Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pavin acquires all of Stabler's outstanding shares on January 1, 2015, for $500,000 in cash, Of this amount, $34,000 was attributed to equipment with a

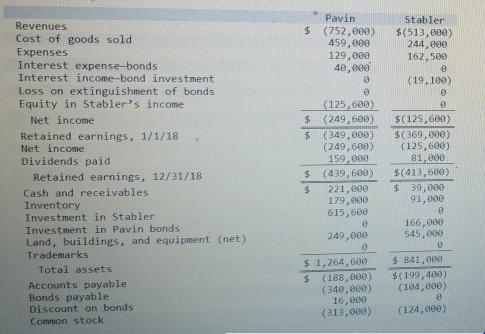

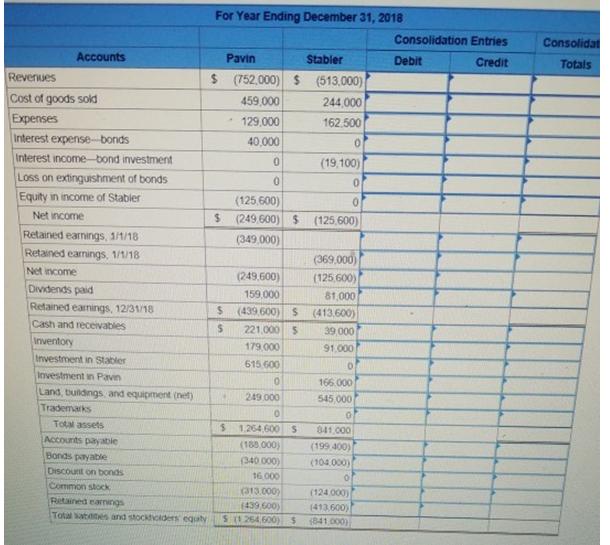

Pavin (752,000) 459,000 129,000 40,000 Stabler Revenues $(513,000) 244, 000 162,500 Cost of goods sold Expenses Interest expense-bonds Interest income-bond investment Loss on extinguishment of bonds Equity in Stabler's income (19,100) (125,600) $ (249,600) $ 349,000) (249,600) 159, 000 $ (439, 600) 221,000 179,000 615,600 Net income $(125,600) Retained earnings, 1/1/18 Net income $(369, 000) (125,600) 81,000 $(413,680) Dividends paid Retained earnings, 12/31/18 Cash and receivables Inventory Investment in Stabler $ 39,000 91,000 166,000 545,000 Investment in Pavin bonds Land, buildings, and equipment (net) Trademarks 249,000 $ 1,264, 600 $ (188,000) (340,000) 16,000 (313,000) $ 841,060 $(199,400) (104,000) Total assets Accounts payable Bonds payable Discount on bonds Common stock (124, 000)

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started