: $49,200 First Bank: $2,500 Federal Savings: $2,000 Add a File Record Audio Record Video

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Income for Married Joint Return of Jim and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started