Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 31, 2019, Powder Co acquired a new machine at an invoiced cost of $3,060,750 including GST. In addition, Powder paid delivery fees

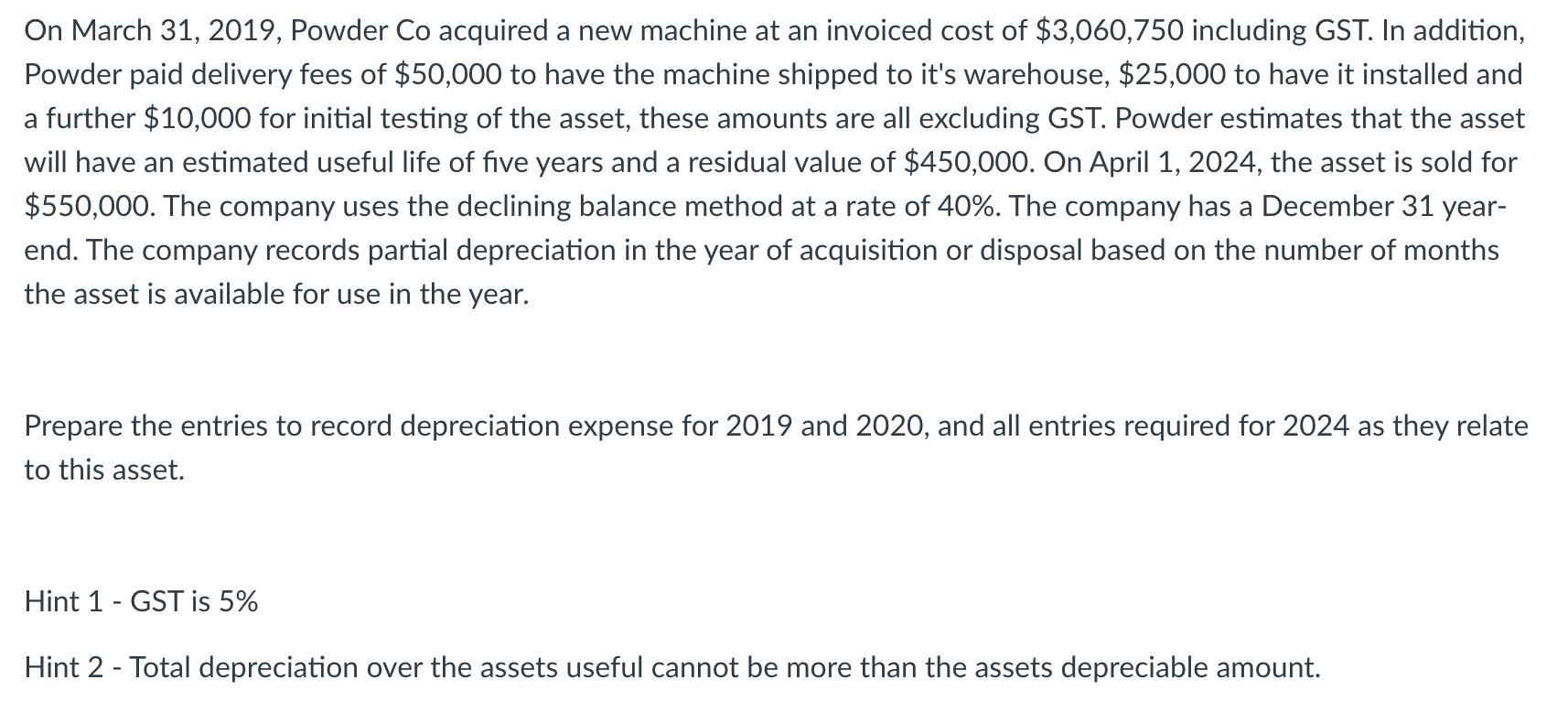

On March 31, 2019, Powder Co acquired a new machine at an invoiced cost of $3,060,750 including GST. In addition, Powder paid delivery fees of $50,000 to have the machine shipped to it's warehouse, $25,000 to have it installed and a further $10,000 for initial testing of the asset, these amounts are all excluding GST. Powder estimates that the asset will have an estimated useful life of five years and a residual value of $450,000. On April 1, 2024, the asset is sold for $550,000. The company uses the declining balance method at a rate of 40%. The company has a December 31 year- end. The company records partial depreciation in the year of acquisition or disposal based on the number of months the asset is available for use in the year. Prepare the entries to record depreciation expense for 2019 and 2020, and all entries required for 2024 as they relate to this asset. Hint 1 - GST is 5% Hint 2 - Total depreciation over the assets useful cannot be more than the assets depreciable amount.

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Depreciable Amount OF Asset As on the date of acquisition 3060750 105 100 50000 25000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started