Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10 points Joseph is a Financial Adviser working for a Big Bank AFSL. New client Mariam has come to see Joseph for advice on

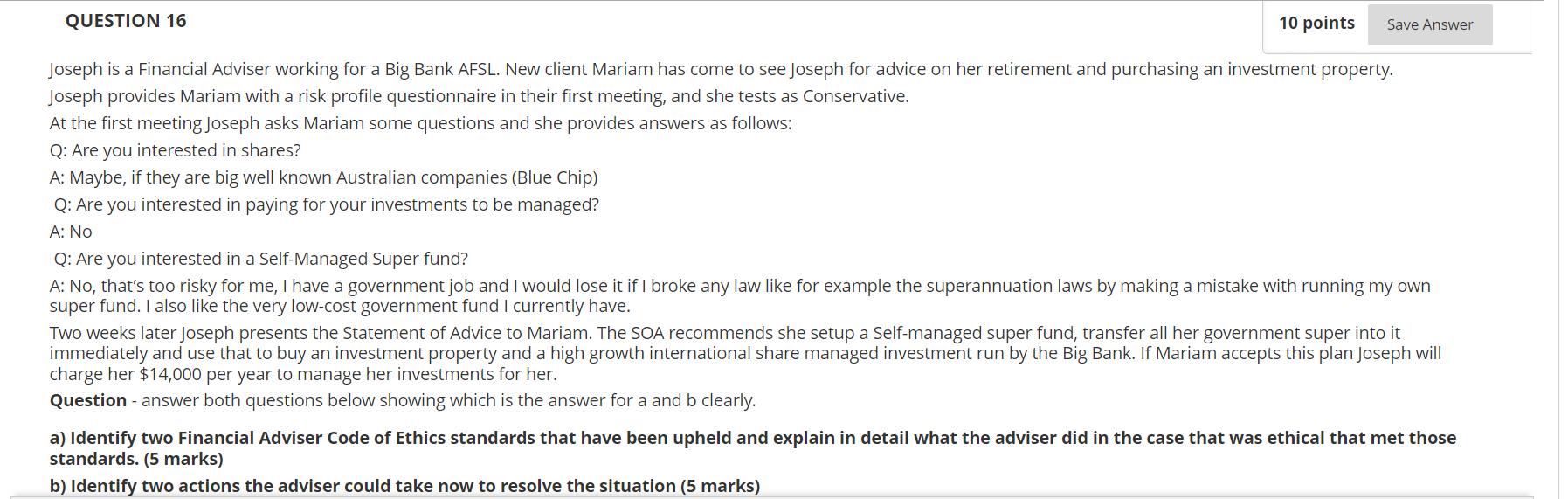

10 points Joseph is a Financial Adviser working for a Big Bank AFSL. New client Mariam has come to see Joseph for advice on her retirement and purchasing an investment property. Joseph provides Mariam with a risk profile questionnaire in their first meeting, and she tests as Conservative. QUESTION 16 At the first meeting Joseph asks Mariam some questions and she provides answers as follows: Q: Are you interested in shares? A: Maybe, if they are big well known Australian companies (Blue Chip) Q: Are you interested in paying for your investments to be managed? A: No Save Answer Q: Are you interested in a Self-Managed Super fund? A: No, that's too risky for me, I have a government job and I would lose it if I broke any law like for example the superannuation laws by making a mistake with running my own super fund. I also like the very low-cost government fund I currently have. Two weeks later Joseph presents the Statement of Advice to Mariam. The SOA recommends she setup a Self-managed super fund, transfer all her government super into it immediately and use that to buy an investment property and a high growth international share managed investment run by the Big Bank. If Mariam accepts this plan Joseph will charge her $14,000 per year to manage her investments for her. Question - answer both questions below showing which is the answer for a and b clearly. a) Identify two Financial Adviser Code of Ethics standards that have been upheld and explain in detail what the adviser did in the case that was ethical that met those standards. (5 marks) b) Identify two actions the adviser could take now to resolve the situation (5 marks)

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Identify two Financial Adviser Code of Ethics standards that have been upheld and explain in detai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started