Answered step by step

Verified Expert Solution

Question

1 Approved Answer

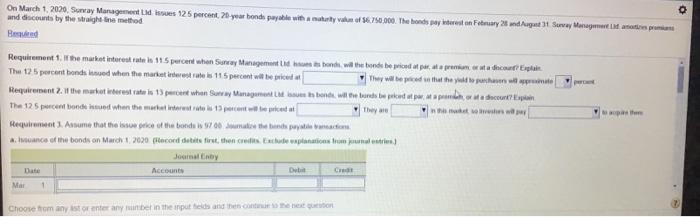

On March 1, 2020, Sunvay Management Lid issues 125 percent. 20-year bond payable wiha ututy va of 75.00. The bonds pay intereton Fetary 2

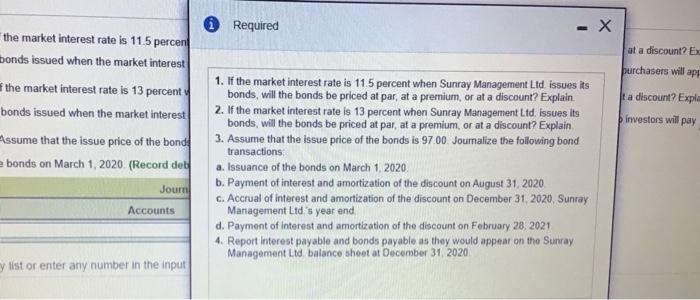

On March 1, 2020, Sunvay Management Lid issues 125 percent. 20-year bond payable wiha ututy va of 75.00. The bonds pay intereton Fetary 2 and Aget 31 Suvay Managet L antn pron and discounts by the straight ne method Beneed Requirement 1. the market interest rate is 115 percent when Sunray Management Lid hs bond, wi the bonds be priced at par, al a prenum er ata dhcont Eplain The 125 percent bonds inued when the market ieterest rate is 115 percent wil be priced at They wil be priced se that he yd o pahaen w apprnate percant Requirement 2. I the market interest rate is 13 percent whan Sunay Managament LM us bend wil he bunds be prked at par, ata pranota decount? Espan The 125 percent bonde isued when the market interest rate 13 percente prced at They are n h aet estn pa pa e Requirement 3. Assume that the issue price of the bonds is 97 00 Jumale the bends payate aati a. uance of the bonds on March 1, 2020 (tecord detits first, then credis. Echude eplanations trom jnal estries) Joarnal Enby Date Accounts Debit Credt Mar Choose from any ist or enter any ninber in the input teids and then contur o he net queton O Required - X the market interest rate is 11.5 percent at a discount? Ex bonds issued when the market interest purchasers will app the market interest rate is 13 percent bonds issued when the market interest 1. If the market interest rate is 11.5 percent when Sunray Management Ltd. issues its bonds, will the bonds be priced at par, at a premium, or at a discount? Explain. 2. If the market interest rate is 13 percent when Sunray Management Ltd. issues its bonds, will the bonds be priced at par, at a premium, or at a discount? Explain. 3. Assume that the issue price of the bonds is 97.00. Journalize the following bond transactions: ta discount? Expla investors will pay Assume that the issue price of the bond e bonds on March 1, 2020. (Record deb a. Issuance of the bonds on March 1, 2020. b. Payment of interest and amortization of the discount on August 31, 2020. c. Accrual of interest and amortization of the discount on December 31, 2020, Sunray Management Ltd's year end. d. Payment of interest and amortization of the discount on February 28, 2021 4. Report interest payable and bonds payable as they would appear on the Sunray Management Ltd. balance sheet at December 31, 2020 Journ Accounts y list or enter any number in the input

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Bond would be issued at premium because coupon rate is greater than market interest rate so bonds ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started