Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. On March 15, 2020, BBB Company established an agency in Quezon City, sending its merchandise samples costing P15,750 and working fund of P9,000

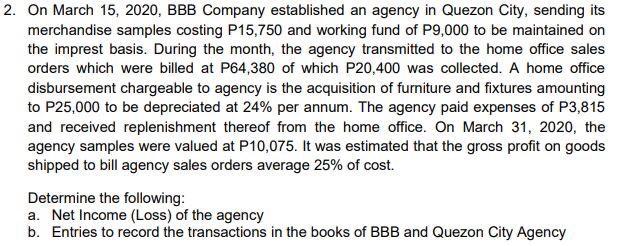

2. On March 15, 2020, BBB Company established an agency in Quezon City, sending its merchandise samples costing P15,750 and working fund of P9,000 to be maintained on the imprest basis. During the month, the agency transmitted to the home office sales orders which were billed at P64,380 of which P20,400 was collected. A home office disbursement chargeable to agency is the acquisition of furniture and fixtures amounting to P25,000 to be depreciated at 24% per annum. The agency paid expenses of P3,815 and received replenishment thereof from the home office. On March 31, 2020, the agency samples were valued at P10,075. It was estimated that the gross profit on goods shipped to bill agency sales orders average 25% of cost. Determine the following: a. Net Income (Loss) of the agency b. Entries to record the transactions in the books of BBB and Quezon City Agency

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the net income of the agency Gross profit is based on cost that why cost is 100 and GP ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started