Answered step by step

Verified Expert Solution

Question

1 Approved Answer

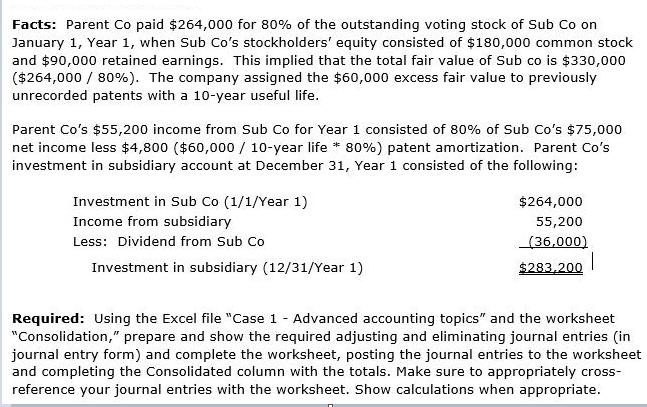

Facts: Parent Co paid $264,000 for 80% of the outstanding voting stock of Sub Co on January 1, Year 1, when Sub Co s

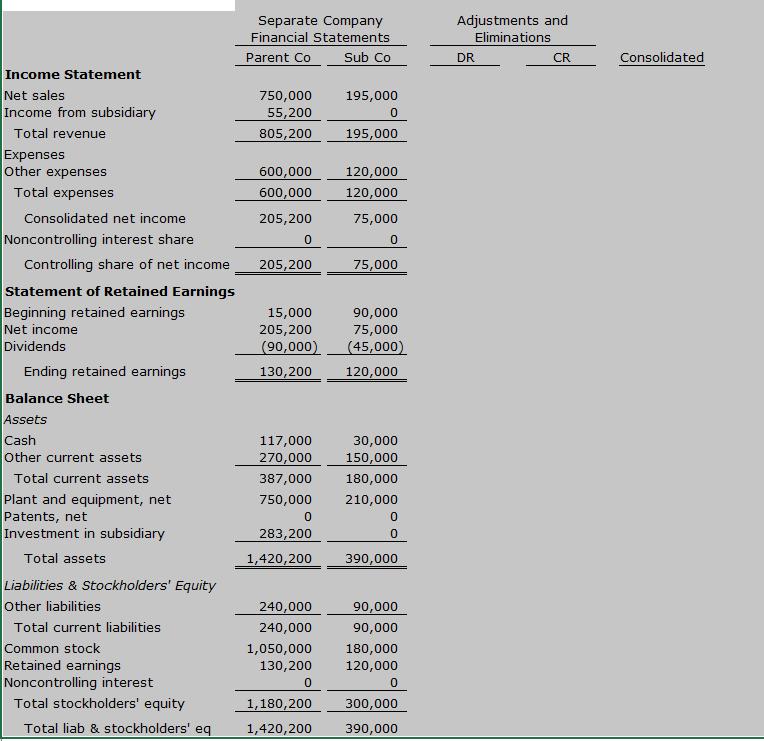

Facts: Parent Co paid $264,000 for 80% of the outstanding voting stock of Sub Co on January 1, Year 1, when Sub Co s stockholders equity consisted of $180,000 common stock and $90,000 retained earnings. This implied that the total fair value of Sub co is $330,000 ($264,000 / 80%). The company assigned the $60,000 excess fair value to previously unrecorded patents with a 10-year useful life. Parent Co s $55,200 income from Sub Co for Year 1 consisted of 80% of Sub Co s $75,000 net income less $4,800 ($60,000 / 10-year life * 80%) patent amortization. Parent Co s investment in subsidiary account at December 31, Year 1 consisted of the following: Investment in Sub Co (1/1/Year 1) Income from subsidiary Less: Dividend from Sub Co Investment in subsidiary (12/31/Year 1) $264,000 55,200 (36,000) $283,200 1 Required: Using the Excel file Case 1 - Advanced accounting topics and the worksheet Consolidation, prepare and show the required adjusting and eliminating journal entries (in journal entry form) and complete the worksheet, posting the journal entries to the worksheet and completing the Consolidated column with the totals. Make sure to appropriately cross- reference your journal entries with the worksheet. Show calculations when appropriate. Income Statement Net sales Income from subsidiary Total revenue Expenses Other expenses Total expenses Consolidated net income Noncontrolling interest share Controlling share of net income Statement of Retained Earnings Beginning retained earnings Net income Dividends Ending retained earnings Balance Sheet Assets Cash Other current assets Total current assets Plant and equipment, net Patents, net Investment in subsidiary Total assets Liabilities & Stockholders Equity Other liabilities Total current liabilities Common stock Retained earnings Noncontrolling interest Total stockholders equity Total liab & stockholders eq Separate Company Financial Statements Parent Co Sub Co 750,000 55,200 805,200 600,000 600,000 205,200 0 205,200 15,000 205,200 (90,000) 130,200 117,000 270,000 387,000 750,000 0 283,200 1,420,200 240,000 240,000 1,050,000 130,200 0 1,180,200 1,420,200 195,000 0 195,000 120,000 120,000 75,000 0 75,000 90,000 75,000 (45,000) 120,000 30,000 150,000 180,000 210,000 0 0 390,000 90,000 90,000 180,000 120,000 0 300,000 390,000 Adjustments and Eliminations DR CR Consolidated

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution Adjustment and elimination journal entries Debit Credit Retained earning of subsidia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started