Question

Making deposits and reconciling a bank statement. Part A: Making deposits p. 169, Assignment 7.4 Plunketts Procedures for the Medical Administrative Assistant Enter the following

Making deposits and reconciling a bank statement.

Part A: Making deposits p. 169, Assignment 7.4 Plunkett’s Procedures for the Medical Administrative Assistant

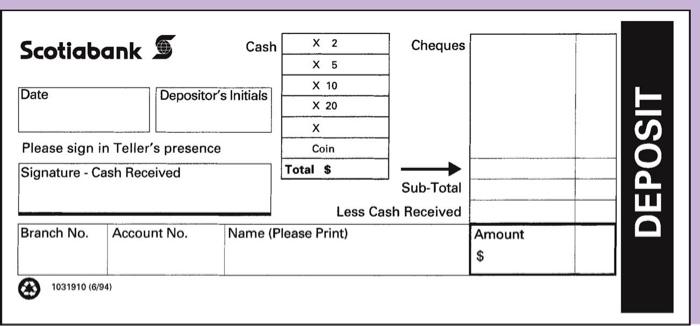

Enter the following information on a deposit slip for Dr. Plunkett: (p. see figure 7.9 on page 169 in Plunkettt’s Procedures for the Professional Administrative Assistant) date, January 13, 20__; cash $152.57 consisting of 9 ones, 4 twos, 3 fives, 6 tens, 3 twenties, and 57 cents in coin; cheques for $13.42 from E.C. Westran, $35 from C.S.A. Insurance Co. (for writing a patient history), $116.28 from W.C. Post, and $52.50 from R.A. James; account no. 6681-35; name of account, Dr. J.E. Plunkett. (you made the deposit).

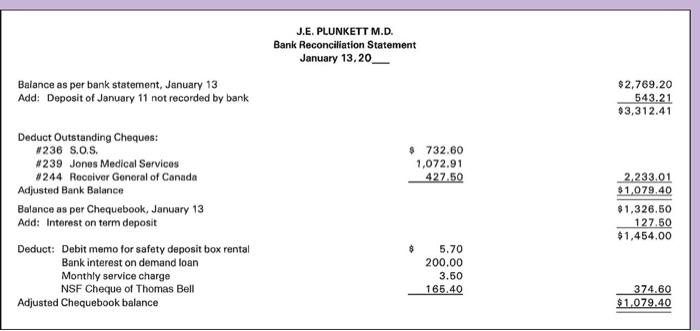

Part B: Read “Bank Reconciling” Assignment 7.7 on page 173 in Plunkett’s Procedures for the Medical Administrative Assistant

Prepare a bank reconciliation statement for Dr.Plunkett using the following information. Date the statement April 1, 20__. Students may use Fig.7.12 on page 172 of Plunkett’s Procedures for the Medical Administrative Assistant. Cash account $2140 and March 31 bank statement $2012. Deposit entered in books on March 30 was not taken to the bank until March 31(amount $530). The bank sent a credit memo for $215 for interest earned on Canada Savings Bonds. The amount is shown on the account. However the memo has not yet been received, Bank service charges $6. A patient’s cheque for $50.00, included in the Marc h 27 deposit has been charged back to the bank on the statement as NSF. The patient is J.Wren Cheque no.502 was made to cash for $35 to reimburse the petty cash; this cheque is recorded in the cash payment journal as $53. The following cheques were returned by the bank with March statement: no.521 to R. Smith for $10:no.523 to J. Jones Ltd. For $50; no.524 to Metric Limited for $100 (certified on March 27); no.525 to P. Brown for $75; and no.526 to J. Smith and Company for $90.

Scotiabank X 2 Cheques Cash X 5 X 10 Date Depositor's Initials X 20 X Please sign in Teller's presence Coin Signature - Cash Received Total $ Sub-Total Less Cash Received Branch No. Account No. Name (Please Print) Amount A 1031910 (6/94) DEPOSIT

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

BANK RECONCILIATION STATEMENT APRIL 1 20 Paarticulars Balance as per Bank Statement as on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started