Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kingbird Inc. had net income for the current year ending December 31, 2020 of $1,020,420. During the entire year, there were 501,000 common shares

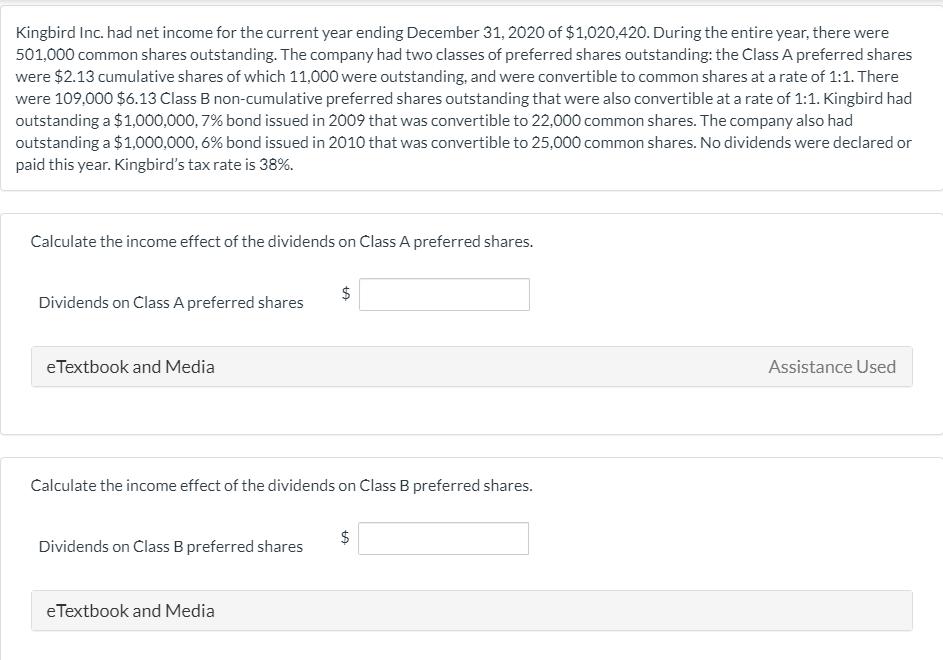

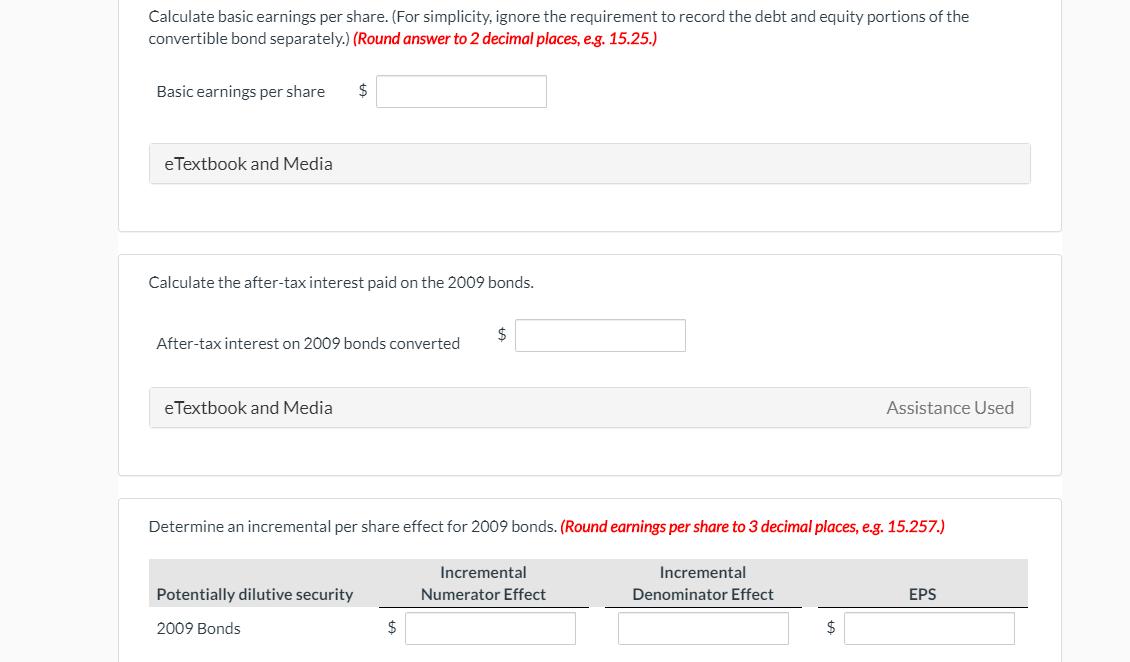

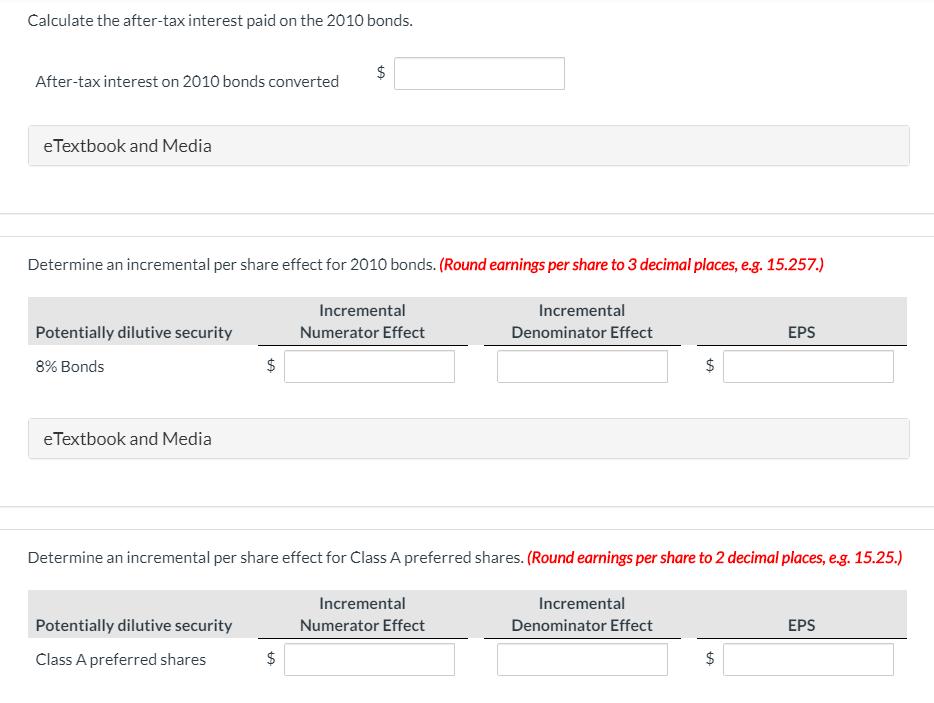

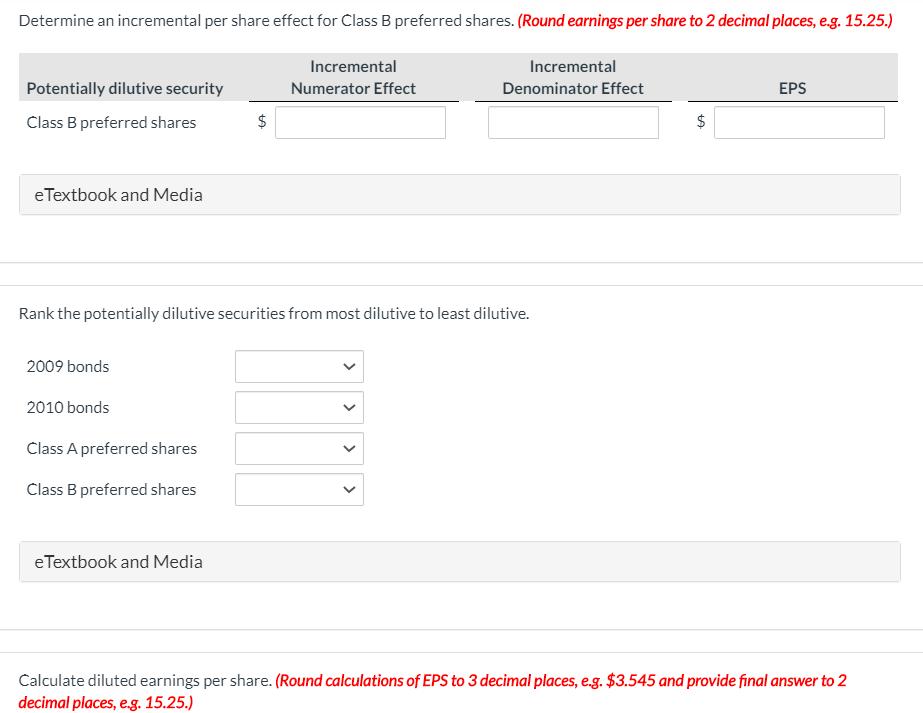

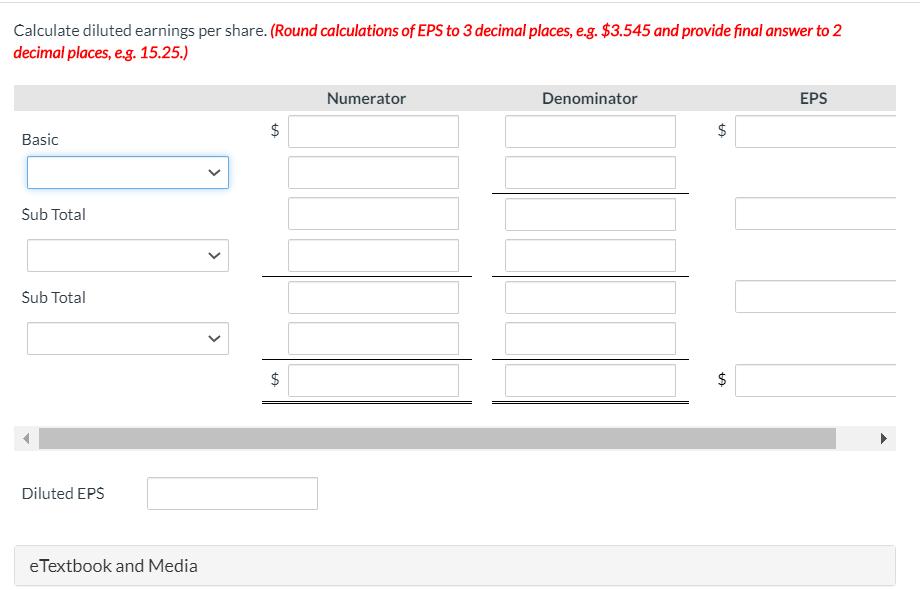

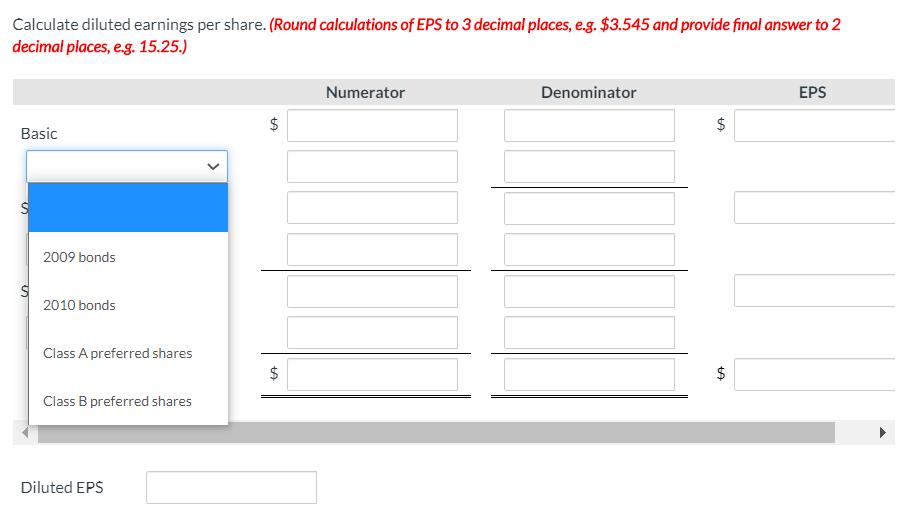

Kingbird Inc. had net income for the current year ending December 31, 2020 of $1,020,420. During the entire year, there were 501,000 common shares outstanding. The company had two classes of preferred shares outstanding: the Class A preferred shares were $2.13 cumulative shares of which 11,000 were outstanding, and were convertible to common shares at a rate of 1:1. There were 109,000 $6.13 Class B non-cumulative preferred shares outstanding that were also convertible at a rate of 1:1. Kingbird had outstanding a $1,000,000, 7% bond issued in 2009 that was convertible to 22,000 common shares. The company also had outstanding a $1,000,000, 6% bond issued in 2010 that was convertible to 25,000 common shares. No dividends were declared or paid this year. Kingbird's tax rate is 38%. Calculate the income effect of the dividends on Class A preferred shares. Dividends on Class A preferred shares eTextbook and Media Dividends on Class B preferred shares to Calculate the income effect of the dividends on Class B preferred shares. eTextbook and Media $ CA Assistance Used Calculate basic earnings per share. (For simplicity, ignore the requirement to record the debt and equity portions of the convertible bond separately.) (Round answer to 2 decimal places, e.g. 15.25.) Basic earnings per share eTextbook and Media Calculate the after-tax interest paid on the 2009 bonds. $ After-tax interest on 2009 bonds converted eTextbook and Media Potentially dilutive security 2009 Bonds $ Determine an incremental per share effect for 2009 bonds. (Round earnings per share to 3 decimal places, e.g. 15.257.) $ Incremental Numerator Effect Incremental Denominator Effect Assistance Used $ EPS Calculate the after-tax interest paid on the 2010 bonds. After-tax interest on 2010 bonds converted e Textbook and Media Potentially dilutive security 8% Bonds Determine an incremental per share effect for 2010 bonds. (Round earnings per share to 3 decimal places, e.g. 15.257.) Incremental Numerator Effect Incremental Denominator Effect eTextbook and Media $ Potentially dilutive security Class A preferred shares $ tA $ +A Determine an incremental per share effect for Class A preferred shares. (Round earnings per share to 2 decimal places, e.g. 15.25.) Incremental Numerator Effect Incremental Denominator Effect $ $ EPS CA EPS Determine an incremental per share effect for Class B preferred shares. (Round earnings per share to 2 decimal places, e.g. 15.25.) Incremental Numerator Effect Potentially dilutive security Class B preferred shares eTextbook and Media 2009 bonds Rank the potentially dilutive securities from most dilutive to least dilutive. 2010 bonds Class A preferred shares Class B preferred shares LA eTextbook and Media > Incremental Denominator Effect < $ GA EPS Calculate diluted earnings per share. (Round calculations of EPS to 3 decimal places, e.g. $3.545 and provide final answer to 2 decimal places, e.g. 15.25.) Calculate diluted earnings per share. (Round calculations of EPS to 3 decimal places, e.g. $3.545 and provide final answer to 2 decimal places, e.g. 15.25.) Basic Sub Total Sub Total Diluted EPS eTextbook and Media > CA $ CA Numerator Denominator tA $ LA EPS Calculate diluted earnings per share. (Round calculations of EPS to 3 decimal places, e.g. $3.545 and provide final answer to 2 decimal places, e.g. 15.25.) Basic S 2009 bonds 2010 bonds Class A preferred shares Class B preferred shares Diluted EPS CA +A $ Numerator Denominator $ $ LA EPS

Step by Step Solution

★★★★★

3.39 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

Net Income for your ady 31 Dec 2020 1 020 420 Commor ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started