Question

Parent Ltd owns all the share capital of Subsidiary Ltd. On 23 September 2018, Subsidiary Ltd sold inventory which cost $8 000 to Parent

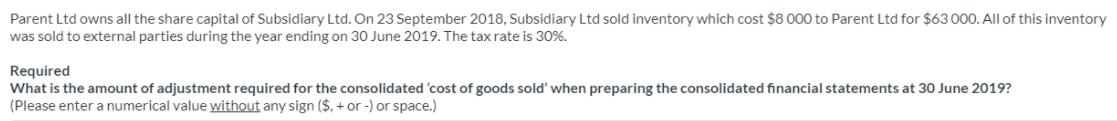

Parent Ltd owns all the share capital of Subsidiary Ltd. On 23 September 2018, Subsidiary Ltd sold inventory which cost $8 000 to Parent Ltd for $63 000. All of this inventory was sold to external parties during the year ending on 30 June 2019. The tax rate is 30%. Required What is the amount of adjustment required for the consolidated 'cost of goods sold' when preparing the consolidated financial statements at 30 June 2019? (Please enter a numerical value without any sign ($. + or -) or space.)

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION AMOUNT OF ADJUSTED REQUIRED FOR THE CONS...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2016 Comprehensive

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

29th Edition

134104374, 978-0134104379

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App