Answered step by step

Verified Expert Solution

Question

1 Approved Answer

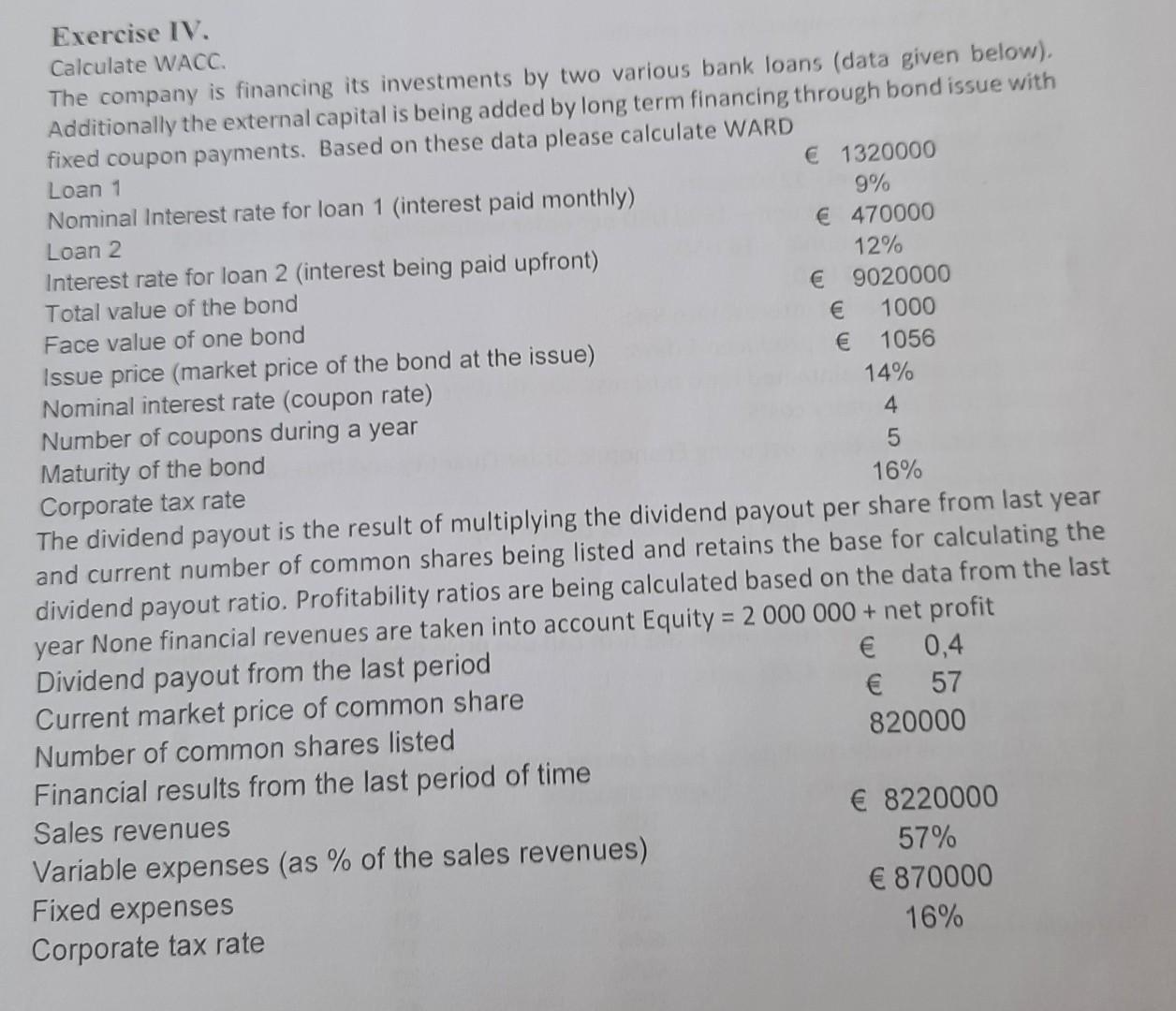

n Exercise IV. Calculate WACC. The company is financing its investments by two various bank loans (data given below). Additionally the external capital is being

n

n

Exercise IV. Calculate WACC. The company is financing its investments by two various bank loans (data given below). Additionally the external capital is being added by long term financing through bond issue with fixed coupon payments. Based on these data please calculate WARD Loan 1 Nominal Interest rate for loan 1 (interest paid monthly) Loan 2 Interest rate for loan 2 (interest being paid upfront) Total value of the bond Face value of one bond Issue price (market price of the bond at the issue) Nominal interest rate (coupon rate) Number of coupons during a year Maturity of the bond Corporate tax rate 1320000 9% 470000 12% Sales revenues Variable expenses (as % of the sales revenues) Fixed expenses Corporate tax rate 9020000 1000 1056 14% 16% The dividend payout is the result of multiplying the dividend payout per share from last year and current number of common shares being listed and retains the base for calculating the dividend payout ratio. Profitability ratios are being calculated based on the data from the last year None financial revenues are taken into account Equity = 2 000 000 + net profit Dividend payout from the last period 0,4 Current market price of common share 57 820000 Number of common shares listed Financial results from the last period of time 8220000 57% 870000 16%

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started