Question

If several attempts to repair the machine has been done but due to limited availability of the spare parts, being purchase only 3 years ago.

If several attempts to repair the machine has been done but due to limited availability of the spare parts, being purchase only 3 years ago. Technical team from Head Office had confirmed these findings, and from joint discussion with external Technical Consulting team and Vendors further validated that from the initial purchase price of IDR 25 billion, if they are sold presently the company get no more than IDR 400 million for the entire equipment at the plant. The current machine has no market value at the end of its economic live.

PT. XYZ had anticipated these conditions early last year and already commissioned the same technical team to prepare alternative plan to invest in new equipment and machinery for MRHP. This has been based on maximum daily FFB processing capacity of 350 tons and facilitate the increase of 5% per year for the next 5 years. After final negotiation with the suppliers and contractors PT. XYZ procurement team received best quote through tender of IDR 40 billion base cost of the total replacement machinery and related hardware. Under the Turn-key project basis, additional 12 percent will be charged for the technical design, construction, installation and commission services;

Should the company replace into the new machine ? Explain the reason using initial cost, operating cash flow, terminal cash flow

Determine the NPV, IRR, payback period, profitability index using spreadsheet.

“Project A" will implement Plantation Optimization

program, this is to immediately overhaul the machinery and increase the production capacity of the CPO mill from the current maximum daily processing capacity of 300 tons of Palm Oil Fresh Fruit Branch (FFB). This increase in production capacity is in line with the projected rise of FFB for the next 10 years, in parallel with corresponding age profile of the maturing oil palm trees within their plantation. Yield of the FFBs from these plants is expected to rise annually by 5 pct.

The local management team has reported to Operations director at PT. XYZ head office relating to concerns in condition of the plant’s machineries. Based on the original built specification, the entire set CPO milling system machinery has an economic life of 5 years.

Actual processing capacity of the current CPO mill has been significantly reduced due to damage in the primary steam boilers at the plant. This was caused by uncontrolled mineral

deposits and had gradually restricts the flow of the heated steam to the sterilization chambers.

Several attempts to repair the equipment has been done but due to the limited availability of the customized spare parts needed, being purchase only 3 years ago.

Because of the above technical factors, in the current production year has been constrained. The plant can only be safely operated at daily load of 300 tons FFB per day. For the next three years, the technical team expects that this capacity will need to be gradually reduced by 6 percent each year. The Technical Support team from Head Office had confirmed these findings, and from joint discussion with external Technical team and Vendors further validated that from the initial purchase price of IDR 25 billion, if they are sold presently the company get no more than IDR 400 million for the entire equipment at the plant. The current machine has no market value at the end of its economic live.PT. XYZ had anticipated these conditions early last year and already commissioned the same technical team to prepare alternative plan to invest in new equipment and machinery. This has been based on maximum daily FFB processing capacity of 350 tons and Facilitate the increase of 5% per year for the next 5 years.

After final negotiation with the suppliers and contractors PT. XYZ procurement team received best quote through tender of IDR 40 billion base cost of the total replacement machinery and related hardware. Under the Turn-key project basis, additional 12 percent will be charged for the technical design, construction, installation and commission services; until ready for handover and production run to Production team at site. After the project ended, the team expected the market value of the proposed machines null.

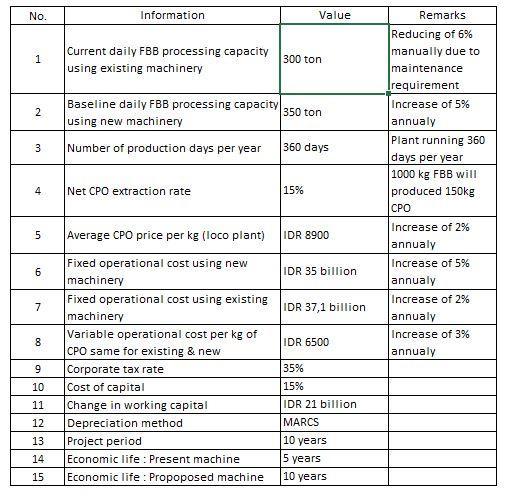

No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Information Current daily FBB processing capacity using existing machinery Baseline daily FBB processing capacity using new machinery Number of production days per year Net CPO extraction rate Average CPO price per kg (loco plant) Fixed operational cost using new machinery Fixed operational cost using existing machinery Variable operational cost per kg of CPO same for existing & new Corporate tax rate Cost of capital Change in working capital Depreciation method Project period Economic life: Present machine Economic life: Propoposed machine Value 300 ton 350 ton 360 days 15% IDR 8900 IDR 35 billion IDR 37,1 billion IDR 6500 35% 15% IDR 21 billion MARCS 10 years 5 years 10 years Remarks Reducing of 6% manually due to maintenance Irequirement Increase of 5% annualy Plant running 360 days per year 1000 kg FBB will produced 150kg CPO Increase of 2% annualy Increase of 5% annualy Increase of 2% annualy Increase of 3% annualy

Step by Step Solution

3.65 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

o determine whether PT XYZ should replace its current machinery with the new equipment we can perform a capital budgeting analysis The key financial metrics to consider in this analysis are Net Presen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started