Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lime Company manufactures computers that are sold to retailers who then sell to the ultimate customer. Lime has been very successful due to producing

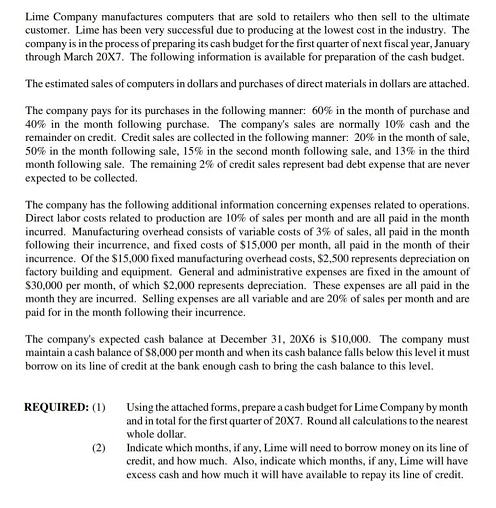

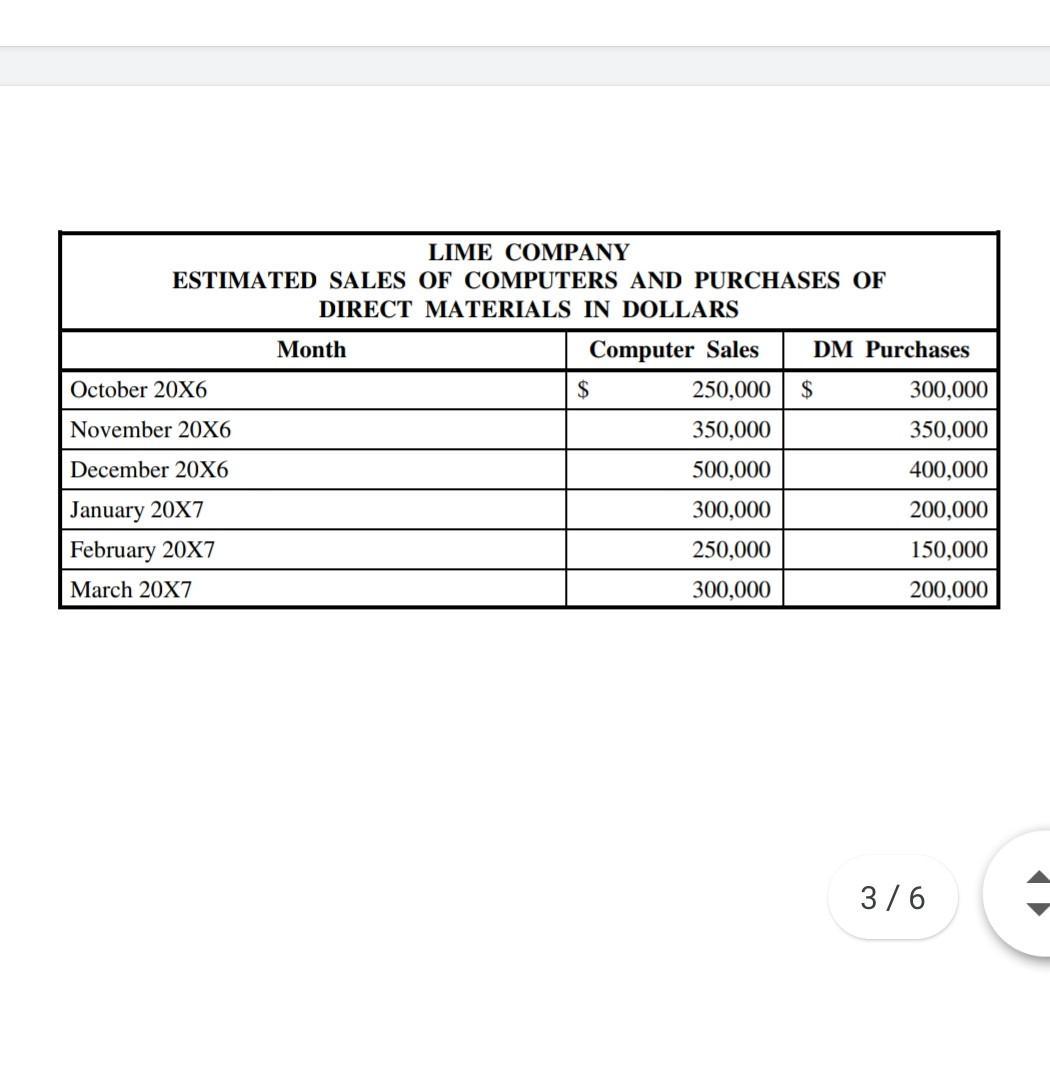

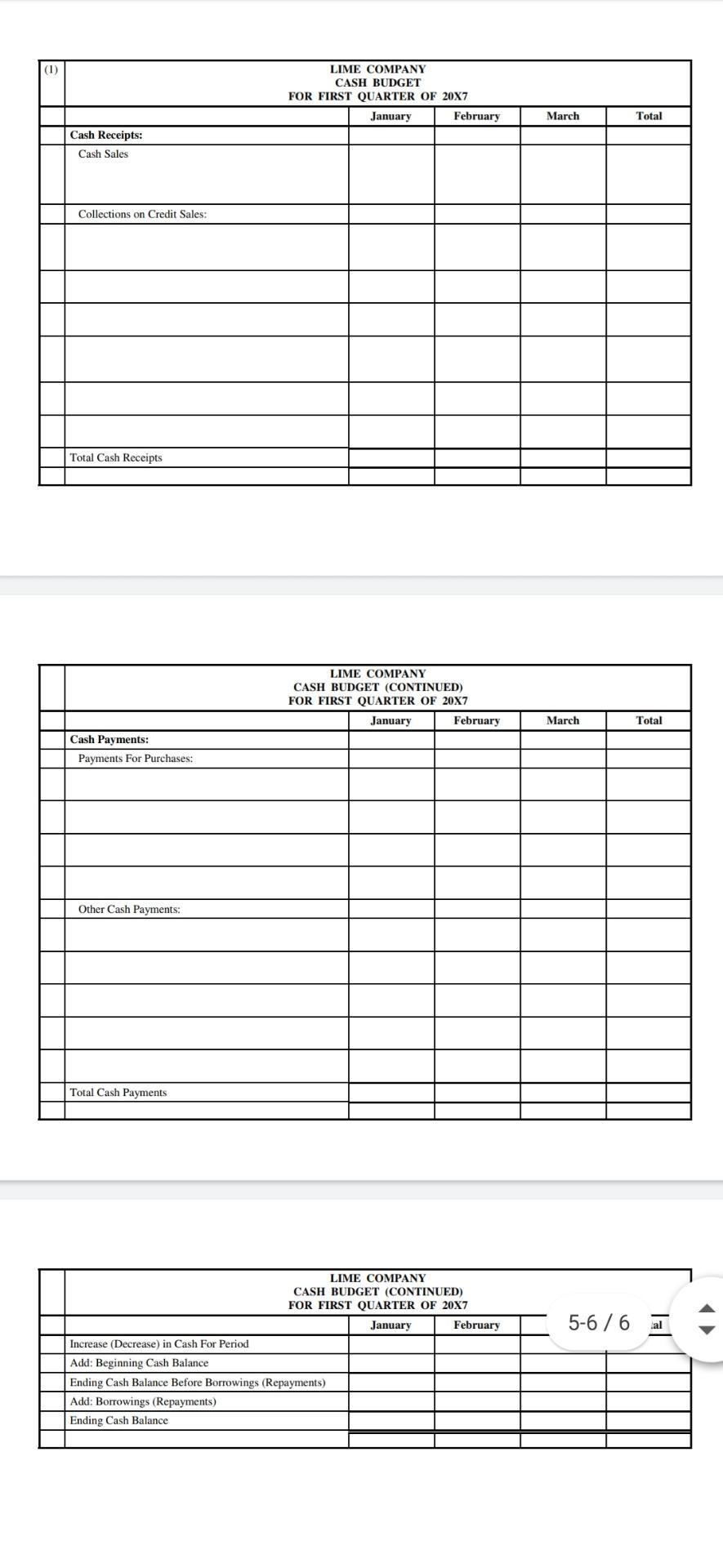

Lime Company manufactures computers that are sold to retailers who then sell to the ultimate customer. Lime has been very successful due to producing at the lowest cost in the industry. The company is in the process of preparing its cash budget for the first quarter of next fiscal year, January through March 20X7. The following information is available for preparation of the cash budget. The estimated sales of computers in dollars and purchases of direct materials in dollars are attached. The company pays for its purchases in the following manner: 60% in the month of purchase and 40% in the month following purchase. The company's sales are normally 10% cash and the remainder on credit. Credit sales are collected in the following manner: 20% in the month of sale, 50% in the month following sale, 15% in the second month following sale, and 13% in the third month following sale. The remaining 2% of credit sales represent bad debt expense that are never expected to be collected. The company has the following additional information concerning expenses related to operations. Direct labor costs related to production are 10% of sales per month and are all paid in the month incurred. Manufacturing overhead consists of variable costs of 3% of sales, all paid in the month following their incurrence, and fixed costs of $15,000 per month, all paid in the month of their incurrence. Of the $15,000 fixed manufacturing overhead costs, $2,500 represents depreciation on factory building and equipment. General and administrative expenses are fixed in the amount of S30,000 per month, of which $2,000 represents depreciation. These expenses are all paid in the month they are incurred. Selling expenses are all variable and are 20% of sales per month and are paid for in the month following their incurrence. The company's expected cash balance at December 31, 20X6 is s10,000. The company must maintain a cash balance of $8,000 per month and when its cash balance falls below this level it must borrow on its line of credit at the bank enough cash to bring the cash balance to this level. Using the attached forms, prepare a cash budget for Lime Company by month and in total for the first quarter of 20X7, Round all calculations to the nearest REQUIRED: (1) whole dollar. Indicate which months, if any, Lime will need to borrow money on its line of credit, and how much. Also, indicate which months, if any, Lime will have excess cash and how much it will have available to repay its line of credit. LIME COMPANY ESTIMATED SALES OF COMPUTERS AND PURCHASES OF DIRECT MATERIALS IN DOLLARS Month Computer Sales DM Purchases October 20X6 250,000 $ 300,000 November 20X6 350,000 350,000 December 20X6 500,000 400,000 January 20X7 300,000 200,000 February 20X7 250,000 150,000 March 20X7 300,000 200,000 3/6 (1) LIME COMPANY CASH BUDGET FOR FIRST QUARTER OF 20X7 January February March Total Cash Receipts: Cash Sales Collections on Credit Sales: Total Cash Receipts LIME COMPANY CASH BUDGET (CONTINUED) FOR FIRST QUARTER OF 20X7 January February March Total Cash Payments: Payments For Purchases: Other Cash Payments: Total Cash Payments LIME COMPANY CASH BUDGET (CONTINUED) FOR FIRST QUARTER OF 20X7 January 5-6 /6 al February Increase (Decrease) in Cash For Period Add: Beginning Cash Balance Ending Cash Balance Before Borrowings (Repayments) Add: Borrowings (Repayments) Ending Cash Balance Lime Company manufactures computers that are sold to retailers who then sell to the ultimate customer. Lime has been very successful due to producing at the lowest cost in the industry. The company is in the process of preparing its cash budget for the first quarter of next fiscal year, January through March 20X7. The following information is available for preparation of the cash budget. The estimated sales of computers in dollars and purchases of direct materials in dollars are attached. The company pays for its purchases in the following manner: 60% in the month of purchase and 40% in the month following purchase. The company's sales are normally 10% cash and the remainder on credit. Credit sales are collected in the following manner: 20% in the month of sale, 50% in the month following sale, 15% in the second month following sale, and 13% in the third month following sale. The remaining 2% of credit sales represent bad debt expense that are never expected to be collected. The company has the following additional information concerning expenses related to operations. Direct labor costs related to production are 10% of sales per month and are all paid in the month incurred. Manufacturing overhead consists of variable costs of 3% of sales, all paid in the month following their incurrence, and fixed costs of $15,000 per month, all paid in the month of their incurrence. Of the $15,000 fixed manufacturing overhead costs, $2,500 represents depreciation on factory building and equipment. General and administrative expenses are fixed in the amount of S30,000 per month, of which $2,000 represents depreciation. These expenses are all paid in the month they are incurred. Selling expenses are all variable and are 20% of sales per month and are paid for in the month following their incurrence. The company's expected cash balance at December 31, 20X6 is s10,000. The company must maintain a cash balance of $8,000 per month and when its cash balance falls below this level it must borrow on its line of credit at the bank enough cash to bring the cash balance to this level. Using the attached forms, prepare a cash budget for Lime Company by month and in total for the first quarter of 20X7, Round all calculations to the nearest REQUIRED: (1) whole dollar. Indicate which months, if any, Lime will need to borrow money on its line of credit, and how much. Also, indicate which months, if any, Lime will have excess cash and how much it will have available to repay its line of credit. LIME COMPANY ESTIMATED SALES OF COMPUTERS AND PURCHASES OF DIRECT MATERIALS IN DOLLARS Month Computer Sales DM Purchases October 20X6 250,000 $ 300,000 November 20X6 350,000 350,000 December 20X6 500,000 400,000 January 20X7 300,000 200,000 February 20X7 250,000 150,000 March 20X7 300,000 200,000 3/6 (1) LIME COMPANY CASH BUDGET FOR FIRST QUARTER OF 20X7 January February March Total Cash Receipts: Cash Sales Collections on Credit Sales: Total Cash Receipts LIME COMPANY CASH BUDGET (CONTINUED) FOR FIRST QUARTER OF 20X7 January February March Total Cash Payments: Payments For Purchases: Other Cash Payments: Total Cash Payments LIME COMPANY CASH BUDGET (CONTINUED) FOR FIRST QUARTER OF 20X7 January 5-6 /6 al February Increase (Decrease) in Cash For Period Add: Beginning Cash Balance Ending Cash Balance Before Borrowings (Repayments) Add: Borrowings (Repayments) Ending Cash Balance Lime Company manufactures computers that are sold to retailers who then sell to the ultimate customer. Lime has been very successful due to producing at the lowest cost in the industry. The company is in the process of preparing its cash budget for the first quarter of next fiscal year, January through March 20X7. The following information is available for preparation of the cash budget. The estimated sales of computers in dollars and purchases of direct materials in dollars are attached. The company pays for its purchases in the following manner: 60% in the month of purchase and 40% in the month following purchase. The company's sales are normally 10% cash and the remainder on credit. Credit sales are collected in the following manner: 20% in the month of sale, 50% in the month following sale, 15% in the second month following sale, and 13% in the third month following sale. The remaining 2% of credit sales represent bad debt expense that are never expected to be collected. The company has the following additional information concerning expenses related to operations. Direct labor costs related to production are 10% of sales per month and are all paid in the month incurred. Manufacturing overhead consists of variable costs of 3% of sales, all paid in the month following their incurrence, and fixed costs of $15,000 per month, all paid in the month of their incurrence. Of the $15,000 fixed manufacturing overhead costs, $2,500 represents depreciation on factory building and equipment. General and administrative expenses are fixed in the amount of S30,000 per month, of which $2,000 represents depreciation. These expenses are all paid in the month they are incurred. Selling expenses are all variable and are 20% of sales per month and are paid for in the month following their incurrence. The company's expected cash balance at December 31, 20X6 is s10,000. The company must maintain a cash balance of $8,000 per month and when its cash balance falls below this level it must borrow on its line of credit at the bank enough cash to bring the cash balance to this level. Using the attached forms, prepare a cash budget for Lime Company by month and in total for the first quarter of 20X7, Round all calculations to the nearest REQUIRED: (1) whole dollar. Indicate which months, if any, Lime will need to borrow money on its line of credit, and how much. Also, indicate which months, if any, Lime will have excess cash and how much it will have available to repay its line of credit. LIME COMPANY ESTIMATED SALES OF COMPUTERS AND PURCHASES OF DIRECT MATERIALS IN DOLLARS Month Computer Sales DM Purchases October 20X6 250,000 $ 300,000 November 20X6 350,000 350,000 December 20X6 500,000 400,000 January 20X7 300,000 200,000 February 20X7 250,000 150,000 March 20X7 300,000 200,000 3/6 (1) LIME COMPANY CASH BUDGET FOR FIRST QUARTER OF 20X7 January February March Total Cash Receipts: Cash Sales Collections on Credit Sales: Total Cash Receipts LIME COMPANY CASH BUDGET (CONTINUED) FOR FIRST QUARTER OF 20X7 January February March Total Cash Payments: Payments For Purchases: Other Cash Payments: Total Cash Payments LIME COMPANY CASH BUDGET (CONTINUED) FOR FIRST QUARTER OF 20X7 January 5-6 /6 al February Increase (Decrease) in Cash For Period Add: Beginning Cash Balance Ending Cash Balance Before Borrowings (Repayments) Add: Borrowings (Repayments) Ending Cash Balance Lime Company manufactures computers that are sold to retailers who then sell to the ultimate customer. Lime has been very successful due to producing at the lowest cost in the industry. The company is in the process of preparing its cash budget for the first quarter of next fiscal year, January through March 20X7. The following information is available for preparation of the cash budget. The estimated sales of computers in dollars and purchases of direct materials in dollars are attached. The company pays for its purchases in the following manner: 60% in the month of purchase and 40% in the month following purchase. The company's sales are normally 10% cash and the remainder on credit. Credit sales are collected in the following manner: 20% in the month of sale, 50% in the month following sale, 15% in the second month following sale, and 13% in the third month following sale. The remaining 2% of credit sales represent bad debt expense that are never expected to be collected. The company has the following additional information concerning expenses related to operations. Direct labor costs related to production are 10% of sales per month and are all paid in the month incurred. Manufacturing overhead consists of variable costs of 3% of sales, all paid in the month following their incurrence, and fixed costs of $15,000 per month, all paid in the month of their incurrence. Of the $15,000 fixed manufacturing overhead costs, $2,500 represents depreciation on factory building and equipment. General and administrative expenses are fixed in the amount of S30,000 per month, of which $2,000 represents depreciation. These expenses are all paid in the month they are incurred. Selling expenses are all variable and are 20% of sales per month and are paid for in the month following their incurrence. The company's expected cash balance at December 31, 20X6 is s10,000. The company must maintain a cash balance of $8,000 per month and when its cash balance falls below this level it must borrow on its line of credit at the bank enough cash to bring the cash balance to this level. Using the attached forms, prepare a cash budget for Lime Company by month and in total for the first quarter of 20X7, Round all calculations to the nearest REQUIRED: (1) whole dollar. Indicate which months, if any, Lime will need to borrow money on its line of credit, and how much. Also, indicate which months, if any, Lime will have excess cash and how much it will have available to repay its line of credit. LIME COMPANY ESTIMATED SALES OF COMPUTERS AND PURCHASES OF DIRECT MATERIALS IN DOLLARS Month Computer Sales DM Purchases October 20X6 250,000 $ 300,000 November 20X6 350,000 350,000 December 20X6 500,000 400,000 January 20X7 300,000 200,000 February 20X7 250,000 150,000 March 20X7 300,000 200,000 3/6 (1) LIME COMPANY CASH BUDGET FOR FIRST QUARTER OF 20X7 January February March Total Cash Receipts: Cash Sales Collections on Credit Sales: Total Cash Receipts LIME COMPANY CASH BUDGET (CONTINUED) FOR FIRST QUARTER OF 20X7 January February March Total Cash Payments: Payments For Purchases: Other Cash Payments: Total Cash Payments LIME COMPANY CASH BUDGET (CONTINUED) FOR FIRST QUARTER OF 20X7 January 5-6 /6 al February Increase (Decrease) in Cash For Period Add: Beginning Cash Balance Ending Cash Balance Before Borrowings (Repayments) Add: Borrowings (Repayments) Ending Cash Balance

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Borrowings required and excess cash are computed as follows Ans Lime company Cash Budge...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started