Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting Policies, Changes in Accounting Estimates and Errors lays down criteria for selection of accounting policies and prescribes circumstances in which an entity may

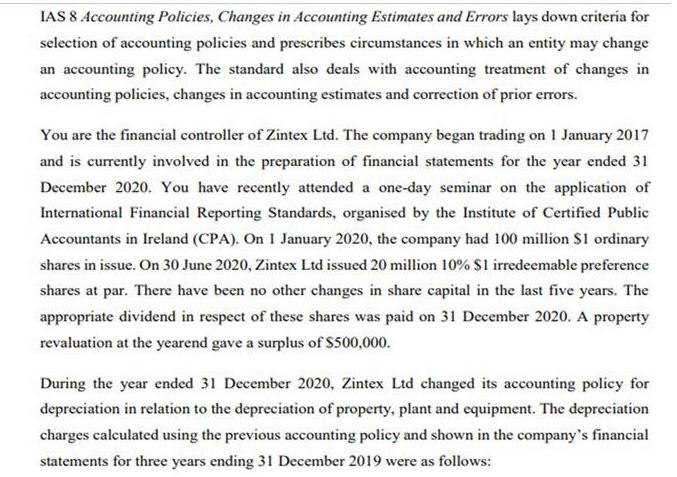

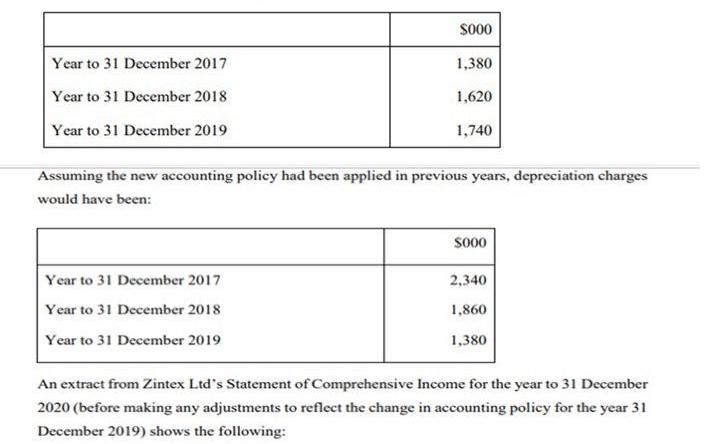

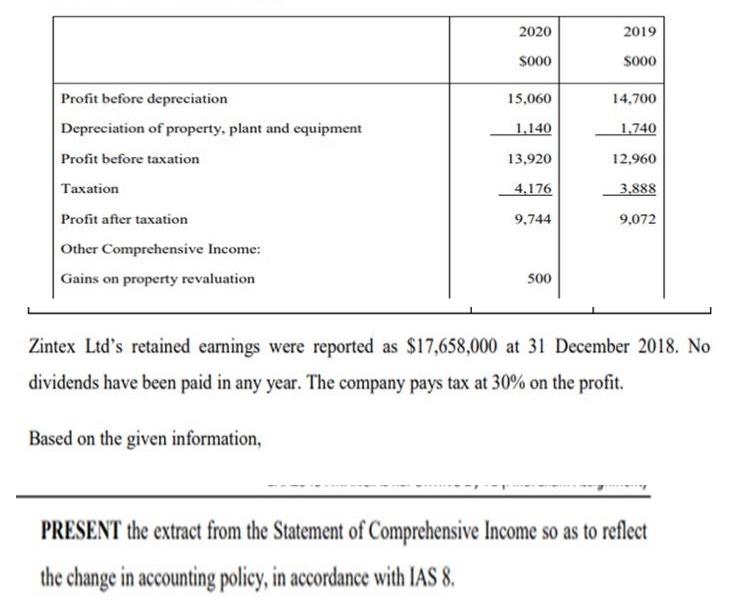

Accounting Policies, Changes in Accounting Estimates and Errors lays down criteria for selection of accounting policies and prescribes circumstances in which an entity may change an accounting policy. The standard also deals with accounting treatment of changes in accounting policies, changes in accounting estimates and correction of prior errors. You are the financial controller of Zintex Ltd. The company began trading on 1 January 2017 and is currently involved in the preparation of financial statements for the year ended 31 December 2020. You have recently attended a one-day seminar on the application of International Financial Reporting Standards, organised by the Institute of Certified Public Accountants in Ireland (CPA). On 1 January 2020, the company had 100 million $1 ordinary shares in issue. On 30 June 2020, Zintex Ltd issued 20 million 10% $1 irredeemable preference shares at par. There have been no other changes in share capital in the last five years. The appropriate dividend in respect of these shares was paid on 31 December 2020. A property revaluation at the yearend gave a surplus of $500,000. During the year ended 31 December 2020, Zintex Ltd changed its accounting policy for depreciation in relation to the depreciation of property, plant and equipment. The depreciation charges calculated using the previous accounting policy and shown in the company's financial statements for three years ending 31 December 2019 were as follows: Year to 31 December 2017 Year to 31 December 2018 Year to 31 December 2019 $000 1,380 1,620 1,740 Assuming the new accounting policy had been applied in previous years, depreciation charges would have been: Year to 31 December 2017 Year to 31 December 2018 Year to 31 December 2019 $000 2,340 1,860 1,380 An extract from Zintex Ltd's Statement of Comprehensive Income for the year to 31 December 2020 (before making any adjustments to reflect the change in accounting policy for the year 31 December 2019) shows the following: Profit before depreciation Depreciation of property, plant and equipment Profit before taxation Taxation Profit after taxation Other Comprehensive Income: Gains on property revaluation 2020 $000 Based on the given information, 15,060 1,140 13,920 4,176 9,744 500 2019 $000 14,700 1,740 12,960 3,888 9,072 Zintex Ltd's retained earnings were reported as $17,658,000 at 31 December 2018. No dividends have been paid in any year. The company pays tax at 30% on the profit. PRESENT the extract from the Statement of Comprehensive Income so as to reflect the change in accounting policy, in accordance with IAS 8.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started