Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2032, Kiwi Ltd, a company based in Auckland, New Zealand, acquired all of the issued shares of Seattle Ltd, an American

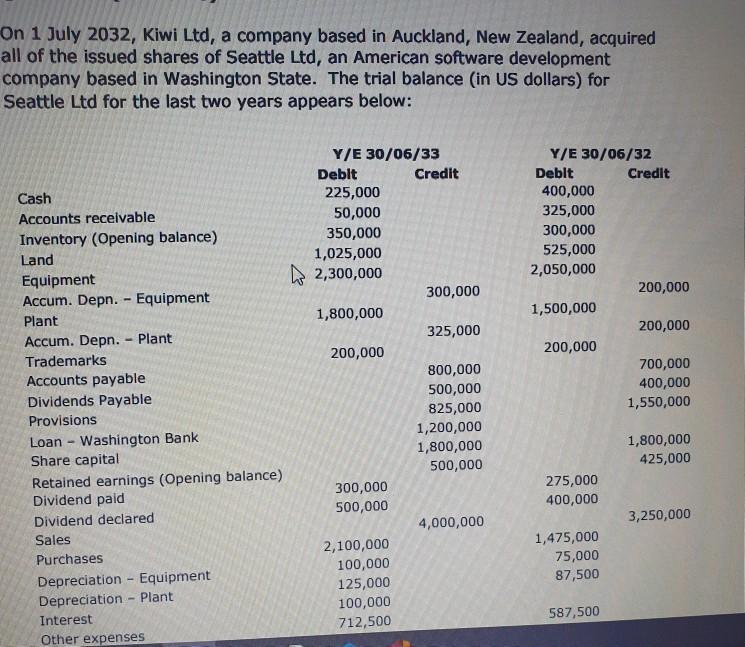

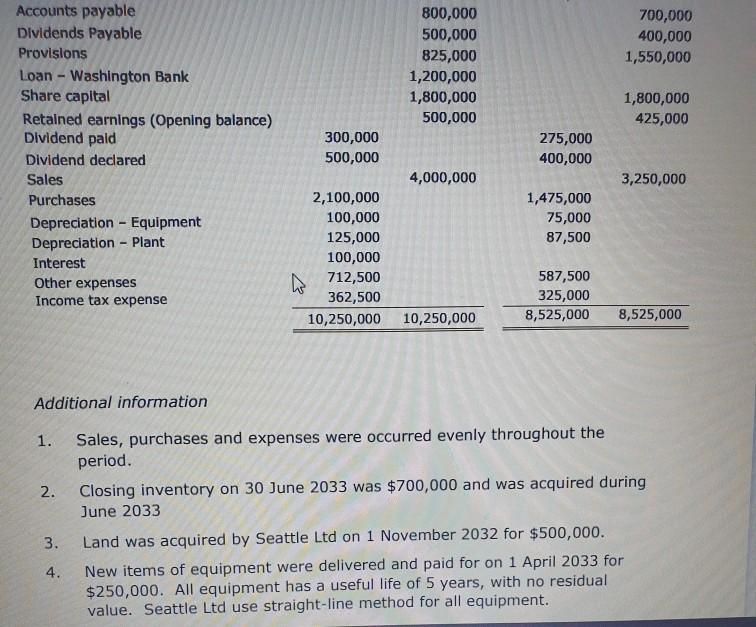

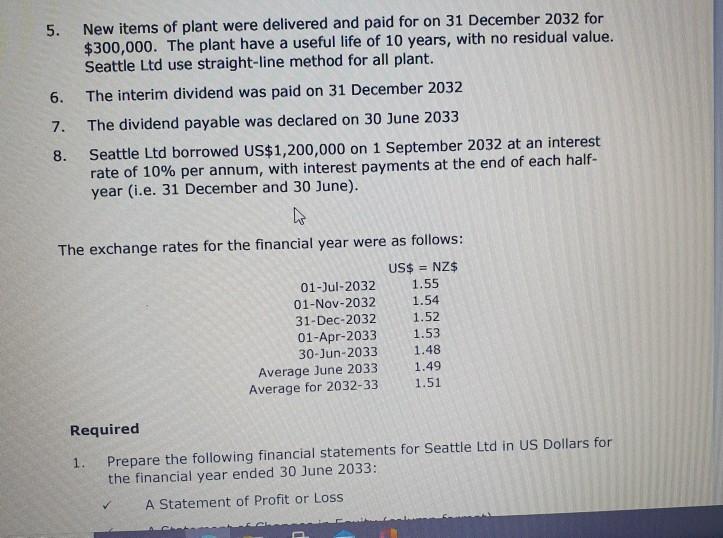

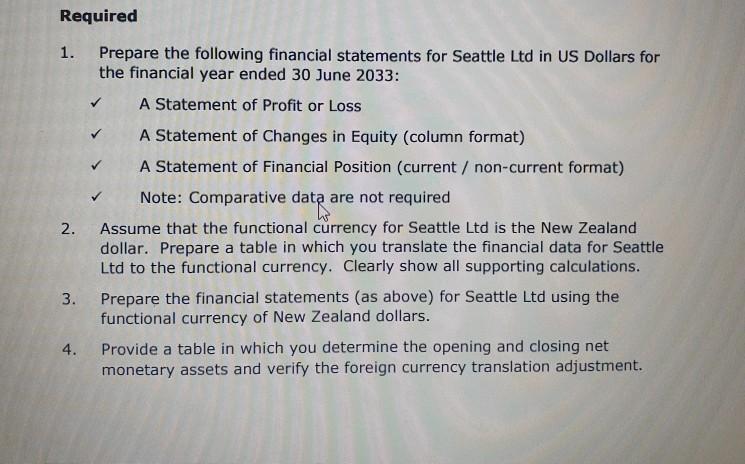

On 1 July 2032, Kiwi Ltd, a company based in Auckland, New Zealand, acquired all of the issued shares of Seattle Ltd, an American software development company based in Washington State. The trial balance (in US dollars) for Seattle Ltd for the last two years appears below: Y/E 30/06/33 Y/E 30/06/32 Deblt Debit Credit Credit 225,000 400,000 Cash 50,000 325,000 Accounts receivable 350,000 300,000 Inventory (Opening balance) 1,025,000 525,000 Land A 2,300,000 2,050,000 Equipment Accum. Depn. - Equipment 300,000 200,000 1,800,000 1,500,000 Plant 200,000 325,000 Accum. Depn. - Plant Trademarks 200,000 200,000 700,000 400,000 800,000 Accounts payable Dividends Payable 500,000 825,000 1,550,000 Provisions Loan Washington Bank Share capital 1,200,000 1,800,000 500,000 1,800,000 425,000 Retained earnings (Opening balance) Dividend paid 275,000 400,000 300,000 500,000 Dividend declared 4,000,000 3,250,000 1,475,000 75,000 87,500 Sales 2,100,000 100,000 125,000 100,000 712,500 Purchases Depreciation - Equipment Depreciation - Plant 587,500 Interest Other expenses Accounts payable Dividends Payable 800,000 500,000 700,000 400,000 Provisions 825,000 1,550,000 Loan - Washington Bank Share capital Retalned earnings (Opening balance) Dividend pald 1,200,000 1,800,000 1,800,000 500,000 425,000 300,000 275,000 Dividend declared 500,000 400,000 Sales 4,000,000 3,250,000 Purchases 2,100,000 1,475,000 100,000 75,000 Depreciation - Equipment Depreciation - Plant 125,000 87,500 100,000 Interest 712,500 587,500 Other expenses Income tax expense 362,500 325,000 10,250,000 10,250,000 8,525,000 8,525,000 Additional information Sales, purchases and expenses were occurred evenly throughout the period. 1. Closing inventory on 30 June 2033 was $700,000 and was acquired during June 2033 2. 3. Land was acquired by Seattle Ltd on 1 November 2032 for $500,000. New items of equipment were delivered and paid for on 1 April 2033 for $250,000. All equipment has a useful life of 5 years, with no residual value. Seattle Ltd use straight-line method for all equipment. 4. New items of plant were delivered and paid for on 31 December 2032 for $300,000. The plant have a useful life of 10 years, with no residual value. Seattle Ltd use straight-line method for all plant. 5. 6. The interim dividend was paid on 31 December 2032 7. The dividend payable was declared on 30 June 2033 Seattle Ltd borrowed US$1,200,000 on 1 September 2032 at an interest rate of 10% per annum, with interest payments at the end of each half- year (i.e. 31 December and 30 June). 8. The exchange rates for the financial year were as follows: US$ = NZ$ 01-Jul-2032 1.55 01-Nov-2032 31-Dec-2032 1.54 1.52 01-Apr-2033 1.53 30-Jun-2033 1.48 Average June 2033 Average for 2032-33 1.49 1.51 Required Prepare the following financial statements for Seattle Ltd in US Dollars for the financial year ended 30 June 2033: 1. A Statement of Profit or Loss Required 1. Prepare the following financial statements for Seattle Ltd in US Dollars for the financial year ended 30 June 2033: A Statement of Profit or Loss A Statement of Changes in Equity (column format) A Statement of Financial Position (current / non-current format) Note: Comparative data are not required 2. Assume that the functional currency for Seattle Ltd is the New Zealand dollar. Prepare a table in which you translate the financial data for Seattle Ltd to the functional currency. Clearly show all supporting calculations. Prepare the financial statements (as above) for Seattle Ltd using the functional currency of New Zealand dollars. 3. 4. Provide a table in which you determine the opening and closing net monetary assets and verify the foreign currency translation adjustment.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started