Johnson Software Inc. has assembled the following data for the year ended December 31, 2020. Requirement Prepare Johnson Software Inc.'s statement of cash flows

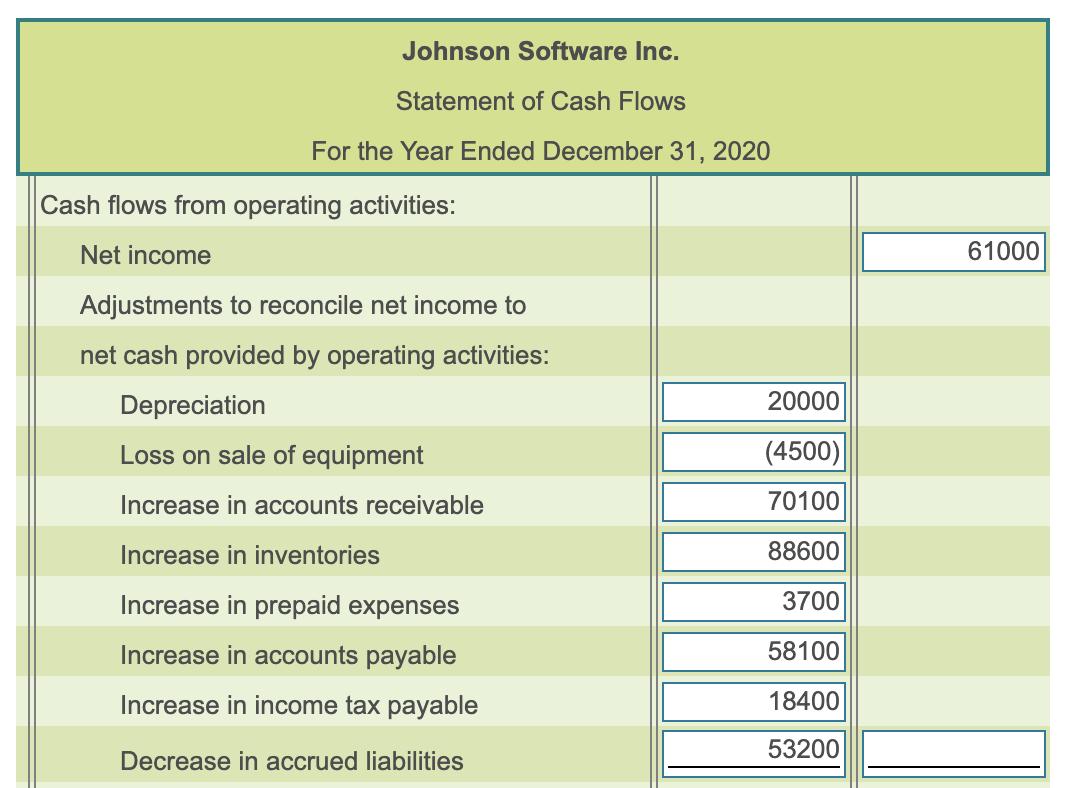

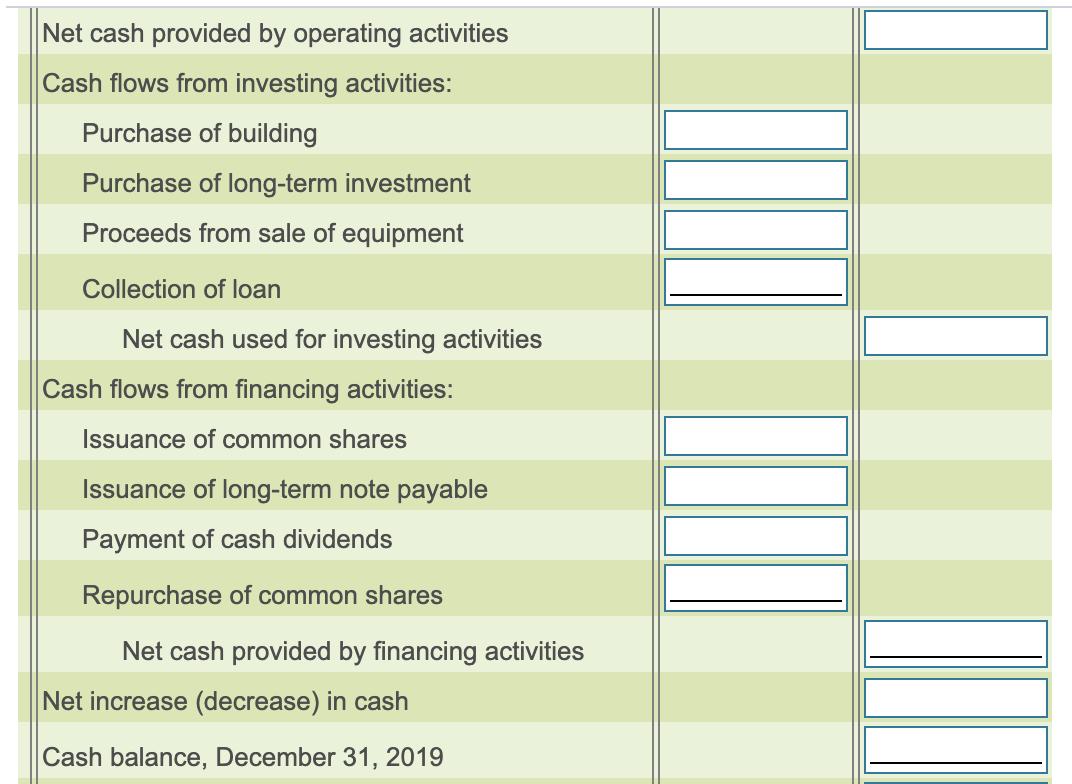

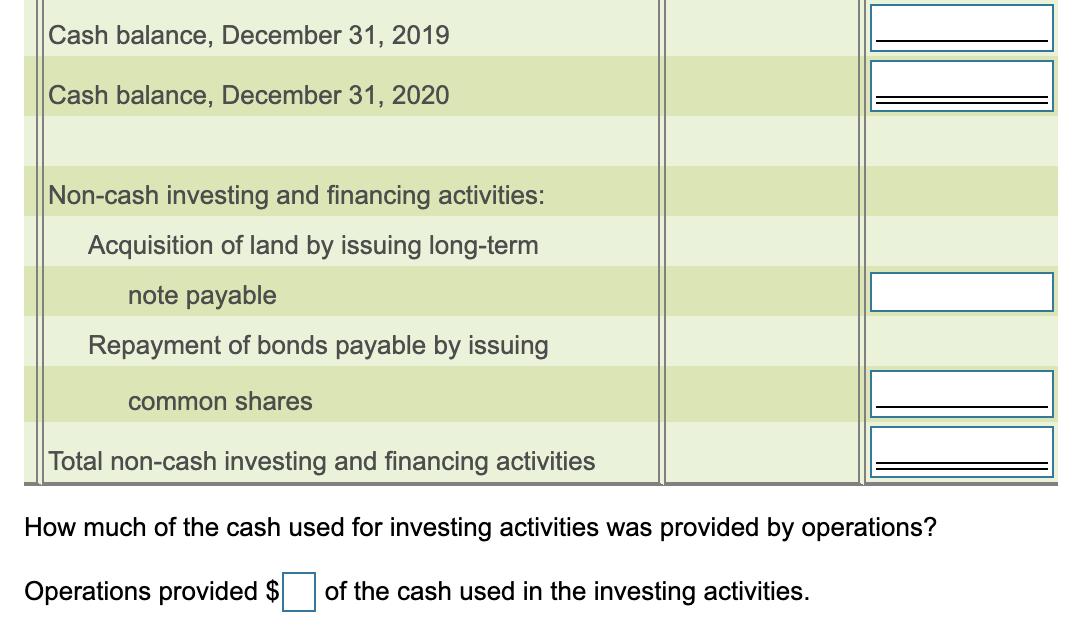

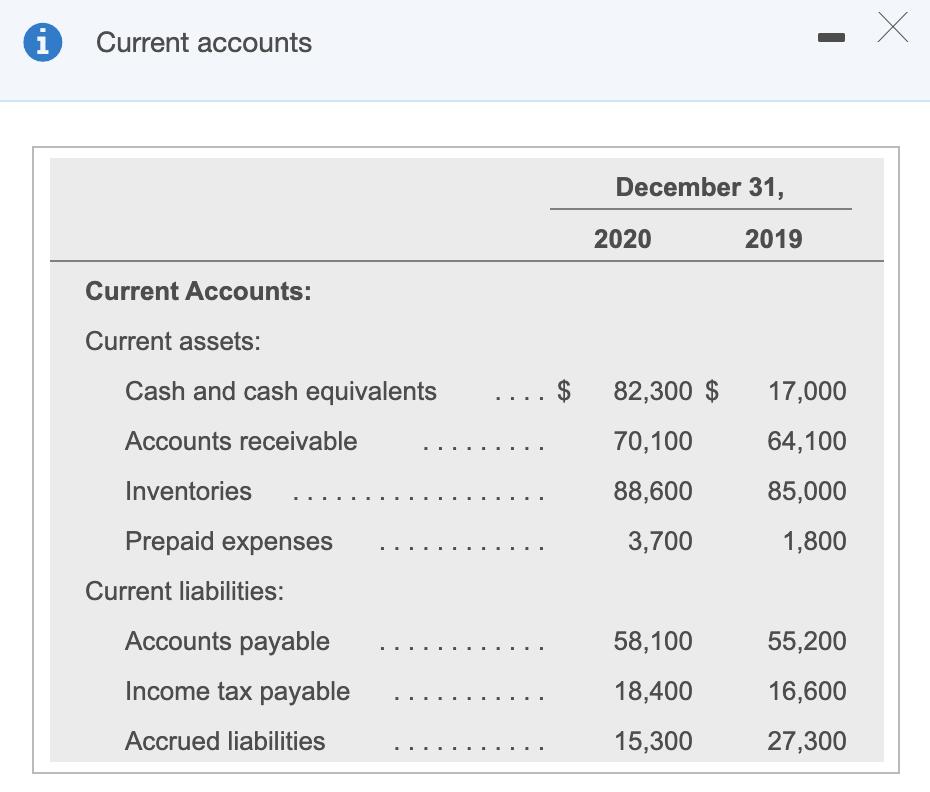

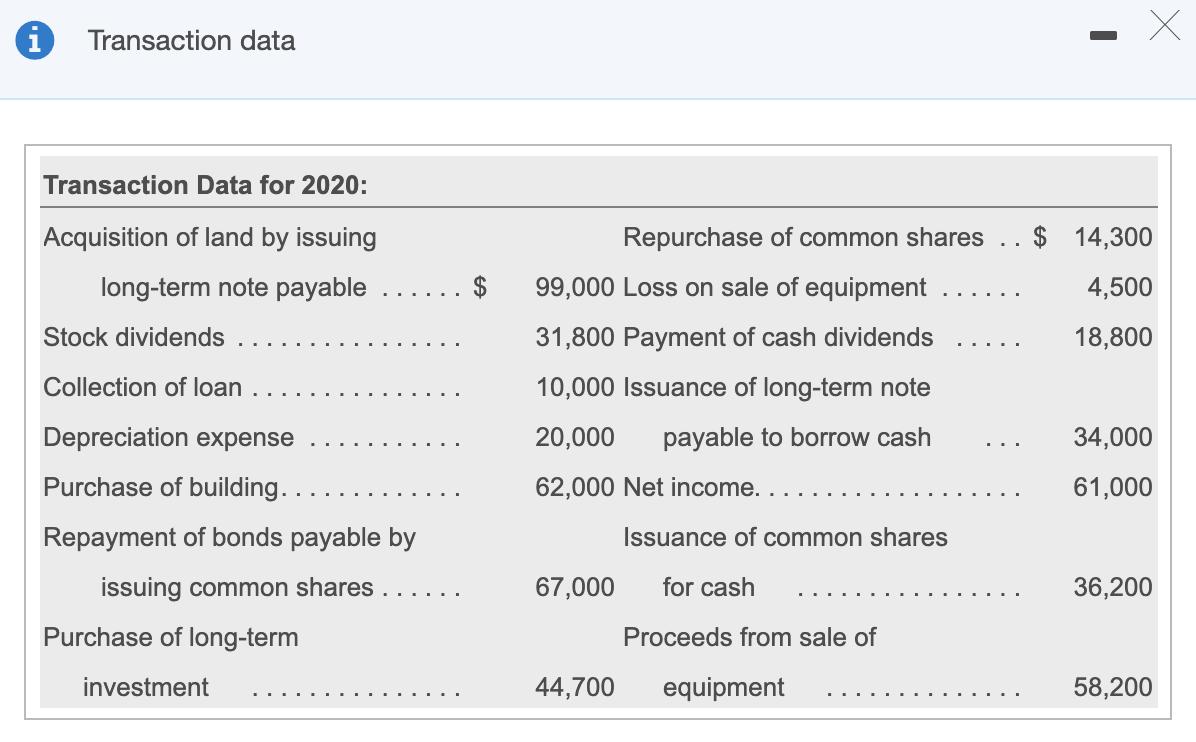

Johnson Software Inc. has assembled the following data for the year ended December 31, 2020. Requirement Prepare Johnson Software Inc.'s statement of cash flows using the indirect method to report operating activities. Include an accompanying schedule of non-cash investing and financing activities. How much of the cash used for investing activities was provided by operations? Start by completing the cash flows from operating activities. Then, continue with completing the investing and financing activities sections. Finally, determine the net increase (decrease) in cash. Johnson Software Inc. Statement of Cash Flows For the Year Ended December 31, 2020 Cash flows from operating activities: Net income 61000 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation 20000 Loss on sale of equipment (4500) Increase in accounts receivable 70100 Increase in inventories 88600 Increase in prepaid expenses 3700 Increase in accounts payable 58100 Increase in income tax payable 18400 53200 Decrease in accrued liabilities Net cash provided by operating activities Cash flows from investing activities: Purchase of building Purchase of long-term investment Proceeds from sale of equipment Collection of loan Net cash used for investing activities Cash flows from financing activities: Issuance of common shares Issuance of long-term note payable Payment of cash dividends Repurchase of common shares Net cash provided by financing activities Net increase (decrease) in cash Cash balance, December 31, 2019 Cash balance, December 31, 2019 Cash balance, December 31, 2020 Non-cash investing and financing activities: Acquisition of land by issuing long-term note payable Repayment of bonds payable by issuing common shares Total non-cash vesting and financing activities How much of the cash used for investing activities was provided by operations? Operations provided $ of the cash used in the investing activities. 1 Current accounts December 31, 2020 2019 Current Accounts: Current assets: Cash and cash equivalents 82,300 $ 17,000 Accounts receivable 70,100 64,100 Inventories 88,600 85,000 Prepaid expenses 3,700 1,800 Current liabilities: Accounts payable 58,100 55,200 Income tax payable 18,400 16,600 Accrued liabilities 15,300 27,300 %24 Transaction data Transaction Data for 2020: Acquisition of land by issuing Repurchase of common shares $ 14,300 .. long-term note payable $ 99,000 Loss on sale of equipment 4,500 Stock dividends 31,800 Payment of cash dividends 18,800 Collection of loan 10,000 Issuance of long-term note Depreciation expense 20,000 payable to borrow cash 34,000 Purchase of building.. 62,000 Net income. . 61,000 Repayment of bonds payable by Issuance of common shares issuing common shares 67,000 for cash 36,200 .... .... Purchase of long-term Proceeds from sale of investment 44,700 equipment 58,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cash flow statement Cash flow from Operating Activities Net Income 61000 Adjustments Depreciation Lo...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started