Answered step by step

Verified Expert Solution

Question

1 Approved Answer

17. Hand owns 90% of Finger. In 2015 Hand purchases Land from third parties for $500,000. On January 1, 2018 Hand sells Land to Finger

17. Hand owns 90% of Finger. In 2015 Hand purchases Land from third parties for $500,000. On January 1, 2018 Hand sells Land to Finger for $800,000. Finger holds the Land until December 31, 2020 and then sells it to third parties for $2,000,000.

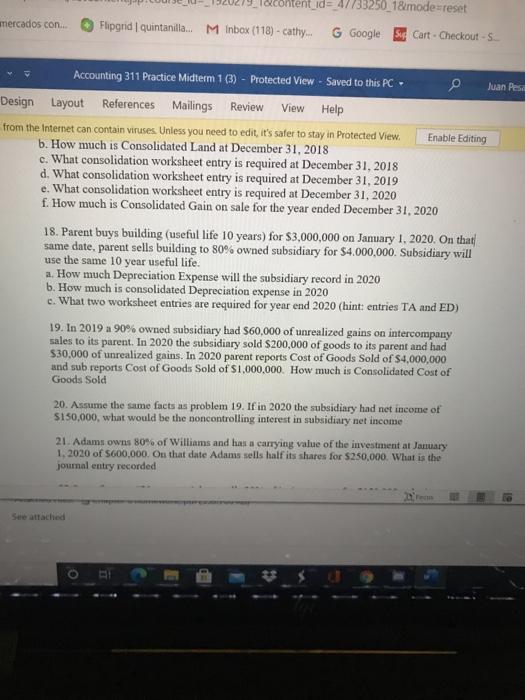

mercados con... tent_id=_47733250_1&mode=reset Flipgrid | quintanilla... M Inbox (118)-cathy.... G Google Sup Cart Checkout - S Accounting 311 Practice Midterm 1 (3) - Protected View - Saved to this PC- Design Layout References Mailings Review View Help from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. b. How much is Consolidated Land at December 31, 2018 c. What consolidation worksheet entry is required at December 31, 2018 d. What consolidation worksheet entry is required at December 31, 2019 e. What consolidation worksheet entry is required at December 31, 2020 f. How much is Consolidated Gain on sale for the year ended December 31, 2020 18. Parent buys building (useful life 10 years) for $3,000,000 on January 1, 2020. On that same date, parent sells building to 80% owned subsidiary for $4.000,000. Subsidiary will use the same 10 year useful life. a. How much Depreciation Expense will the subsidiary record in 2020 b. How much is consolidated Depreciation expense in 2020 c. What two worksheet entries are required for year end 2020 (hint: entries TA and ED) See attached Enable Editing 19. In 2019 a 90% owned subsidiary had $60,000 of unrealized gains on intercompany sales to its parent. In 2020 the subsidiary sold $200,000 of goods to its parent and had $30,000 of unrealized gains. In 2020 parent reports Cost of Goods Sold of $4,000,000 and sub reports Cost of Goods Sold of $1,000,000. How much is Consolidated Cost of Goods Sold 20. Assume the same facts as problem 19. If in 2020 the subsidiary had net income of $150,000, what would be the noncontrolling interest in subsidiary net income 0 21. Adams owns 80% of Williams and has a carrying value of the investment at January 1, 2020 of $600,000. On that date Adams sells half its shares for $250,000. What is the journal entry recorded FI Fea Juan Pesa

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

17 Jom3831 a 0 b 500000 c Please see entry below d Please see entry below e Please see entry below f 1500000 C December 31 2018 Gain on sale of Land 300000 Land 300000 To record the consolidated elimi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started