Answered step by step

Verified Expert Solution

Question

1 Approved Answer

rn Monopoly Transactions These are the transactions that occurred when you played Monopoly. Use these transactions to complete the requirements noted above. 1) Started the

rn

rn

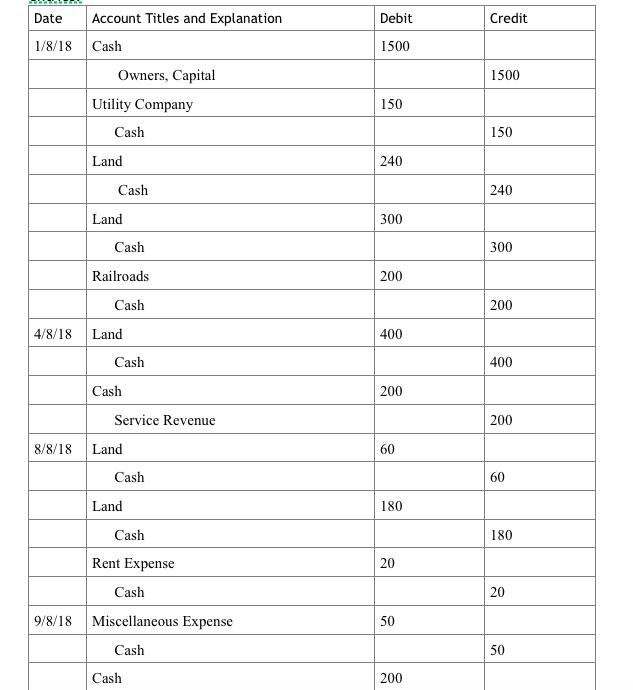

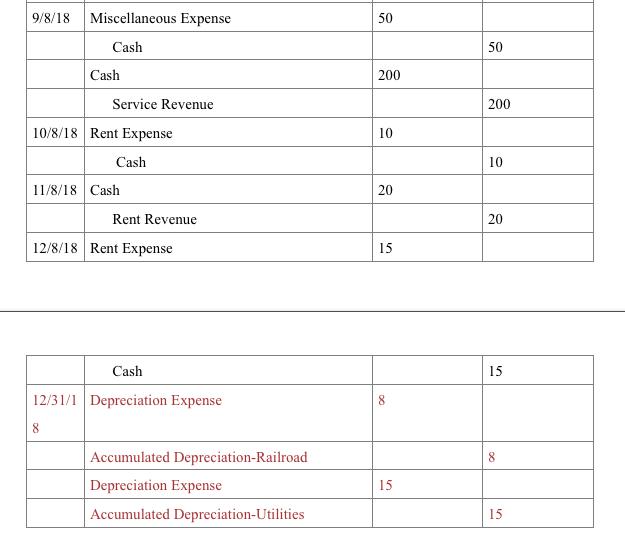

Monopoly Transactions These are the transactions that occurred when you "played" Monopoly. Use these transactions to complete the requirements noted above. 1) Started the business by investing $1,500 into the business. 2) Purchased Electric Company for $150. 3) Purchased Illinois for $240. 4) Purchased North Carolina for $300. 5) Purchased Short Line Railroad for $200. 6) Purchased Boardwalk for $400. 7) Passed Go and collected $200 (Hint. SERVICE REVENUE). 8) Purchased Baltic for $60. 9) Purchased St. James for $180. 10) Paid $20 rent. 11) Paid $50 doctor's fee. 12) Passed Go and collected $200. 13) Paid $10 rent. 14) Received $20 rent 15) Paid $15 rent. Ending cash = $295.

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Monopoly Journal entries No Account Debit Credit 1 Cash 1500 Your Name Capital 1500 2 Utility ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started