Question

Jacobs asked Dean to present her findings to the larger community of employees at the firm. Several representatives of the manufacturing departments were present, as

Jacobs asked Dean to present her findings to the larger community of employees at the firm. Several representatives of the manufacturing departments were present, as well as the general sales manager, two assistant sales managers, the purchasing officer and two people from production engineering. Following is a chart of those attending. Exhibit 2 (Meeting participants) Barb Dean Staff Accountant Ben Jacobs Controller Brad Stone Production Control Nolan Banks Manufacturing Braden Bishop Assistant Sales Manager Yakoub Dym General Sales Manager Tyler Fray Administrative Assistant to the President The following comments were noted: Brad Stone: I am concerned that this analysis has not allowed for the planned changes in volume next year. The sales department guesses that we will boost unit sales which will result in us pushing 90% capacity. Nolan Banks: If you are talking about 90% of capacity, then you better consider the fact that we have received approval on an investment for an expansion of the plant that will increase fixed costs by $60,000 a month. We may call it 90% capacity, but there are places that we really cannot produce any more. Brad Stone: Nolan may be right, but this break-even analysis uses average figures and does not take into account that we are dealing with three basic products. I have brought the report that the accounting department produced on product line costs last year (see Exhibit 3). This information makes it very clear that your “average” is way out of line. How would the break-even point look if we took this on an individual product basis? Braden Bishop: If you are going to do something with individual products, you should know that we are looking into a big shift in our product mix. The “A” line is really losing out and I imagine that we will be lucky to hold two-thirds of its volume next year. Yakoub can back me up on this. However, we should pick up the 200,000 that we will lose plus about a quarter million more units in “C” production. Product “B” has been solid for years and there should be no changes in volume. Yakoub Dym: I agree with Braden. Also, note that his estimates of the volume increases are on the basis of doubling the price with no change in costs. We have been priced so low on this item and need to raise the price since the price is out of line with other products in its class and the current price is inconsistent with our quality reputation. Second, we anticipate the increase in demand could not be handled if we did not increase the price. It would be well above Braden's estimates, maybe by another half million. You heard the discussions about capacity, we could not possibly fulfill the orders unless we increase the price. Tyler Fray: I also feel that there are items to consider. First of all, let’s remember that profits are divided evenly between the government and us. After taxes, we are only left with around 50% of our profit as shown by the break-even analysis provided by Ann Means. Secondly, we paid out dividends of $300,000 to stockholders. Since we have an anniversary year coming up, we would like to pay out a special dividend of 50% extra. We need to retain $150,000 in the business also. That means we would like to hit $600,000 of profit after taxes. A third concern is the upcoming negotiations with the union. All indications are that we may have to increase wages which will increase the variable costs by 10%. This may kill the bonus dividend plan but we have to hold the line on past profits. Any increase in wages must be offset by added revenues. I would think that would affect our break-even point. Ben Jacobs: I want to thank Barb for preparing the presentation. It has certainly got us all to thinking about how we can improve this analysis and use it for next year. First of all, the break-even analysis is based upon some assumptions. Some of the points raised were really about those assumptions. It might help us if Barb set the assumptions down in black and white so we can see how they influence the analysis. Next, I think we should adapt our analysis where possible to adjust for future changes. First, I think that Brad would like to see calculations based upon an analysis of individual product lines. Also, as Braden suggested, since the product mix is bound to change, why not see how things look if the shift materializes as he has forecast? Yakoub would like to see the influence of a price increase in the “C” line and Nolan looks toward an increase in fixed manufacturing costs of $60,000 a month. Tyler has suggested that we consider taxes, dividends, expected union demands and the question of product emphasis. .

3. Identify the assumptions implicit in break-even analysis.

4. He argues that individual product break-even points need to be computed.

a. Using the data from Exhibit 3, calculate the break-even in both units and sales dollars.

b. Why is the sum of the three items (in both units and dollars) not equal to the total break even numbers you computed in requirement #1? All remaining questions relate to next year projections.

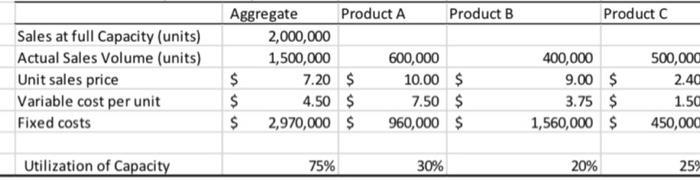

5. Recreate Exhibit 3 incorporating the original and revised information provided by the participants. Create a separate legend based on line numbers so I can clearly follow your work. Fixed costs should be allocated proportionally based upon the original allocation. The average unit variable cost should be a weighted average.

6. Prepare a responsibility margin income statement including taxes as a separately listed cost after operating income (this would include a total and the three products. Although you allocated fixed costs in #5, do not allocate fixed costs or taxes.)

7. Compute the break-even point in revenues (for the business as a whole assuming the product sales mix for units remains constant.) Exhibit 3 Product class Cost Analysis - normal year Aggregate Product A Product B Product C Sales at full Capacity (units) 2,000,000 Actual Sales Volume (units) 1,500,000 600,000 400,000 500,000 Unit sales price $ 7.20 $ 10.00 $ 9.00 $ 2.40 Variable cost per unit $ 4.50 $ 7.50 $ 3.75 $ 1.50 Fixed costs $ 2,970,000 $ 960,000 $ 1,560,000 $ 450,000 Utilization of Capacity 75% 30% 20% 25% Exhibit 3 Product class Cost Analysis - normal year Line Last year Next year Last year Next year Last year Next year Last year Next year Sales at full Capacity (units) 2,000,000 1 Actual Sales Volume (units) 1,500,000 600,000 400,000 500,000 2 Unit sales price $ 7.20 $ 10.00 $ 9.00 $ 2.40 3 Variable cost per unit $ 4.50 $ 7.50 $ 3.75 $ 1.50 4 Fixed costs $ 2,970,000 $ 960,000 $ 1,560,000 $ 450,000

Utilization of Capacity 75% 30% 20% 25% Legend Line 1 Product A volume increased by 5,000,000 , B increased by 42,000 and C decreased by 40,000 (note this is just an example) Aggregate Product A Product B Product C

8. Compute the level of revenues that must be achieved to pay the projected dividend and meet the retention objectives of after tax income.

Sales at full Capacity (units) Actual Sales Volume (units) Unit sales price Variable cost per unit Fixed costs Utilization of Capacity Aggregate $ 555 $ $ 2,000,000 1,500,000 7.20 $ 4.50 $ $ 2,970,000 Product A 75% 600,000 Product B 10.00 $ 7.50 $ 960,000 $ 30% 400,000 Product C 9.00 $ 3.75 $ 1,560,000 $ 20% 500,000 2.40 1.50 450,000 25%

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer 3 Assumptions implicit in breakeven analysis include the following Revenue and cost assumptions Breakeven analysis assumes that current revenue and cost trends will continue into the future and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started