ACCOUNTING

Please answer all 4 questions!

1.

2.

3.

4.

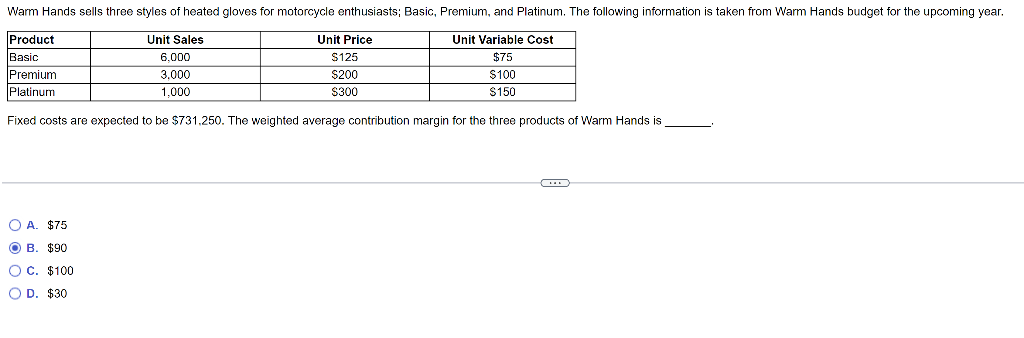

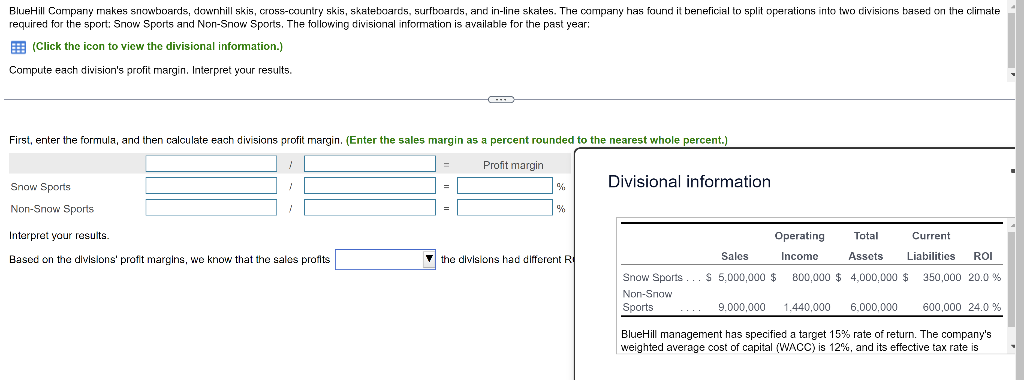

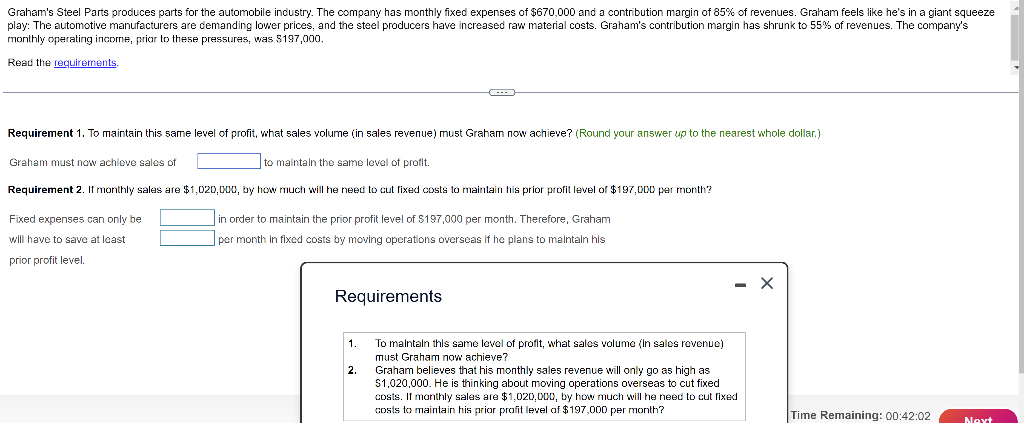

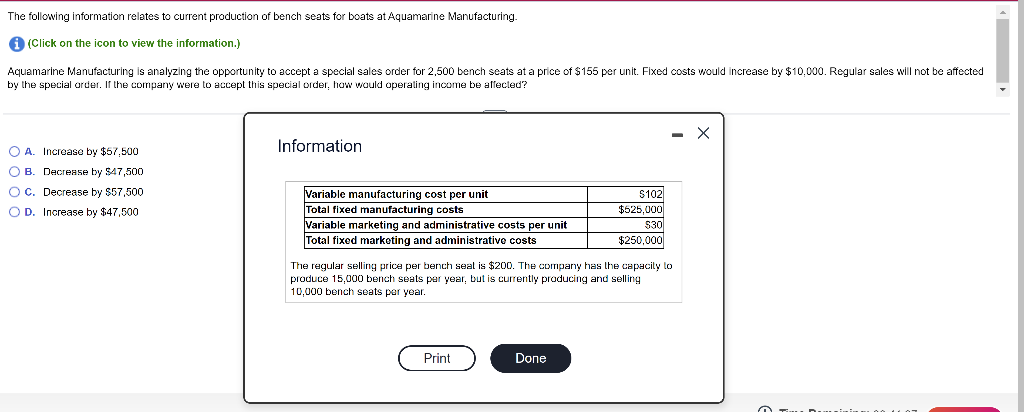

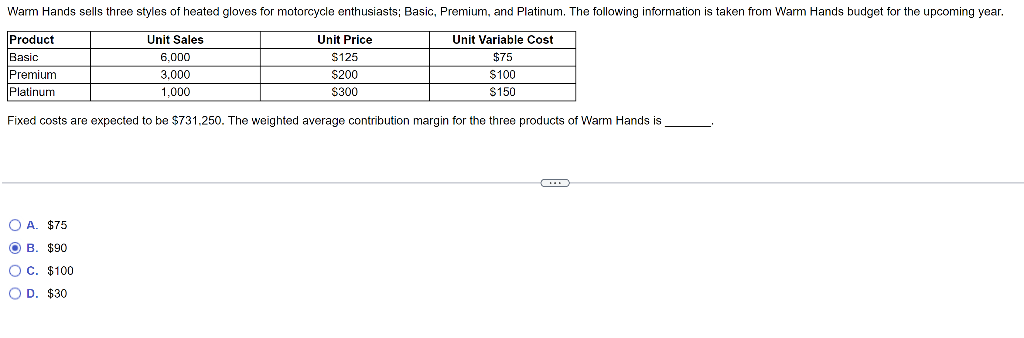

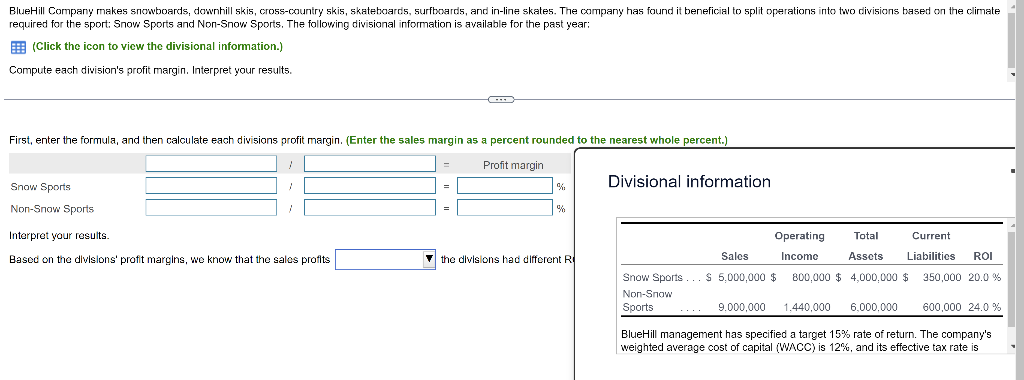

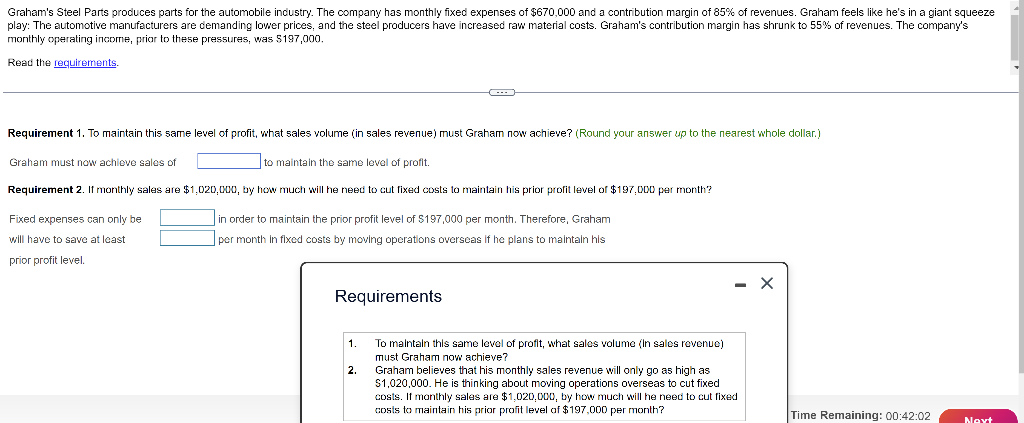

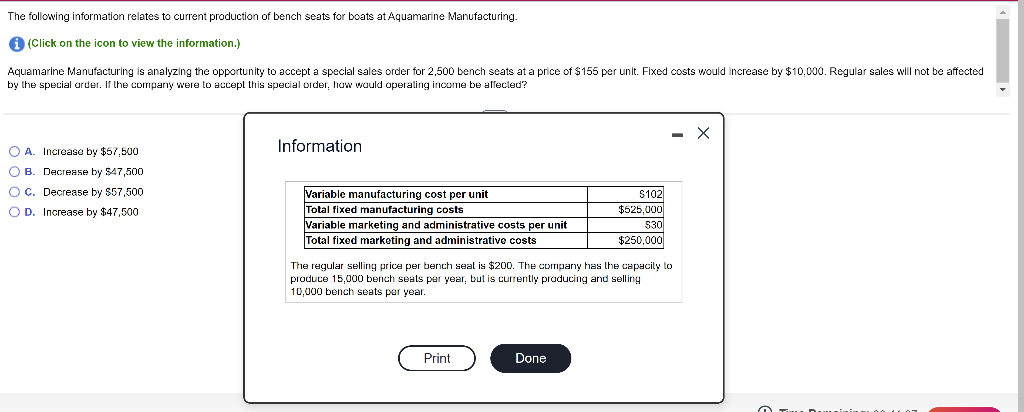

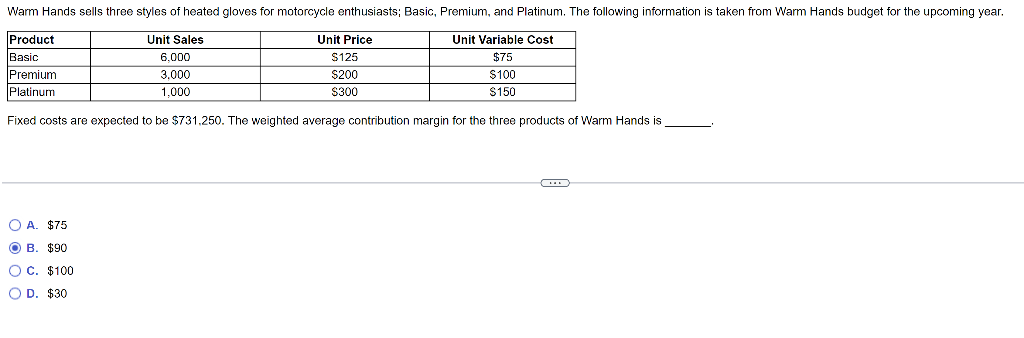

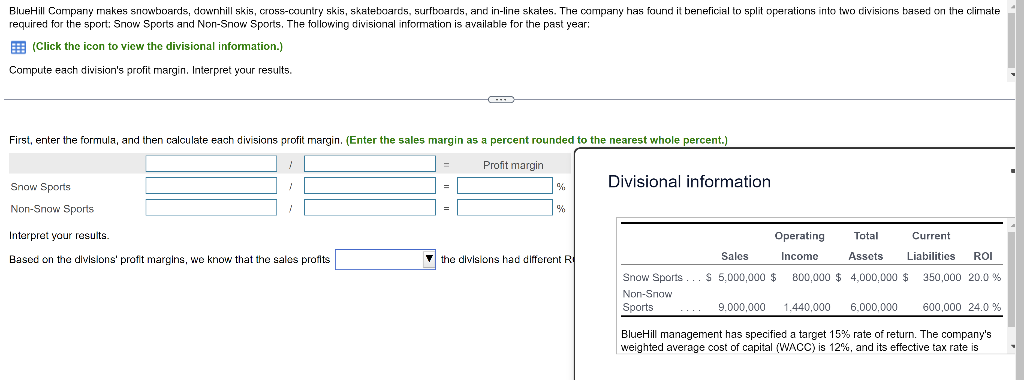

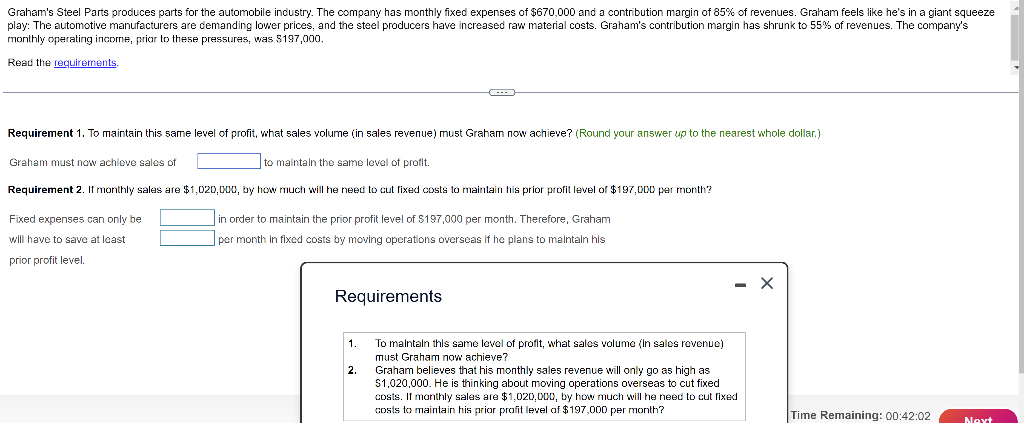

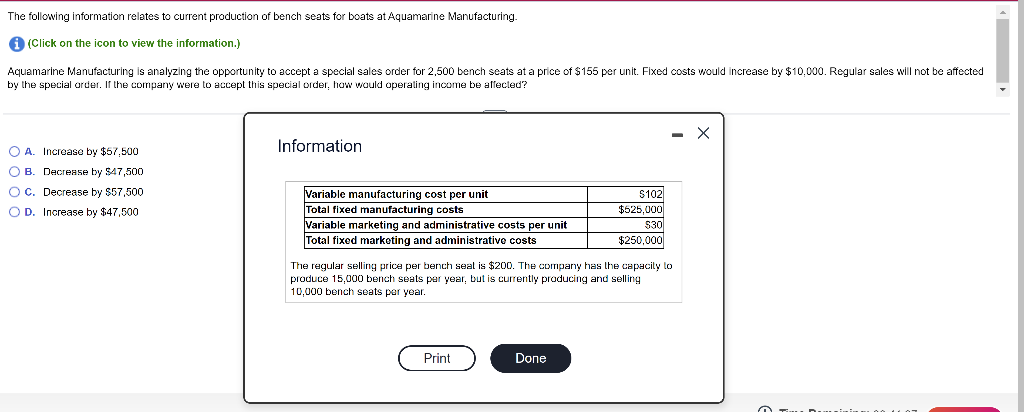

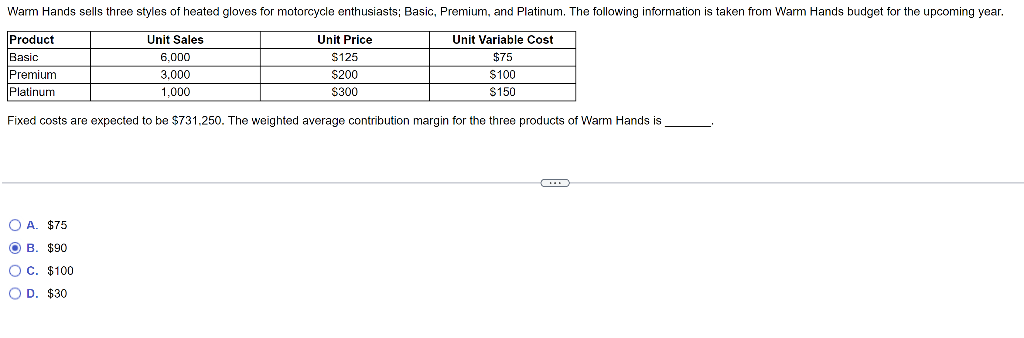

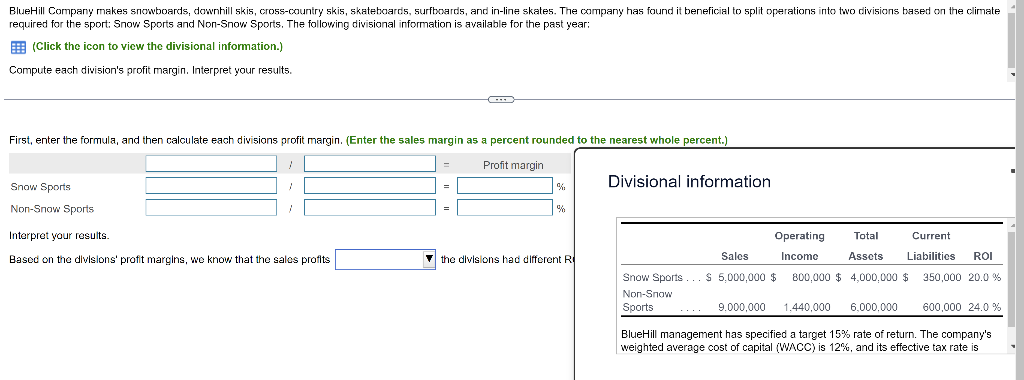

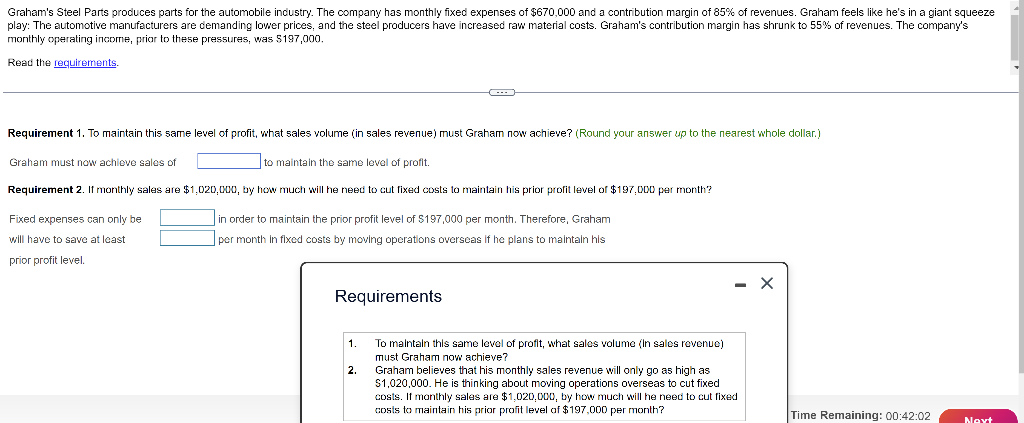

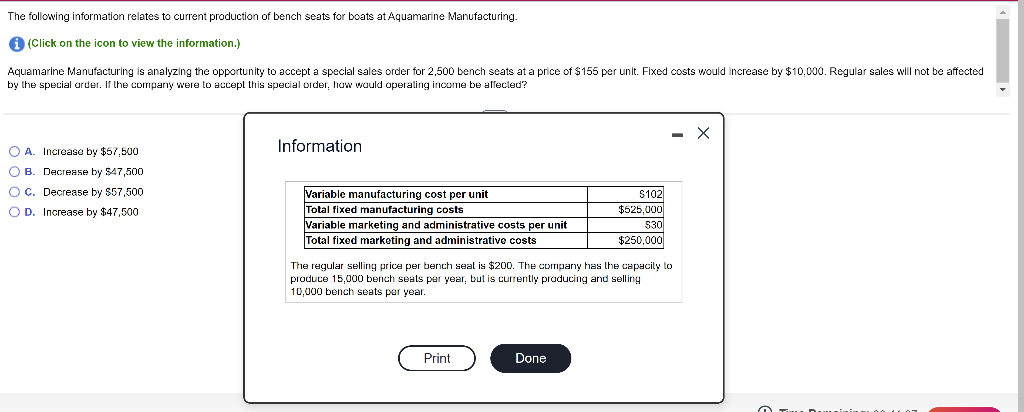

Warm Hands sells three styles of heated gloves for motorcycle enthusiasts; Basic, Premium, and Platinum. The following information is taken from Warm Hands budget for the upcoming year. Product Basic Premium Platinum Unit Sales 6.000 3.000 1.000 Unit Price S125 $200 S300 Unit Variable Cost $75 $100 S150 Fixed costs are expected to be $731.250. The weighted average contribution margin for the three products of Warm Hands is O A. $75 OB. $90 OC. $100 OD. $30 BlueHill Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and in-line skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and Non-Snow Sports. The following divisional information is available for the past year: (Click the icon to view the divisional information.) Compute each division's profit margin. Interpret your results. First, enter the formula, and then calculate each divisions profit margin. (Enter the sales margin as a percent rounded to the nearest whole percent.) Profit margin Divisional information Snow Sports Non-Snow Sports 1 Interpret your results Based on the divisions' profit margins, we know that the sales profits the divisions had different R Operating Total Current Sales Income Assets Liabilities ROI Snow Sports ... S 5,000,000 $ 800,000 $4,000,000 $ 350,000 20.0 % Non-Snow Sports 9,000,000 1.440,000 6.000.000 600,000 24.0 % BlueHill management has specified a target 15% rate of return. The company's weighted average cost of capital (WACC) is 12%, and its effective tax rate is Graham's Steel Parts produces parts for the automobile industry. The company has monthly fixed expenses of $670,000 and a contribution margin of 85% of revenues. Graham feels like he's in a giant squeeze play: The automotive manufacturers are demanding lower prices, and the steel producers have increased raw material costs. Graham's contribution margin has shrunk to 55% of revenues. The company's monthly operating income, prior to these pressures, was $197,000. Read the requirements. Requirement 1. To maintain this same level of profit, what sales volume (in sales revenue) must Graham now achieve? (Round your answer up to the nearest whole dollar.) Graham must now achlovo sales of to maintain the same level of profit. Requirement 2. If monthly sales are $1,020,000, by how much will he need to cut fixed costs to maintain his prior profit level of $197.000 per month? Fixed expenses can only be in order to maintain the prior profit level of $197,000 per month. Therefore, Graham per month in fixed costs by moving operations overseas if he plans to maintain his will have to save at least prior profit level - X Requirements 2. To maintain this same level of profit, what sales volume (In sales revenue) must Graham now achieve? Graham believes that his monthly sales revenue will only go as high as $1,020,000. He is thinking about moving operations overseas to cut fixed costs. If monthly sales are $1,020,000, by how much will he need to cut fixed costs to maintain his prior profit level of $197,000 per month? Time Remaining: 00:42:02 Neyt The following information relates to current production of bench seats for boats at Aquamarine Manufacturing (Click on the icon to view the information.) Aquamarine Manufacturing is analyzing the opportunity to accept a special sales order for 2,500 bench seats at a price of $155 per unit. Fixed costs would increase by $10.000. Regular sales will not be affected by the special order. If the company were to accept this special order, how would operating income be affected? Information O A. Increase by $67,500 OB. Decrease by $47,500 O c. Decrease by $57,500 OD Increase by $47,500 Variable manufacturing cost per unit S102 Total fixed manufacturing costs $525,000 Variable marketing and administrative costs per unit 530 Total fixed marketing and administrative costs $250,000 The regular selling price per bench seal is $200. The company has the capacity to produce 15,000 bench seats per year, but is currently producing and selling 10,000 bench seats per year. Print Done