Answered step by step

Verified Expert Solution

Question

1 Approved Answer

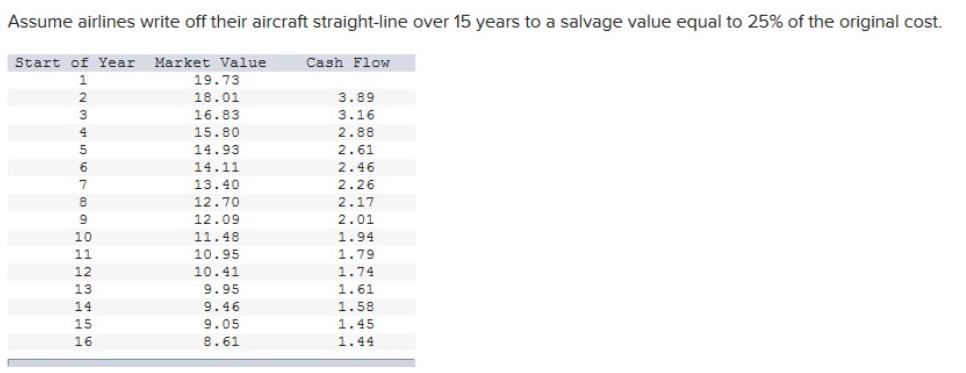

Accounting measures of performance The table given below shows how, on average, the market value of a Boeing 737 has varied with its age and

Accounting measures of performance The table given below shows how, on average, the market value of a Boeing 737 has varied with its age and the cash flow needed in each year to provide a 11% return. (For example, if you bought a 737 for $19.73 million at the start of year 1 and sold it a year later, your total profit would be 18.01 +3.89 - 19.73 = $2.17 million, 11% of the purchase cost.)

Assume airlines write off their aircraft straight-line over 15 years to a salvage value equal to 25% of the original cost. Start of Year Market Value 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 19.73 18.01 16.83 15.80 14.93 14.11 13.40 12.70 12.09 11.48 10.95 10.41 9.95 9.46 9.05 8.61 Cash Flow 3.89 3.16 2.88 2.61 2.46 2.26 2.17 2.01 1.94 1.79 1.74 1.61 1.58 1.45 1.44 a. Calculate economic depreciation, book depreciation, economic return, and book return for each year of the plane s life. (Leave no cells blank - be certain to enter 0 wherever required. Do not round intermediate calculations. Enter your answers in millions except for percentage values. Round your percentage answers to 1 decimal place and other answers to 2 decimal places.) Start of Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Economic depreciation Book depreciation Economic return (%) Book return (%) b-1. Suppose an airline invested in a fixed number of Boeing 737s each year. Calculate the steady-state book rate of return. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Steady-state book rate of return %

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started