Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kiewit does not expect to change the mode of the operation for the next year. However, subcontract costs will decrease and the expected decrease

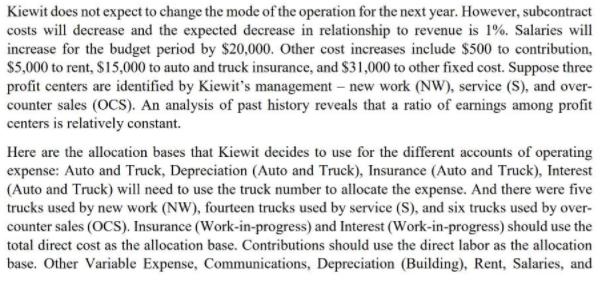

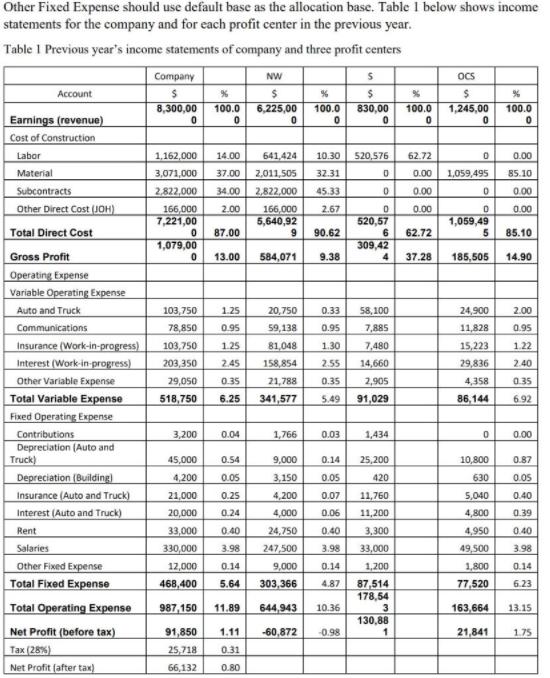

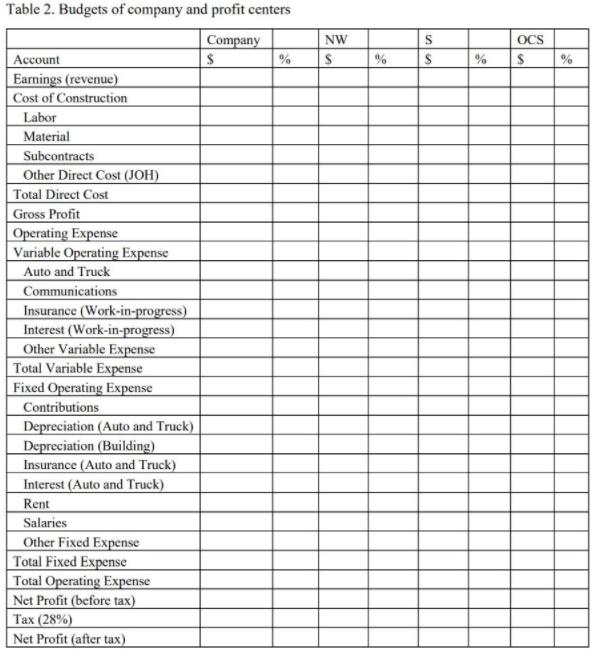

Kiewit does not expect to change the mode of the operation for the next year. However, subcontract costs will decrease and the expected decrease in relationship to revenue is 1%. Salaries will increase for the budget period by $20,000. Other cost increases include $500 to contribution, $5,000 to rent, $15,000 to auto and truck insurance, and $31,000 to other fixed cost. Suppose three profit centers are identified by Kiewit's management- new work (NW), service (S), and over- counter sales (OCS). An analysis of past history reveals that a ratio of earnings among profit centers is relatively constant. Here are the allocation bases that Kiewit decides to use for the different accounts of operating expense: Auto and Truck, Depreciation (Auto and Truck), Insurance (Auto and Truck), Interest (Auto and Truck) will need to use the truck number to allocate the expense. And there were five trucks used by new work (NW), fourteen trucks used by service (S), and six trucks used by over- counter sales (OCS). Insurance (Work-in-progress) and Interest (Work-in-progress) should use the total direct cost as the allocation base. Contributions should use the direct labor as the allocation base. Other Variable Expense, Communications, Depreciation (Building), Rent, Salaries, and Other Fixed Expense should use default base as the allocation base. Table 1 below shows income statements for the company and for each profit center in the previous year. Table 1 Previous year's income statements of company and three profit centers Company NW OCS Account 8,300,00 100.0 6,225,00 100.0 830,00 100.0 1,245,00 100.0 Earnings (revenue) Cost of Construction Labor 1,162,000 14.00 641,424 10.30 520,576 62.72 0.00 Material 3,071,000 37.00 2,011,505 32.31 0.00 1,059,495 85.10 Subcontracts 2,822,000 34.00 2,822,000 45.33 0.00 0.00 Other Direct Cost (JOH) 0.00 166,000 7,221,00 2.00 166,000 5,640,92 2.67 0.00 520,57 6 309,42 1,059,49 Total Direct Cost Gross Profit Operating Expense Variable Operating Expense Auto and Truck 87.00 90.62 62.72 85.10 1,079,00 13.00 584,071 9.38 37.28 185,505 14.90 103,750 1.25 20,750 0.33 58, 100 24,900 2.00 Communications 78,850 0.95 59,138 0.95 7,885 11,828 0.95 Insurance (Work-in-progress) Interest (Work-in progress) Other Variable Expense Total Variable Expense Fixed Operating Expense 103,750 1.25 81,048 1.30 7,480 15,223 1.22 203,350 2.45 158,854 2.55 14,660 29,836 2.40 29,050 0.35 21,788 0.35 2,905 4,358 0.35 518,750 6.25 341,577 5.49 91,029 86,144 6.92 Contributions Depreciation (Auto and Truck) 3,200 0.04 1,766 0.03 1,434 0.00 45,000 0.54 9,000 0.14 25,200 10,800 0.87 Depreciation (Building) Insurance (Auto and Truck) Interest (Auto and Truck) 4,200 0.05 3,150 0.05 420 630 0.05 21,000 0.25 4,200 0.07 11,760 5,040 0.40 20,000 0.24 4,000 0.06 11,200 4,800 0.39 Rent 33,000 0.40 24,750 0.40 3,300 4,950 0.40 Salaries 330,000 3.98 247,500 3.98 33,000 49,500 3.98 Other Fixed Expense Total Fixed Expense 12,000 0.14 9,000 0.14 1,200 1,800 0.14 5.64 87,514 178,54 468,400 303,366 4.87 77,520 6.23 Total Operating Expense Net Profit (before tax) x (28%) 987,150 11.89 644,943 10.36 163,664 13.15 130,88 91,850 1.11 -60,872 0.98 1 21,841 1.75 25,718 0.31 Net Profit (after tax) 66,132 0.80 Table 2. Budgets of company and profit centers Company NW OCS % % Account Earnings (revenue) Cost of Construction Labor Material Subcontracts Other Direct Cost (JOH) Total Direct Cost Gross Profit Operating Expense Variable Operating Expense Auto and Truck Communications Insurance (Work-in-progress) Interest (Work-in-progress) Other Variable Expense Total Variable Expense Fixed Operating Expense Contributions Depreciation (Auto and Truck) Depreciation (Building) Insurance (Auto and Truck) Interest (Auto and Truck) Rent Salaries Other Fixed Expense Total Fixed Expense Total Operating Expense Net Profit (before tax) x (28%) Net Profit (after tax)

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Company NW 5 S 14 OCS 6 Account Earnings revenue 8300000 100 6225000 100 830000 100 1245000 100 Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started