Answered step by step

Verified Expert Solution

Question

1 Approved Answer

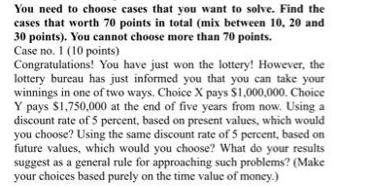

You need to choose cases that you want to solve. Find the cases that worth 70 points in total (mix between 10, 20 and

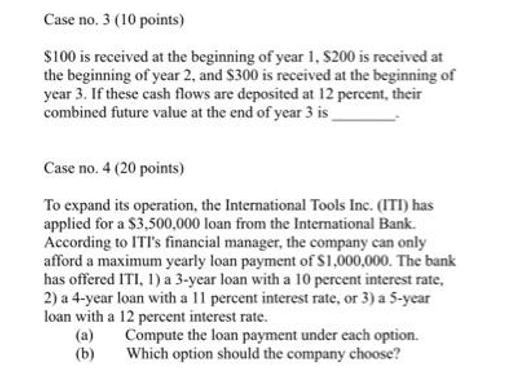

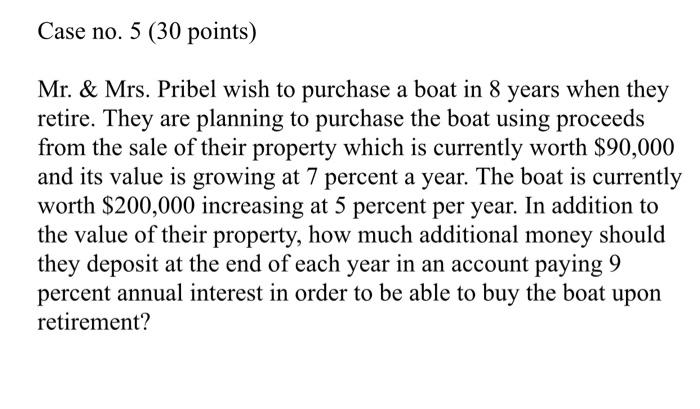

You need to choose cases that you want to solve. Find the cases that worth 70 points in total (mix between 10, 20 and 30 points). You cannot choose more than 70 points. Case no. 1 (10 points) Congratulations! You have just won the lottery! However, the lottery bureau has just informed you that you can take your winnings in one of two ways. Choice X pays $1,000,000. Choice Y pays $1,750,000 at the end of five years from now. Using a discount rate of 5 percent, based on present values, which would you choose? Using the same discount rate of 5 percent, based on future values, which would you choose? What do your results suggest as a general rule for approaching such problems? (Make your choices based purely on the time value of money.) Case no. 3 (10 points) $100 is received at the beginning of year 1, $200 is received at the beginning of year 2, and $300 is received at the beginning of year 3. If these cash flows are deposited at 12 percent, their combined future value at the end of year 3 is Case no. 4 (20 points) To expand its operation, the International Tools Inc. (ITI) has applied for a $3,500,000 loan from the International Bank. According to ITI's financial manager, the company can only afford a maximum yearly loan payment of $1,000,000. The bank has offered ITI, 1) a 3-year loan with a 10 percent interest rate, 2) a 4-year loan with a 11 percent interest rate, or 3) a 5-year loan with a 12 percent interest rate. (a) (b) Compute the loan payment under each option. Which option should the company choose? Case no. 5 (30 points) Mr. & Mrs. Pribel wish to purchase a boat in 8 years when they retire. They are planning to purchase the boat using proceeds from the sale of their property which is currently worth $90,000 and its value is growing at 7 percent a year. The boat is currently worth $200,000 increasing at 5 percent per year. In addition to the value of their property, how much additional money should they deposit at the end of each year in an account paying 9 percent annual interest in order to be able to buy the boat upon retirement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

CASE 1 PV of X 1000000 PV of Y 17500001055 1371170791 Therefore we would choose Y as we are getting ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started