Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 20X4, PLE Corp. purchased 100% of the outstanding voting shares of SPP Inc. On this date, SPP reported $200,000 in common

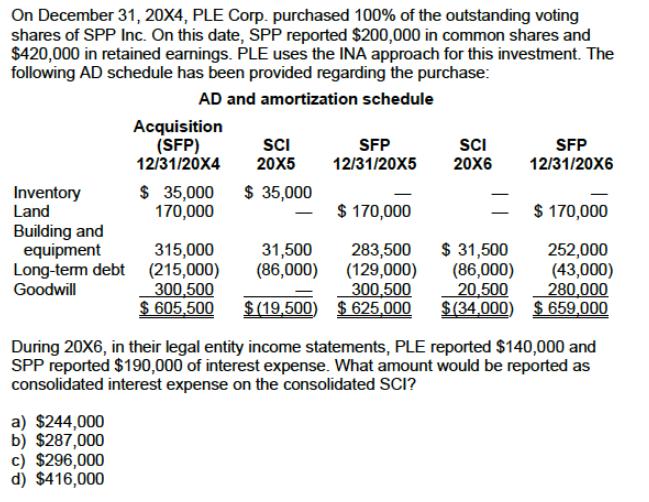

On December 31, 20X4, PLE Corp. purchased 100% of the outstanding voting shares of SPP Inc. On this date, SPP reported $200,000 in common shares and $420,000 in retained earnings. PLE uses the INA approach for this investment. The following AD schedule has been provided regarding the purchase: AD and amortization schedule Acquisition (SFP) 12/31/20X4 SCI 20X5 ScI 20X6 SFP 12/31/20X6 SFP 12/31/20X5 Inventory Land $ 35,000 170,000 $ 35,000 $ 170,000 $ 170,000 Building and equipment Long-term debt Goodwill $ 31,500 (86,000) 20,500 $(34,000) $ 659,000 31,500 (86,000) 315,000 (215,000) 300,500 $ 605,500 283,500 (129,000) 300,500 $ (19,500) $ 625,000 252,000 (43,000) 280,000 During 20X6, in their legal entity income statements, PLE reported $140,000 and SPP reported $190,000 of interest expense. What amount would be reported as consolidated interest expense on the consolidated SCI? a) $244,000 b) $287,000 c) $296,000 d) $416,000

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Summarized the data and the information prov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started