Answered step by step

Verified Expert Solution

Question

1 Approved Answer

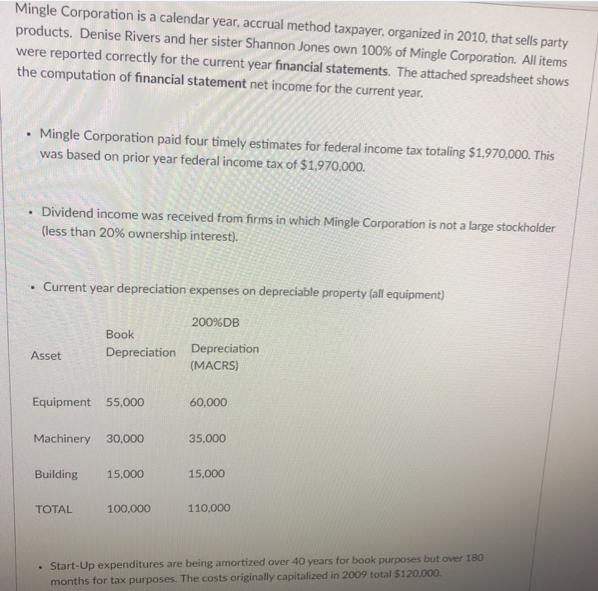

Mingle Corporation is a calendar year, accrual method taxpayer, organized in 2010, that sells party products. Denise Rivers and her sister Shannon Jones own

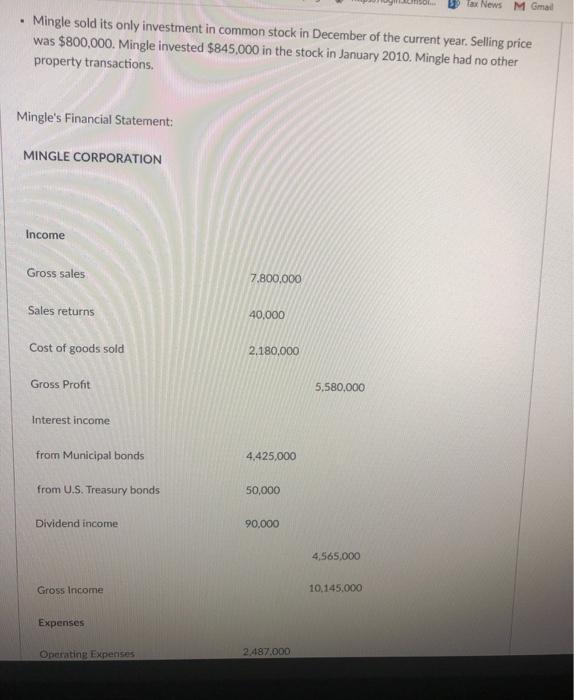

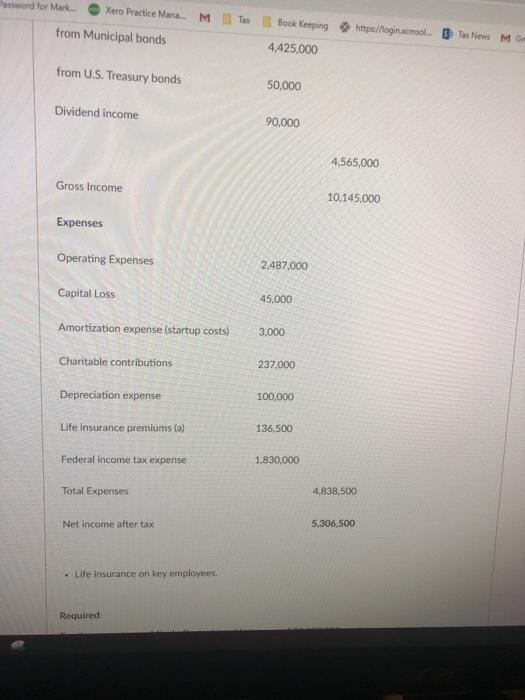

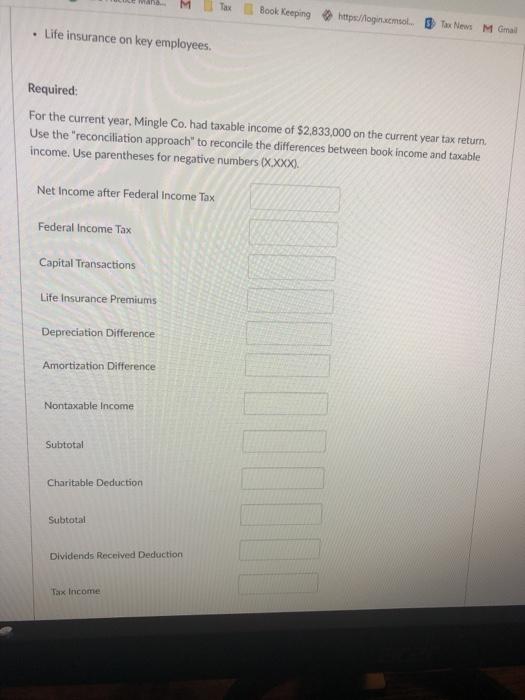

Mingle Corporation is a calendar year, accrual method taxpayer, organized in 2010, that sells party products. Denise Rivers and her sister Shannon Jones own 100% of Mingle Corporation. All items were reported correctly for the current year financial statements. The attached spreadsheet shows the computation of financial statement net income for the current year. Mingle Corporation paid four timely estimates for federal income tax totaling $1,970,000. This was based on prior year federal income tax of $1,970,000. Dividend income was received from firms in which Mingle Corporation is not a large stockholder (less than 20% ownership interest). Current year depreciation expenses on depreciable property (all equipment) 200%DB Book Depreciation Depreciation (MACRS) Asset Equipment 55,000 60,000 Machinery 30,000 35,000 Building 15,000 15,000 TOTAL 100,000 110,000 Start-Up expenditures are being amortized over 40 years for book purposes but over 180 months for tax purposes. The costs originally capitalized in 2009 total $120.000 Tax News MGmail Mingle sold its only investment in common stock in December of the current year. Selling price was $800,000. Mingle invested $845,000 in the stock in January 2010. Mingle had no other property transactions. Mingle's Financial Statement: MINGLE CORPORATION Income Gross sales 7.800,000 Sales returns 40,000 Cost of goods sold 2.180.000 Gross Profit 5,580,000 Interest income from Municipal bonds 4,425,000 from U.S. Treasury bonds 50,000 Dividend income 90,000 4,565,000 Gross Income 10,145.000 Expenses Operating Expenses 2,487.000 Fassword for Mark. Xero Practice Mana. M Tax Book Keeping https//loginacmsol. Tax News M Gm from Municipal bonds 4,425,000 from U.S. Treasury bonds 50,000 Dividend income 90,000 4,565,000 Gross Income 10,145,000 Expenses Operating Expenses 2,487,000 Capital Loss 45,000 Amortization expense (startup costs) 3,000 Charitable contributions 237,000 Depreciation expense 100,000 Life insurance premiums (a) 136,500 1,830,000 Federal income tax expense 4,838,500 Total Expenses 5,306,500 Net income after tax - Life insurance on key employees. Required: Tax Book Keeping https:/login.xcmsol. Tax News MGmail Life insurance on key employees. Required: For the current year, Mingle Co. had taxable income of $2,833,000 on the current year tax return. Use the "reconciliation approach" to reconcile the differences between book income and taxable income. Use parentheses for negative numbers (XXXX). Net Income after Federal Income Tax Federal Income Tax Capital Transactions Life Insurance Premiums Depreciation Difference Amortization Difference Nontaxable Income Subtotal Charitable Deduction Subtotal Dividends Received Deduction Tax Income

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

All the countries the preparations of accounts and presentations of financial statemen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started