Answered step by step

Verified Expert Solution

Question

1 Approved Answer

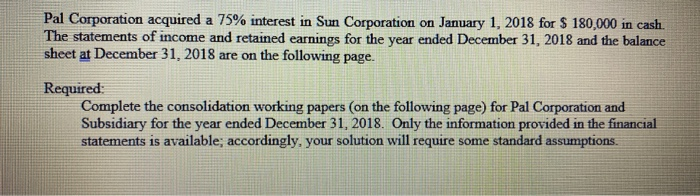

Pal Corporation acquired a 75% interest in Sun Corporation on January 1, 2018 for $ 180,000 in cash. The statements of income and retained

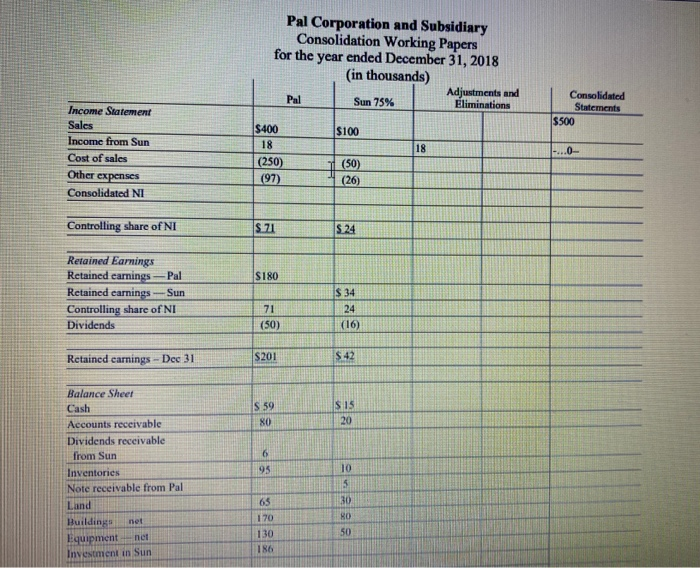

Pal Corporation acquired a 75% interest in Sun Corporation on January 1, 2018 for $ 180,000 in cash. The statements of income and retained earnings for the year ended December 31, 2018 and the balance sheet at December 31, 2018 are on the following page. Required: Complete the consolidation working papers (on the following page) for Pal Corporation and Subsidiary for the year ended December 31, 2018. Only the information provided in the financial statements is available; accordingly, your solution will require some standard assumptions. Income Statement Sales Income from Sun Cost of sales Other expenses Consolidated NI Controlling share of NI Retained Earnings Retained earnings-Pal Retained earnings -Sun Controlling share of NI Dividends Retained earnings - Dec 31 Balance Sheet Cash Accounts receivable Dividends receivable from Sun Inventories Note receivable from Pal Land Buildings net Equipment net Investment in Sun $400 18 Pal Corporation and Subsidiary Consolidation Working Papers for the year ended December 31, 2018 (in thousands) Sun 75% (250) (97) $ 71 $180 71 (50) $201 $ 59 80 6 95 65 170 130 186 Pal $100 (50) (26) $.24 $34 24 (16) $42 $15 20 24999 10 5 30 80 50 18 Adjustments and Eliminations Consolidated Statements $500 ...0- Investment in Sun Total Assets Accounts payable Note payable to Sun Dividends payable Capital stock, $10 par Retained earnings Total Liabilities & Equity 186 $791 $85 5 500 201 $791 $210 $ 10 8 150 42 $210

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Pal Corporation and Subsidiary Consolidation Working Papers for the year ended December 31 2018 in t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started