Answered step by step

Verified Expert Solution

Question

1 Approved Answer

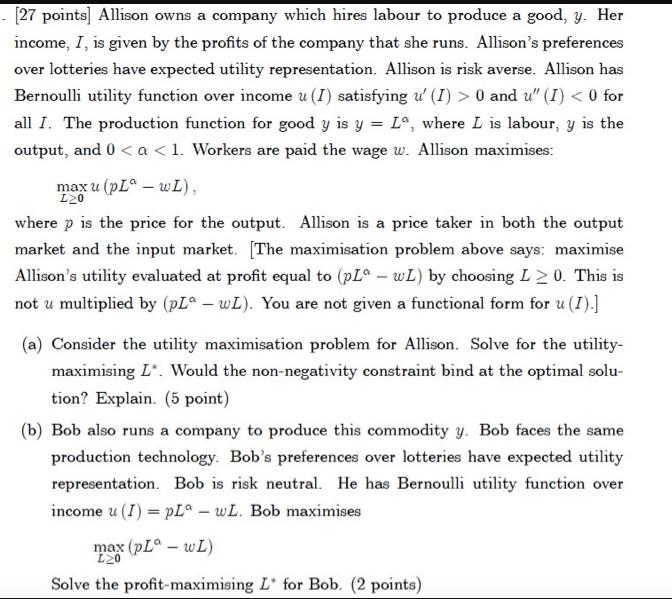

[27 points] Allison owns a company which hires labour to produce a good, y. Her income, I, is given by the profits of the

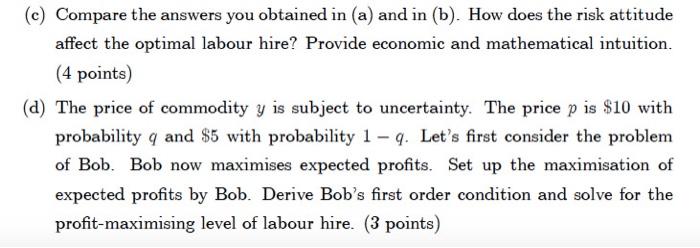

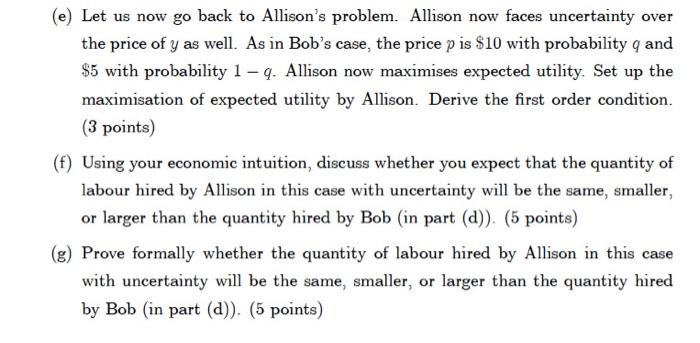

[27 points] Allison owns a company which hires labour to produce a good, y. Her income, I, is given by the profits of the company that she runs. Allison's preferences over lotteries have expected utility representation. Allison is risk averse. Allison has Bernoulli utility function over income u (I) satisfying u' (I) > 0 and u" (I) < 0 for all I. The production function for good y is y = La, where L is labour, y is the output, and 0 < a < 1. Workers are paid the wage w. Allison maximises: max u (pLwL), L20 where p is the price for the output. Allison is a price taker in both the output market and the input market. [The maximisation problem above says: maximise Allison's utility evaluated at profit equal to (pLawL) by choosing L20. This is not u multiplied by (pLawL). You are not given a functional form for u (I).] (a) Consider the utility maximisation problem for Allison. Solve for the utility- maximising L*. Would the non-negativity constraint bind at the optimal solu- tion? Explain. (5 point) (b) Bob also runs a company to produce this commodity y. Bob faces the same production technology. Bob's preferences over lotteries have expected utility representation. Bob is risk neutral. He has Bernoulli utility function over income u (I) = pLawL. Bob maximises max (pL-wL) L20 Solve the profit-maximising L* for Bob. (2 points) (c) Compare the answers you obtained in (a) and in (b). How does the risk attitude affect the optimal labour hire? Provide economic and mathematical intuition. (4 points) (d) The price of commodity y is subject to uncertainty. The price p is $10 with probability q and $5 with probability 1- q. Let's first consider the problem of Bob. Bob now maximises expected profits. Set up the maximisation of expected profits by Bob. Derive Bob's first order condition and solve for the profit-maximising level of labour hire. (3 points) (e) Let us now go back to Allison's problem. Allison now faces uncertainty over the price of y as well. As in Bob's case, the price p is $10 with probability q and $5 with probability 1-q. Allison now maximises expected utility. Set up the maximisation of expected utility by Allison. Derive the first order condition. (3 points) (f) Using your economic intuition, discuss whether you expect that the quantity of labour hired by Allison in this case with uncertainty will be the same, smaller, or larger than the quantity hired by Bob (in part (d)). (5 points) Prove formally whether the quantity of labour hired by Allison in this case with uncertainty will be the same, smaller, or larger than the quantity hired by Bob (in part (d)). (5 points)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To solve for the utilitymaximizing labor supply we need to maximize the objective function upLa wL subject to the constraint L 0 Taking the derivati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started