Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Marsh has been employed by the Ace Distributing Company for the past three years. During 2019, the following amounts were credited to Ms.

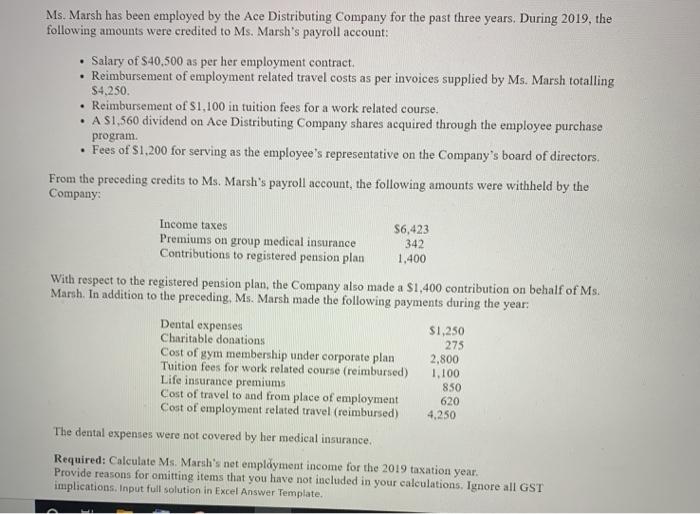

Ms. Marsh has been employed by the Ace Distributing Company for the past three years. During 2019, the following amounts were credited to Ms. Marsh's payroll account: Salary of $40,500 as per her employment contract. Reimbursement of employment related travel costs as per invoices supplied by Ms. Marsh totalling $4,250. Reimbursement of $1,100 in tuition fees for a work related course. A S1,560 dividend on Ace Distributing Company shares acquired through the employee purchase program. Fees of $1,200 for serving as the employee's representative on the Company's board of directors. From the preceding credits to Ms. Marsh's payroll account, the following amounts were withheld by the Company: Income taxes $6,423 342 Premiums on group medical insurance Contributions to registered pension plan 1,400 With respect to the registered pension plan, the Company also made a $1,400 contribution on behalf of Ms. Marsh. In addition to the preceding, Ms. Marsh made the following payments during the year: Dental expenses Charitable donations Cost of gym membership under corporate plan Tuition fees for work related course (reimbursed) Life insurance premiums Cost of travel to and from place of employment Cost of employment related travel (reimbursed) S1,250 275 2,800 1,100 850 620 4,250 The dental expenses were not covered by her medical insurance, Required: Calculate Ms. Marsh's net empldyment income for the 2019 taxation year. Provide reasons for omitting items that you have not included in your caleulations. Ignore all GST implications. Input full solution in Excel Answer Template.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started