Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2017, when the current market interest rate was 8%, Waveland Corporation issued $120,000,000, 5-year bonds. The bonds pay an annual coupon

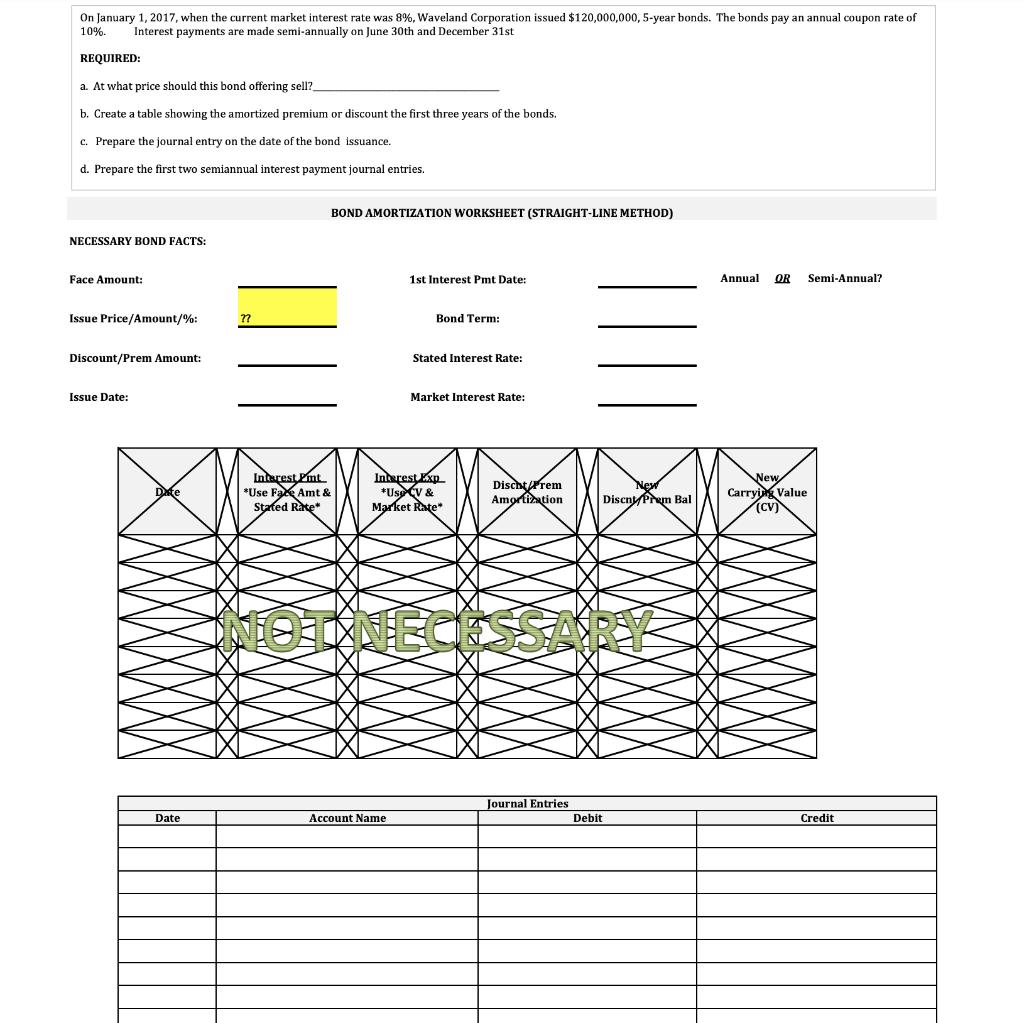

On January 1, 2017, when the current market interest rate was 8%, Waveland Corporation issued $120,000,000, 5-year bonds. The bonds pay an annual coupon rate of 10%. Interest payments are made semi-annually on June 30th and December 31st REQUIRED: a. At what price should this bond offering sell? b. Create a table showing the amortized premium or discount the first three years of the bonds. c. Prepare the journal entry on the date of the bond issuance. d. Prepare the first two semiannual interest payment journal entries. BOND AMORTIZATION WORKSHEET (STRAIGHT-LINE METHOD) NECESSARY BOND FACTS: Face Amount: 1st Interest Pmt Date: Annual OR Semi-Annual? Issue Price/Amount/%: ?? Bond Term: Discount/Prem Amount: Stated Interest Rate: Issue Date: Market Interest Rate: Interest Pmt *Use Face Amt & Stated Rate Interest Exp *Us v & Market Rate Dischtrem Amgrtization New Carrying Value (CV) Discn Prem Bal Journal Entries Date Account Name Debit redit

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Workings Cash Flow Factor Present Value 120000000 par maturity value 068058 81669600 6000000 inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started