Answered step by step

Verified Expert Solution

Question

1 Approved Answer

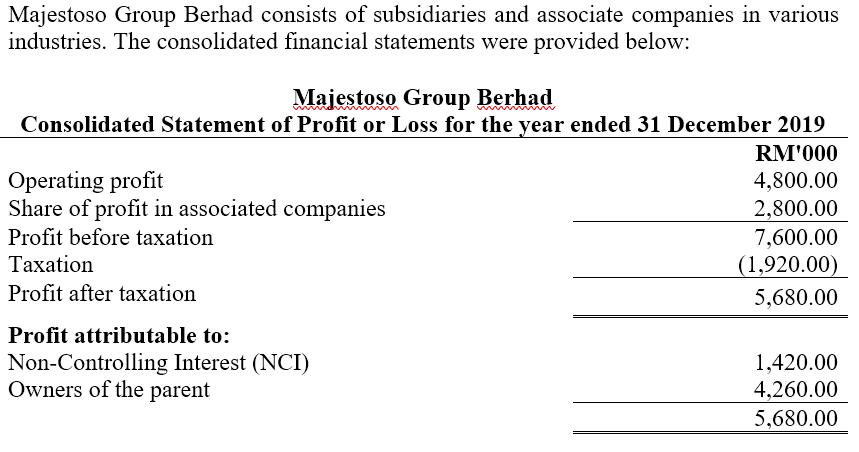

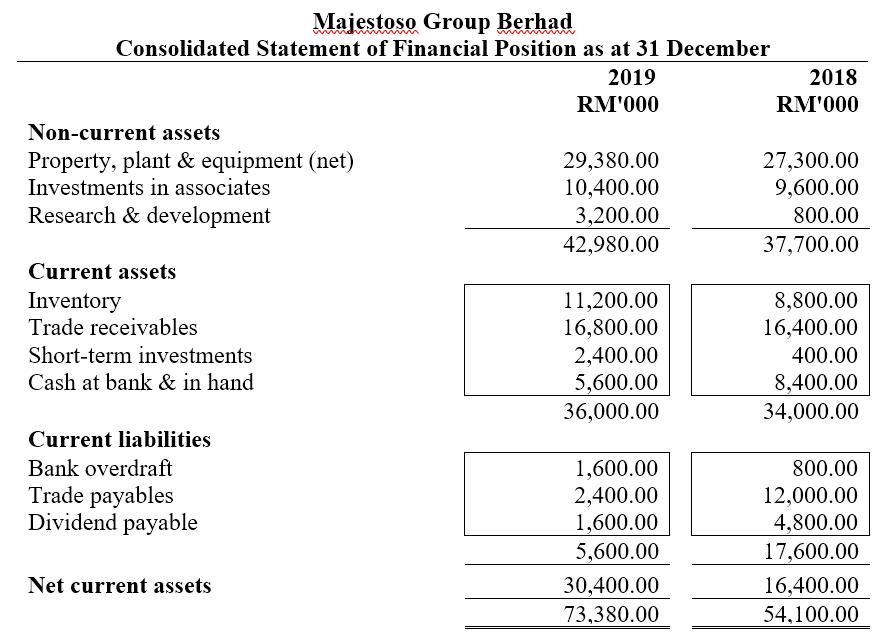

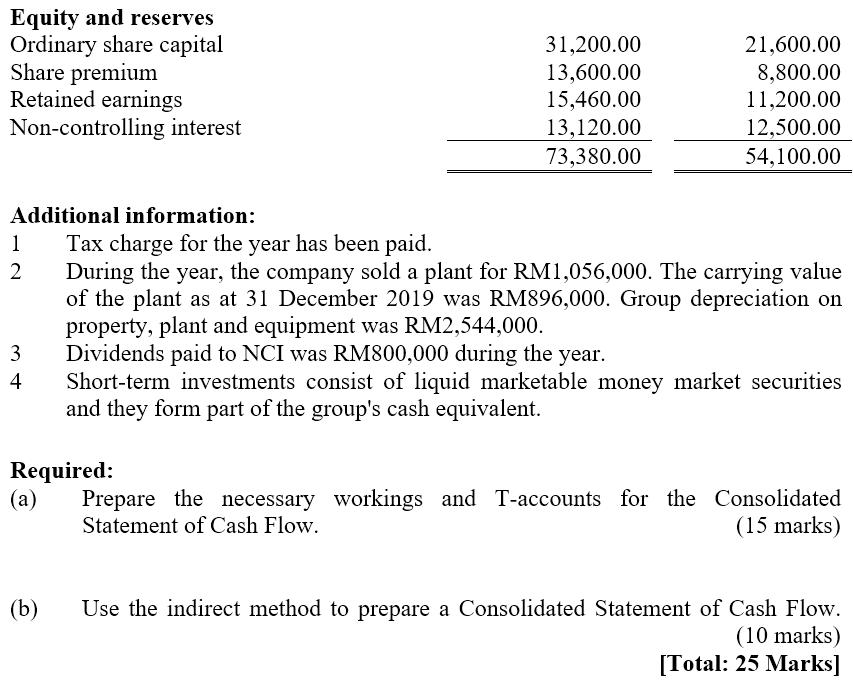

Majestoso Group Berhad consists of subsidiaries and associate companies in various industries. The consolidated financial statements were provided below: Majestoso Group Berhad Consolidated Statement

Majestoso Group Berhad consists of subsidiaries and associate companies in various industries. The consolidated financial statements were provided below: Majestoso Group Berhad Consolidated Statement of Profit or Loss for the year ended 31 December 2019 RM'000 Operating profit Share of profit in associated companies Profit before taxation 4,800.00 2,800.00 7,600.00 xation (1,920.00) Profit after taxation 5,680.00 Profit attributable to: Non-Controlling Interest (NCI) Owners of the parent 1,420.00 4,260.00 5,680.00 Majestoso Group Berhad Consolidated Statement of Financial Position as at 31 December 2019 2018 RM'000 RM'000 Non-current assets Property, plant & equipment (net) Investments in associates 29,380.00 10,400.00 27,300.00 9,600.00 Research & development 3,200.00 42,980.00 800.00 37,700.00 Current assets Inventory Trade receivables 11,200.00 16,800.00 2,400.00 5,600.00 36,000.00 8,800.00 16,400.00 Short-term investments 400.00 Cash at bank & in hand 8,400.00 34,000.00 Current liabilities Bank overdraft Trade payables Dividend payable 1,600.00 2,400.00 1,600.00 5,600.00 800.00 12,000.00 4,800.00 17,600.00 Net current assets 30,400.00 73,380.00 16,400.00 54,100.00 Equity and reserves Ordinary share capital Share premium Retained earnings Non-controlling interest 31,200.00 13,600.00 15,460.00 13,120.00 73,380.00 21,600.00 8,800.00 11,200.00 12,500.00 54,100.00 Additional information: Tax charge for the year has been paid. During the year, the company sold a plant for RM1,056,000. The carrying value of the plant as at 31 December 2019 was RM896,000. Group depreciation on property, plant and equipment was RM2,544,000. Dividends paid to NCI was RM800,000 during the year. Short-term investments consist of liquid marketable money market securities and they form part of the group's cash equivalent. 1 2 3 4 Required: () Prepare the necessary workings and T-accounts for the Consolidated Statement of Cash Flow. (15 marks) (b) Use the indirect method to prepare a Consolidated Statement of Cash Flow. (10 marks) [Total: 25 Marks]

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started