Answered step by step

Verified Expert Solution

Question

1 Approved Answer

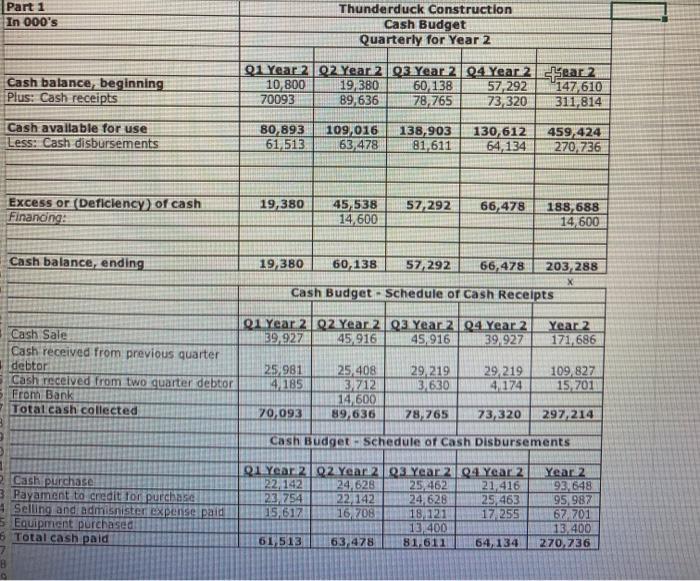

Calculate revenue and spending variances in the income statement for each account for each quarter of Year 2. Compare the budgeted results calculated in

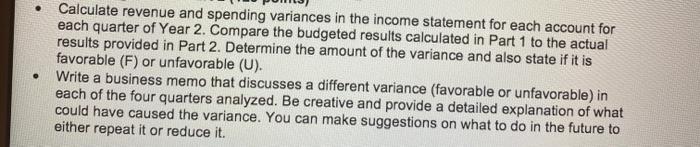

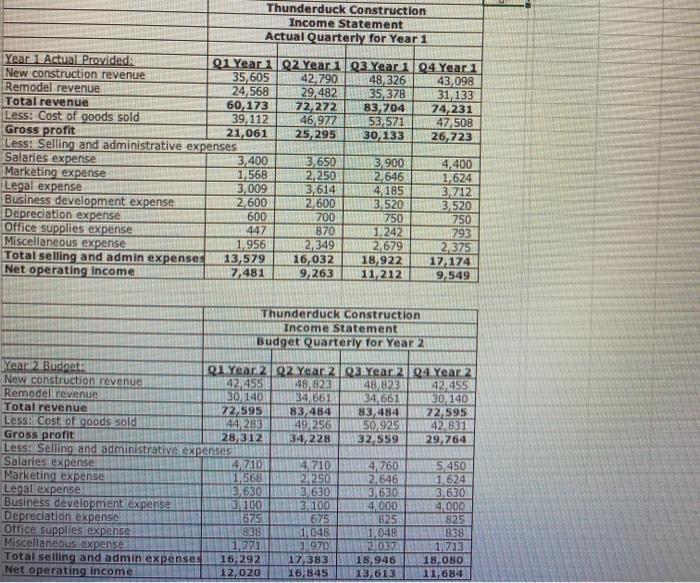

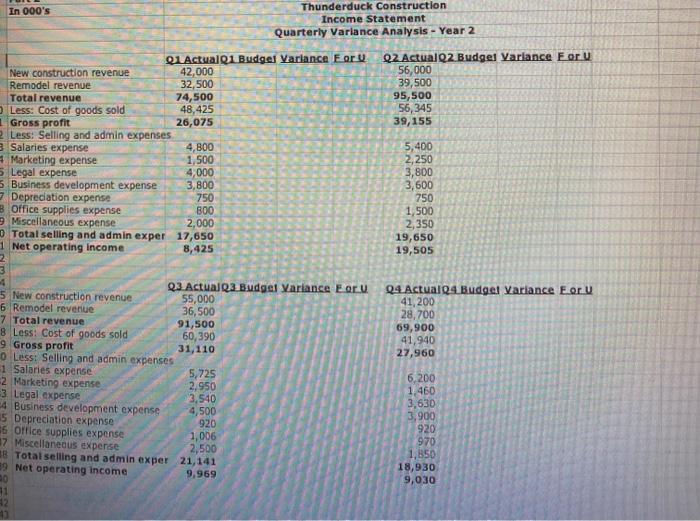

Calculate revenue and spending variances in the income statement for each account for each quarter of Year 2. Compare the budgeted results calculated in Part 1 to the actual results provided in Part 2. Determine the amount of the variance and also state if it is favorable (F) or unfavorable (U). Write a business memo that discusses a different variance (favorable or unfavorable) in each of the four quarters analyzed. Be creative and provide a detailed explanation of what could have caused the variance. You can make suggestions on what to do in the future to either repeat it or reduce it. Year 1 Actual Provided: New construction revenue Salaries expense Marketing expense Remodel revenue Total revenue Less: Cost of goods sold Gross profit Less: Selling and administrative expenses Legal expense Business development expense Depreciation expense Office supplies expense Miscellaneous expense Total selling and admin expenses Net operating income Year 2 Budget: New construction revenue Salaries expense Marketing expense Legal expense Business development expense Depreciation expense Office supplies expense Miscellaneous expense 01 Year 1 Q2 Year 1 Q3 Year 1 04 Year 1 42,790 48,326 43,098 29,482 35,378 31,133 83,704 53,571 30,133 Total selling and admin expenses Net operating income 35,605 24,568 Remodel revenue Total revenue Less: Cost of goods sold Gross profit Less: Selling and administrative expenses 60,173 72,272 39,112 46,977 21,061 25,295 Thunderduck Construction Income Statement Actual Quarterly for Year 1 3,400 1,568 3,009 2,600 600 447 1,956 13,579 7,481 72,595 44,283 28,312 4,710 1,568 Thunderduck Construction Income Statement Budget Quarterly for Year 2 3,630 3,100 3,650 2,250 3,614 2,600 3,900 2,646 4,185 3,520 750 1,242 2,679 16,032 18,922 9,263 11,212 675 838 1,771 21 Year 2 92 Year 2 Q3 Year 2 Q4 Year 2 42,455 48,823 42,455 30,140 34,661 30,140 700 870 2,349 48,823 34,661 83,484 49,256 34,228 4,710 2,250 3.630 3,100 675 1,048 1.970 16,292 17,383 12,020 16,845 83,484 50,925 32,559 4,760 2,646 3,630 4,000 825 1,048 2.037 74,231 47,508 26,723 18,946 13,613 4,400 1,624 3,712 3,520 750 793 2,375 17,174 9,549 72,595 42,831 29,764 5,450 1,624 3.630 4,000 825 838 1,713 18,080 11,684 Part 1 In 000's Cash balance, beginning Plus: Cash receipts Cash available for use Less: Cash disbursements Excess or (Deficiency) of cash Financing: Cash balance, ending Cash Sale Cash received from previous quarter debtor Cash received from two quarter debtor From Bank Total cash collected 2 Cash purchase 3 Payament to credit for purchase 4 Selling and admisnister expense paid 5 Equipment purchased 6 Total cash paid 01 Year 2 10,800 70093 80,893 61,513 19,380 19,380 25,981 4,185 Thunderduck Construction Cash Budget Quarterly for Year 2 02 Year 2 Q3 Year 2 Q4 Year 2 19,380 60,138 57,292 89,636 78,765 73,320 109,016 63,478 Q1 Year 2 Q2 Year 2 39,927 45,916 22,142 23,754 15,617 45,538 14,600 60,138 57,292 66,478 Cash Budget- Schedule of Cash Receipts 61,513 138,903 81,611 22,142 16,708 63,478 130,612 459,424 64,134 270,736 57,292 66,478 188,688 14,600 25,408 3,712 14,600 70,093 89,636 78,765 Cash Budget- Schedule of Cash Disbursements Q3 Year 2 Q4 Year 2 45.916 39,927 29,219 3,630 91 Year 2 Q2 Year 2 Q3 Year 2 Q4 Year 2 24,628 25,462 21,416 24,628 25,463 18,121 17, 255 13.400 81,611 ear 2 147,610 311,814 29,219 4,174 203,288 109,827 15,701 73,320 297,214 64,134 Year 2 171,686 Year 2 93,648 95,987 67.701 13,400 270,736 In 000's New construction revenue Remodel revenue Total revenue O Less: Cost of goods sold Gross profit 2 Less: Selling and admin expenses 3 Salaries expense 4,800 1,500 4,000 3,800 750 800 2,000 0 Total selling and admin exper 17,650 1 Net operating income 8,425 2 Marketing expense 5 Legal expense 5 Business development expense 7 Depreciation expense B Office supplies expense 9 Miscellaneous expense Q1 ActualQ1 Budget Variance For U 42,000 32,500 74,500 48,425 26,075 3 4 5 New construction revenue 6 Remodel revenue 7 Total revenue 8 Less: Cost of goods sold 9 Gross profit 0 Less: Selling and admin expenses 1 Salaries expense -2 Marketing expense 3 Legal expense 4 Business development expense 5 Depreciation expense #6 Office supplies expense 7 Miscellaneous expense 42 43 Q3 Actual Q3 Budget Variance For U 55,000 36,500 91,500 60,390 31,110 Thunderduck Construction Income Statement Quarterly Variance Analysis - Year 2 5,725 2,950 3,540 4,500 920 1,006 2,500 38 Total selling and admin exper 21,141 39 Net operating income 9,969 20 41 Q2 ActualQ2 Budget Variance For U 56,000 39,500 95,500 56,345 39,155 5,400 2,250 3,800 3,600 750 1,500 2,350 19,650 19,505 Q4 ActualQ4 Budget Variance For U 41,200 28,700 69,900 41,940 27,960 6,200 1,460 3,630 3,900 920 970 1,850 18,930 9,030

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

In given question we will using Boyles law equation Px At constant temperature So PV PV2 Where P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started