Answered step by step

Verified Expert Solution

Question

1 Approved Answer

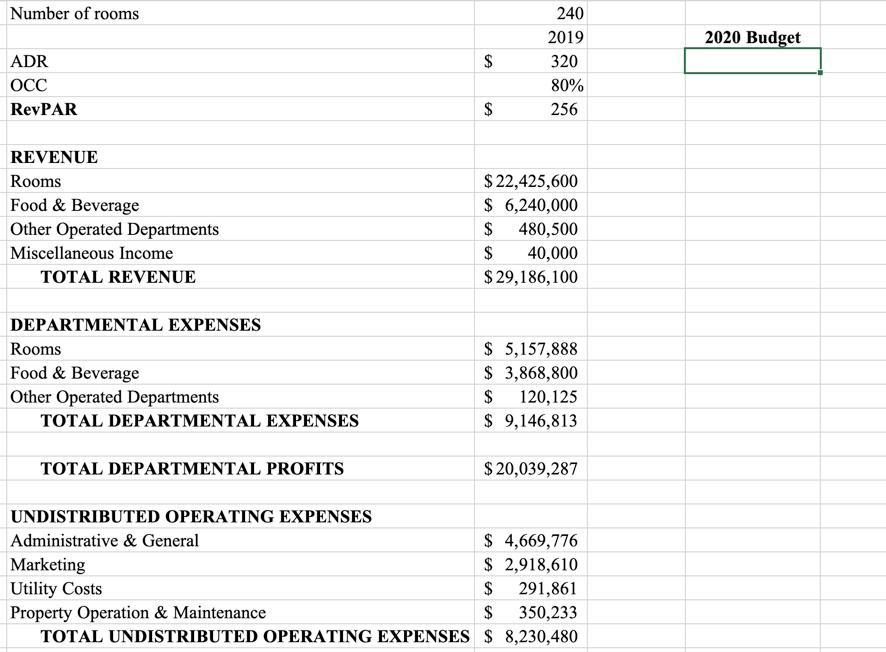

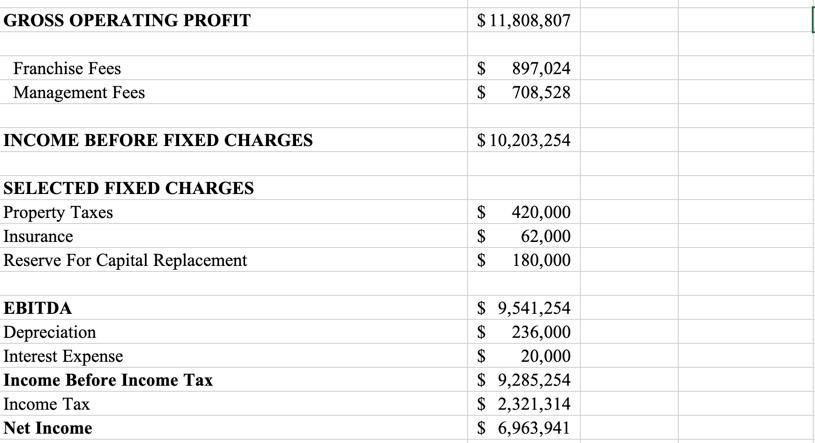

Number of rooms 240 2019 2020 Budget ADR $ 320 O 80% RevPAR 256 REVENUE $ 22,425,600 $ 6,240,000 Rooms Food & Beverage Other

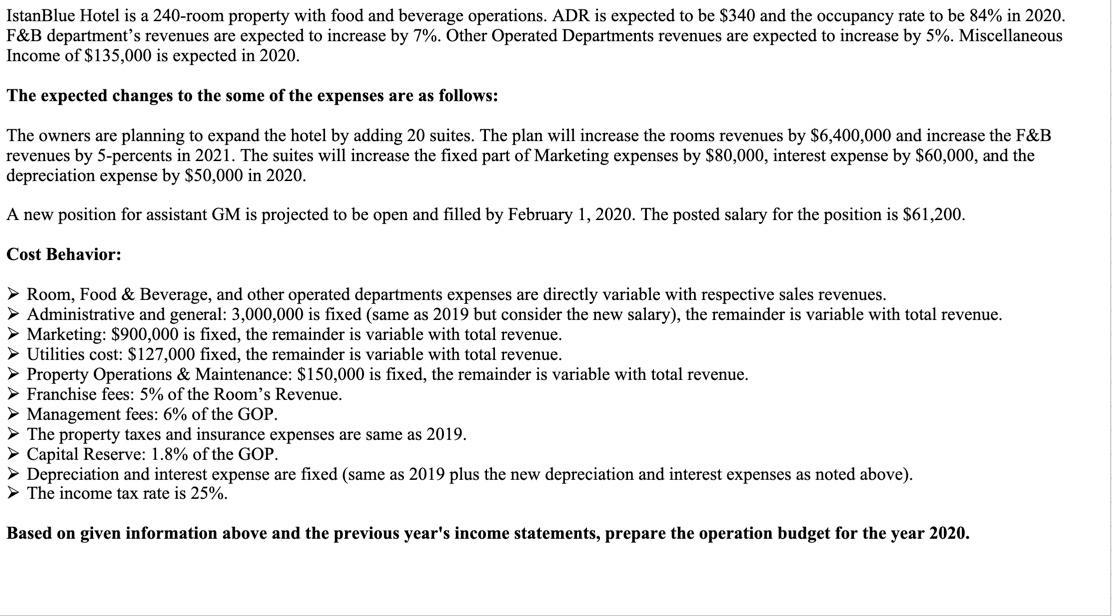

Number of rooms 240 2019 2020 Budget ADR $ 320 O 80% RevPAR 256 REVENUE $ 22,425,600 $ 6,240,000 Rooms Food & Beverage Other Operated Departments $ 480,500 Miscellaneous Income $ 40,000 TOTAL REVENUE $ 29,186,100 DEPARTMENTAL EXPENSES $ 5,157,888 $ 3,868,800 Rooms Food & Beverage Other Operated Departments 2$ 120,125 TOTAL DEPARTMENTAL EXPENSES $ 9,146,813 TOTAL DEPARTMENTAL PROFITS $20,039,287 UNDISTRIBUTED OPERATING EXPENSES $ 4,669,776 $ 2,918,610 Administrative & General Marketing Utility Costs Property Operation & Maintenance TOTAL UNDISTRIBUTED OPERATING EXPENSES $ 8,230,480 $ 291,861 $ 350,233 %24 %24 GROSS OPERATING PROFIT $11,808,807 Franchise Fees $ 897,024 Management Fees $ 708,528 INCOME BEFORE FIXED CHARGES $ 10,203,254 SELECTED FIXED CHARGES Property Taxes $ 420,000 $ 62,000 180,000 Insurance Reserve For Capital Replacement $ EBITDA $ 9,541,254 Depreciation Interest Expense $ 236,000 20,000 $ 9,285,254 $ 2,321,314 $ 6,963,941 $ Income Before Income Tax Income Tax Net Income IstanBlue Hotel is a 240-room property with food and beverage operations. ADR is expected to be $340 and the occupancy rate to be 84% in 2020. F&B department's revenues are expected to increase by 7%. Other Operated Departments revenues are expected to increase by 5%. Miscellaneous Income of $135,000 is expected in 2020. The expected changes to the some of the expenses are as follows: The owners are planning to expand the hotel by adding 20 suites. The plan will increase the rooms revenues by $6,400,000 and increase the F&B revenues by 5-percents in 2021. The suites will increase the fixed part of Marketing expenses by $80,000, interest expense by $60,000, and the depreciation expense by $50,000 in 2020. A new position for assistant GM is projected to be open and filled by February 1, 2020. The posted salary for the position is $61,200. Cost Behavior: > Room, Food & Beverage, and other operated departments expenses are directly variable with respective sales revenues. > Administrative and general: 3,000,000 is fixed (same as 2019 but consider the new salary), the remainder is variable with total revenue. > Marketing: $900,000 is fixed, the remainder is variable with total revenue. > Utilities cost: $127,000 fixed, the remainder is variable with total revenue. > Property Operations & Maintenance: $150,000 is fixed, the remainder is variable with total revenue. > Franchise fees: 5% of the Room's Revenue. > Management fees: 6% of the GOP. > The property taxes and insurance expenses are same as 2019. > Capital Reserve: 1.8% of the GOP. > Depreciation and interest expense are fixed (same as 2019 plus the new depreciation and interest expenses as noted above). > The income tax rate is 25%. Based on given information above and the previous year's income statements, prepare the operation budget for the year 2020. Number of rooms 240 2019 2020 Budget ADR $ 320 O 80% RevPAR 256 REVENUE $ 22,425,600 $ 6,240,000 Rooms Food & Beverage Other Operated Departments $ 480,500 Miscellaneous Income $ 40,000 TOTAL REVENUE $ 29,186,100 DEPARTMENTAL EXPENSES $ 5,157,888 $ 3,868,800 Rooms Food & Beverage Other Operated Departments 2$ 120,125 TOTAL DEPARTMENTAL EXPENSES $ 9,146,813 TOTAL DEPARTMENTAL PROFITS $20,039,287 UNDISTRIBUTED OPERATING EXPENSES $ 4,669,776 $ 2,918,610 Administrative & General Marketing Utility Costs Property Operation & Maintenance TOTAL UNDISTRIBUTED OPERATING EXPENSES $ 8,230,480 $ 291,861 $ 350,233 %24 %24 GROSS OPERATING PROFIT $11,808,807 Franchise Fees $ 897,024 Management Fees $ 708,528 INCOME BEFORE FIXED CHARGES $ 10,203,254 SELECTED FIXED CHARGES Property Taxes $ 420,000 $ 62,000 180,000 Insurance Reserve For Capital Replacement $ EBITDA $ 9,541,254 Depreciation Interest Expense $ 236,000 20,000 $ 9,285,254 $ 2,321,314 $ 6,963,941 $ Income Before Income Tax Income Tax Net Income IstanBlue Hotel is a 240-room property with food and beverage operations. ADR is expected to be $340 and the occupancy rate to be 84% in 2020. F&B department's revenues are expected to increase by 7%. Other Operated Departments revenues are expected to increase by 5%. Miscellaneous Income of $135,000 is expected in 2020. The expected changes to the some of the expenses are as follows: The owners are planning to expand the hotel by adding 20 suites. The plan will increase the rooms revenues by $6,400,000 and increase the F&B revenues by 5-percents in 2021. The suites will increase the fixed part of Marketing expenses by $80,000, interest expense by $60,000, and the depreciation expense by $50,000 in 2020. A new position for assistant GM is projected to be open and filled by February 1, 2020. The posted salary for the position is $61,200. Cost Behavior: > Room, Food & Beverage, and other operated departments expenses are directly variable with respective sales revenues. > Administrative and general: 3,000,000 is fixed (same as 2019 but consider the new salary), the remainder is variable with total revenue. > Marketing: $900,000 is fixed, the remainder is variable with total revenue. > Utilities cost: $127,000 fixed, the remainder is variable with total revenue. > Property Operations & Maintenance: $150,000 is fixed, the remainder is variable with total revenue. > Franchise fees: 5% of the Room's Revenue. > Management fees: 6% of the GOP. > The property taxes and insurance expenses are same as 2019. > Capital Reserve: 1.8% of the GOP. > Depreciation and interest expense are fixed (same as 2019 plus the new depreciation and interest expenses as noted above). > The income tax rate is 25%. Based on given information above and the previous year's income statements, prepare the operation budget for the year 2020. Number of rooms 240 2019 2020 Budget ADR $ 320 O 80% RevPAR 256 REVENUE $ 22,425,600 $ 6,240,000 Rooms Food & Beverage Other Operated Departments $ 480,500 Miscellaneous Income $ 40,000 TOTAL REVENUE $ 29,186,100 DEPARTMENTAL EXPENSES $ 5,157,888 $ 3,868,800 Rooms Food & Beverage Other Operated Departments 2$ 120,125 TOTAL DEPARTMENTAL EXPENSES $ 9,146,813 TOTAL DEPARTMENTAL PROFITS $20,039,287 UNDISTRIBUTED OPERATING EXPENSES $ 4,669,776 $ 2,918,610 Administrative & General Marketing Utility Costs Property Operation & Maintenance TOTAL UNDISTRIBUTED OPERATING EXPENSES $ 8,230,480 $ 291,861 $ 350,233 %24 %24 GROSS OPERATING PROFIT $11,808,807 Franchise Fees $ 897,024 Management Fees $ 708,528 INCOME BEFORE FIXED CHARGES $ 10,203,254 SELECTED FIXED CHARGES Property Taxes $ 420,000 $ 62,000 180,000 Insurance Reserve For Capital Replacement $ EBITDA $ 9,541,254 Depreciation Interest Expense $ 236,000 20,000 $ 9,285,254 $ 2,321,314 $ 6,963,941 $ Income Before Income Tax Income Tax Net Income IstanBlue Hotel is a 240-room property with food and beverage operations. ADR is expected to be $340 and the occupancy rate to be 84% in 2020. F&B department's revenues are expected to increase by 7%. Other Operated Departments revenues are expected to increase by 5%. Miscellaneous Income of $135,000 is expected in 2020. The expected changes to the some of the expenses are as follows: The owners are planning to expand the hotel by adding 20 suites. The plan will increase the rooms revenues by $6,400,000 and increase the F&B revenues by 5-percents in 2021. The suites will increase the fixed part of Marketing expenses by $80,000, interest expense by $60,000, and the depreciation expense by $50,000 in 2020. A new position for assistant GM is projected to be open and filled by February 1, 2020. The posted salary for the position is $61,200. Cost Behavior: > Room, Food & Beverage, and other operated departments expenses are directly variable with respective sales revenues. > Administrative and general: 3,000,000 is fixed (same as 2019 but consider the new salary), the remainder is variable with total revenue. > Marketing: $900,000 is fixed, the remainder is variable with total revenue. > Utilities cost: $127,000 fixed, the remainder is variable with total revenue. > Property Operations & Maintenance: $150,000 is fixed, the remainder is variable with total revenue. > Franchise fees: 5% of the Room's Revenue. > Management fees: 6% of the GOP. > The property taxes and insurance expenses are same as 2019. > Capital Reserve: 1.8% of the GOP. > Depreciation and interest expense are fixed (same as 2019 plus the new depreciation and interest expenses as noted above). > The income tax rate is 25%. Based on given information above and the previous year's income statements, prepare the operation budget for the year 2020. Number of rooms 240 2019 2020 Budget ADR $ 320 O 80% RevPAR 256 REVENUE $ 22,425,600 $ 6,240,000 Rooms Food & Beverage Other Operated Departments $ 480,500 Miscellaneous Income $ 40,000 TOTAL REVENUE $ 29,186,100 DEPARTMENTAL EXPENSES $ 5,157,888 $ 3,868,800 Rooms Food & Beverage Other Operated Departments 2$ 120,125 TOTAL DEPARTMENTAL EXPENSES $ 9,146,813 TOTAL DEPARTMENTAL PROFITS $20,039,287 UNDISTRIBUTED OPERATING EXPENSES $ 4,669,776 $ 2,918,610 Administrative & General Marketing Utility Costs Property Operation & Maintenance TOTAL UNDISTRIBUTED OPERATING EXPENSES $ 8,230,480 $ 291,861 $ 350,233 %24 %24 GROSS OPERATING PROFIT $11,808,807 Franchise Fees $ 897,024 Management Fees $ 708,528 INCOME BEFORE FIXED CHARGES $ 10,203,254 SELECTED FIXED CHARGES Property Taxes $ 420,000 $ 62,000 180,000 Insurance Reserve For Capital Replacement $ EBITDA $ 9,541,254 Depreciation Interest Expense $ 236,000 20,000 $ 9,285,254 $ 2,321,314 $ 6,963,941 $ Income Before Income Tax Income Tax Net Income IstanBlue Hotel is a 240-room property with food and beverage operations. ADR is expected to be $340 and the occupancy rate to be 84% in 2020. F&B department's revenues are expected to increase by 7%. Other Operated Departments revenues are expected to increase by 5%. Miscellaneous Income of $135,000 is expected in 2020. The expected changes to the some of the expenses are as follows: The owners are planning to expand the hotel by adding 20 suites. The plan will increase the rooms revenues by $6,400,000 and increase the F&B revenues by 5-percents in 2021. The suites will increase the fixed part of Marketing expenses by $80,000, interest expense by $60,000, and the depreciation expense by $50,000 in 2020. A new position for assistant GM is projected to be open and filled by February 1, 2020. The posted salary for the position is $61,200. Cost Behavior: > Room, Food & Beverage, and other operated departments expenses are directly variable with respective sales revenues. > Administrative and general: 3,000,000 is fixed (same as 2019 but consider the new salary), the remainder is variable with total revenue. > Marketing: $900,000 is fixed, the remainder is variable with total revenue. > Utilities cost: $127,000 fixed, the remainder is variable with total revenue. > Property Operations & Maintenance: $150,000 is fixed, the remainder is variable with total revenue. > Franchise fees: 5% of the Room's Revenue. > Management fees: 6% of the GOP. > The property taxes and insurance expenses are same as 2019. > Capital Reserve: 1.8% of the GOP. > Depreciation and interest expense are fixed (same as 2019 plus the new depreciation and interest expenses as noted above). > The income tax rate is 25%. Based on given information above and the previous year's income statements, prepare the operation budget for the year 2020.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

STEP 1 Calculation of increase in Sales Revenue Sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started