Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Martinez and Associates produces two products named Loser and Big Winner. Last month 1,000 units of Loser and 4,000 units of Big Winner were

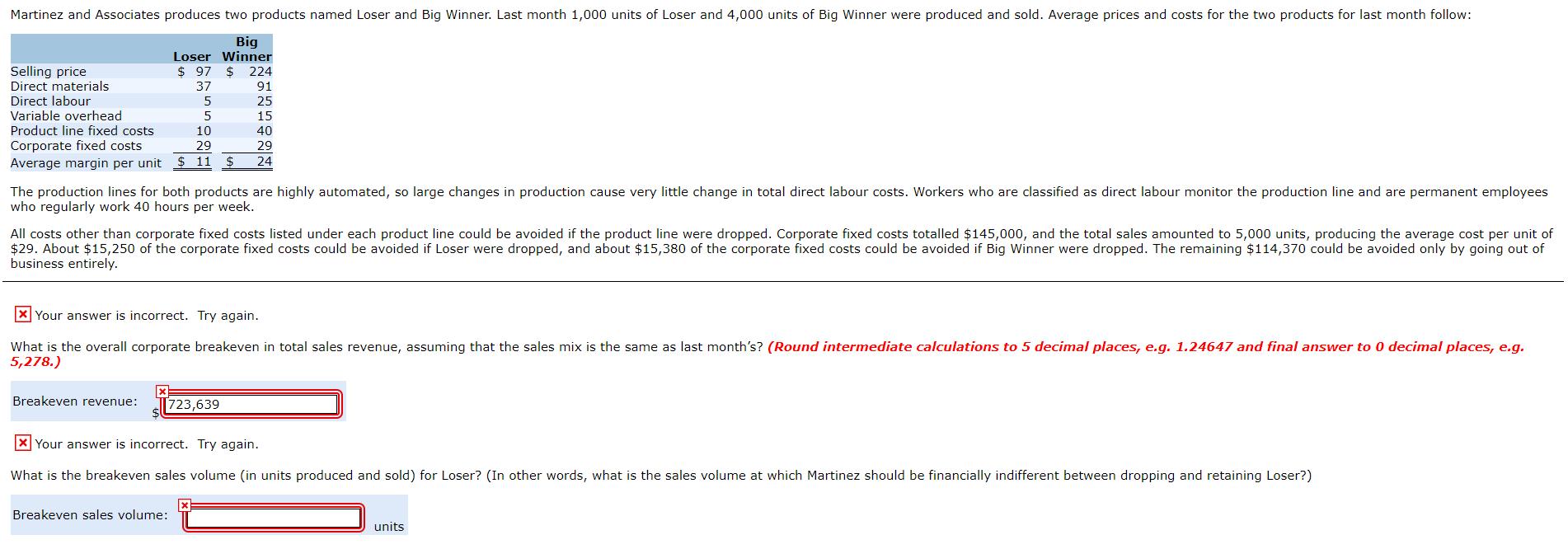

Martinez and Associates produces two products named Loser and Big Winner. Last month 1,000 units of Loser and 4,000 units of Big Winner were produced and sold. Average prices and costs for the two products for last month follow: Big Loser Winner $ 97 $ Selling price Direct materials Direct labour Variable overhead Product line fixed costs Corporate fixed costs Average margin per unit $ 11 224 91 37 25 15 10 40 29 29 $ 24 The production lines for both products are highly automated, so large changes in production cause very little change in total direct labour costs. Workers who are classified as direct labour monitor the production line and are permanent employees who regularly work 40 hours per week. All costs other than corporate fixed costs listed under each product line could be avoided if the product line were dropped. Corporate fixed costs totalled $145,000, and the total sales amounted to 5,000 units, producing the average cost per unit of $29. About $15,250 of the corporate fixed costs could be avoided if Loser were dropped, and about $15,380 of the corporate fixed costs could be avoided if Big Winner were dropped. The remaining $114,370 could be avoided only by going out of business entirely. XYour answer is incorrect. Try again. What is the overall corporate breakeven in total sales revenue, assuming that the sales mix is the same as last month's? (Round intermediate calculations to 5 decimal places, e.g. 1.24647 and final answer to 0 decimal places, e.g. 5,278.) Breakeven revenue: [723,639 X Your answer is incorrect. Try again. What is the breakeven sales volume (in units produced and sold) for Loser? (In other words, what is the sales volume at which Martinez should be financially indifferent between dropping and retaining Loser?) Breakeven sales volume: units

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started