Answered step by step

Verified Expert Solution

Question

1 Approved Answer

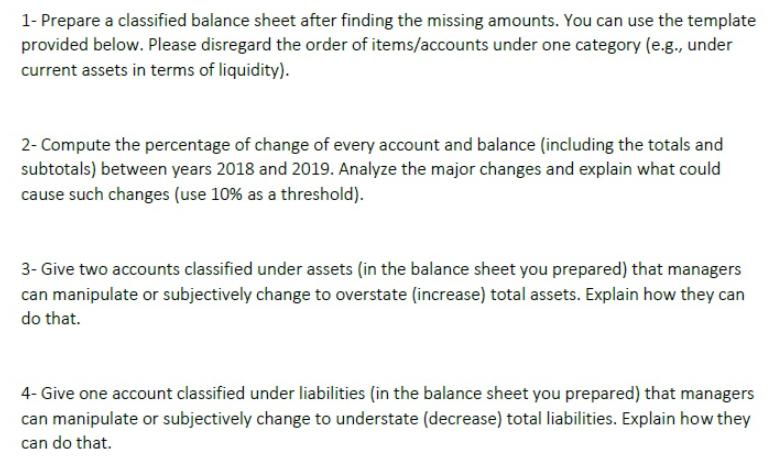

1- Prepare a classified balance sheet after finding the missing amounts. You can use the template provided below. Please disregard the order of items/accounts

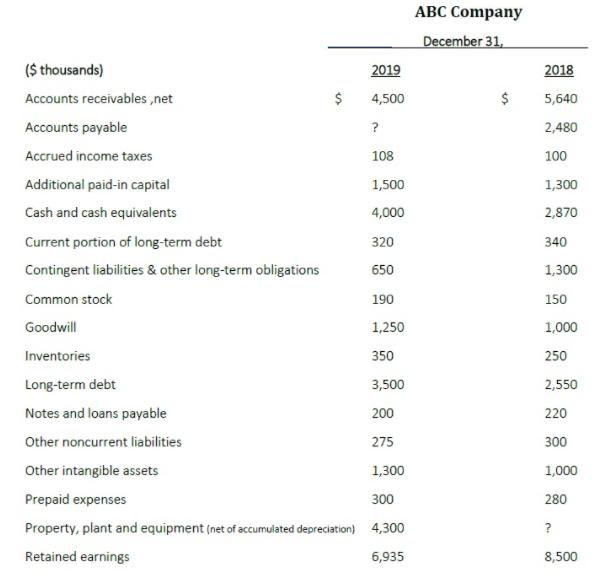

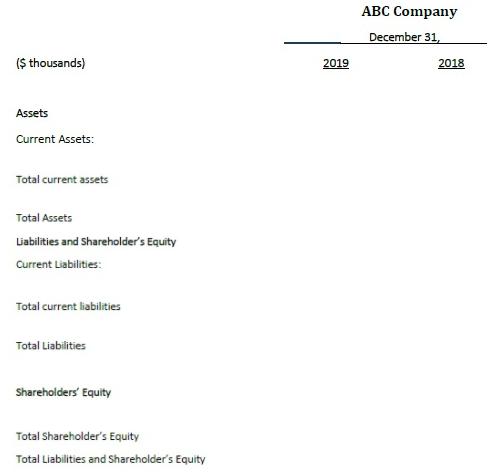

1- Prepare a classified balance sheet after finding the missing amounts. You can use the template provided below. Please disregard the order of items/accounts under one category (e.g., under current assets in terms of liquidity). 2- Compute the percentage of change of every account and balance (including the totals and subtotals) between years 2018 and 2019. Analyze the major changes and explain what could cause such changes (use 10% as a threshold). 3- Give two accounts classified under assets (in the balance sheet you prepared) that managers can manipulate or subjectively change to overstate (increase) total assets. Explain how they can do that. 4- Give one account classified under liabilities (in the balance sheet you prepared) that managers can manipulate or subjectively change to understate (decrease) total liabilities. Explain how they can do that. ABC Company December 31, ($ thousands) 2019 2018 Accounts receivables ,net 2$ 4,500 2$ 5,640 Accounts payable ? 2,480 Accrued income taxes 108 100 Additional paid-in capital 1,500 1,300 Cash and cash equivalents 4,000 2,870 Current portion of long-term debt 320 340 Contingent liabilities & other long-term obligations 650 1,300 Common stock 190 150 Goodwill 1,250 1,000 Inventories 350 250 Long-term debt 3,500 2,550 Notes and loans payable 200 220 Other noncurrent liabilities 275 300 Other intangible assets 1,300 1,000 Prepaid expenses 300 280 Property, plant and equipment (net of accumulated depreciation) 4,300 Retained earnings 6,935 8,500 ABC Company December 31, ($ thousands) 2019 2018 Assets Current Assets: Total current assets Total Assets Labilities and Shareholder's Equity Current Liabilities: Total current liabilities Total Liabilities Shareholders' Equity Total Shareholder's Eguity Total Liabilities and Shareholder's Equity

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started