Answered step by step

Verified Expert Solution

Question

1 Approved Answer

accounting practice review ch 5-9 can someone provide answers, need to compare my answers and make sure I did this correctly. 17, All of the

accounting practice review ch 5-9

can someone provide answers, need to compare my answers and make sure I did this correctly.

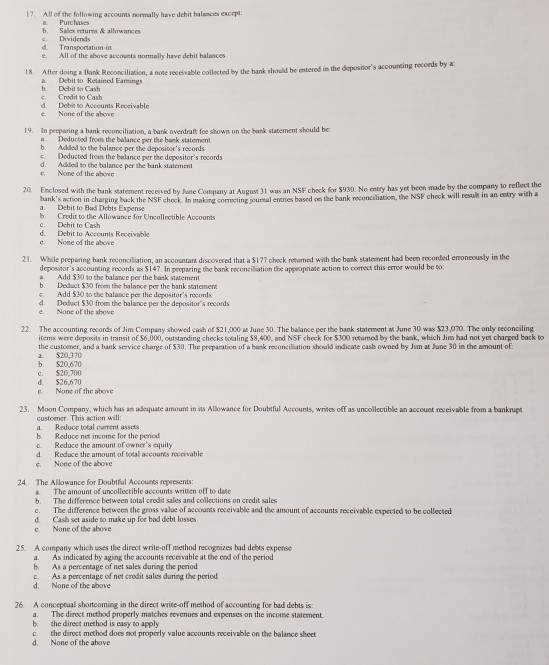

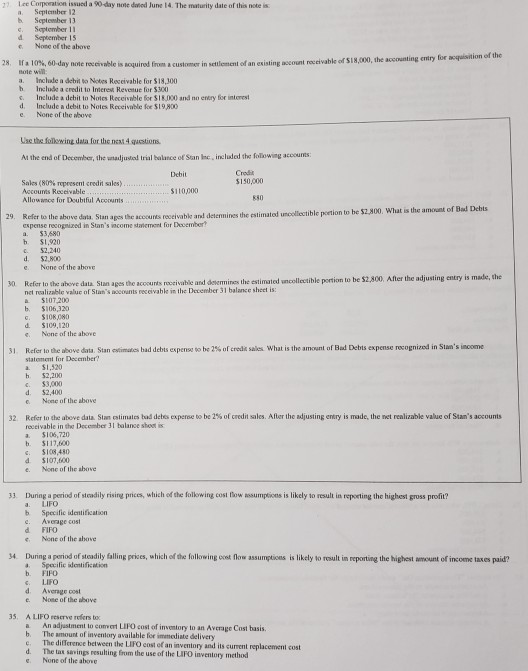

17, All of the following accounts normally have debit halances excet a Purchases h. Sales returms& allowances c. Dividends d Transportation-in e. All of the above accounts nommally have dehit halances a note receivable collected by the bank should be emtered in the depositor's accounting recoeds by a a Debit to Retainod Eanings b. Debit to Cash c. Credit to Cash d. Debit bo Accounts Receivable e. None of the above 19. In peeparing a hank reconciliation, a bank overdraft fee showm on the bunk statement should be a Deducted froes the balance per the bank statement b. Added so the balance per the depositor's records c Deducted from the balance per the depositor's records d. Added to the balance per the hank statement e None of the above Company at August 3I was an NSF check for $930. No emtry has yet been made by the company to reflect the the bank reconciliation, the NSF check will resuk in an entry with a 20. Enclosed with the hank statement rec eived by June unk sacticn in charging bo:k the NSF check In making correcting joumal entries based on t a. Debit to Bad Debts Expense h. Credit to the Allowance for Uncollectible Accounts c. Dehit to Cash d. Debit to Accounts Receivable e None of the above 21. While preparing hank reconciliation, an accountant discovered that a $177 check retuned with the bank statement had been reconded eronecusly in the depositor's accounting reconds as $147. In preparing the bank reconciliation the appeopriate action to correct this esror would be o a Add $30 to the balance per the bank statement b. Dedact 530 from the halance per the bank statemen Add S30 to the halance pes the depositor's records d. Deduct 530 from the balance per the depositor's reconds e. None of the above 22 The accounting records of Jim Company showed eash of $21,000June 30. The balance per the bank statement at June 30 was $23,070. items were deposits in transit of $6,000, outstanding checks totaling $8,400, and NSF check for 5300 retumed by the bank, which Jim had not yet charged back to the custoener, and a hank service charge of 530. The preparation of a bank reconciliation should indicate cash owned by Jim at June 30 in the amount of The only reconciling $20,370 b. $20,670 c. $20,700 d. $26,670 e None of the above 23. Moon Company, which has an adequate amount in its Allowance for Doubiful Accounts, writes off as uncollectible an account receivable from a bankrup customer. This action will a. Reduce total carrent assets b. Reduce net income for the period c Reduce the amount of owner's equity d. Reduce the amount of total accounts roceivable c None of the above The Allowance for Doubtful Aceounts represents: a The amount of uncollectible accounts writtien off to date b. The difference between total credit sales and collections on credit sales c The difference bctween the gross value of accounts receivable and the amount ofaccounts receivable epected to be collected d. Cash set aside to make up for bad debt losses c. None of the above 24. A company which uses the direct write-off method recognizes had debes expense a. As indicated by aging the accounts receivable at the end of the period b. As a percentage of net sales during the period c. As a percentage of net credit sales during the peried d. None of the above 25. 26 A concepoual shortcoming in the direct write-off method of accounting for bad debts is a. b. c. d. The direct method properly matches revenues and expenses on the income statement the direct method is easy to apply the direct method does not properly value accounts receivable on the balance sheet None of the above 2 Lce Corporation issued a 90-day note datied June 14. The maturity date of this note is b. September 13 Saptember 11 d September 15 . None of the above 28, lfa 10%, 60-day note reemable is Boquired Bote will a. Inclhude a debit so Notes Receivable for $18,300 h Include a credit to Imeres Revenue for $300 . Include a debit to Notes Receivable for $18,000 and no entery for intorest d. Include a debit to Notes Receivable foe $19800 e. None of the whove from a customer in setlement of an existing account roceivable of $18,000, the accounting entry for acquisition of the of an es sting account Use the folkwing data for the ncat 4 qucstions At the end of December, the unadjustod trial balance of Stan Inc, included the following accoums Sales (80% represent credit sles) Crodit $150,000 Debit ..$110,000 29. Refer to the above dsta. Stan apes the accounts receivablk and detennines the estimatod unollectible poetion to he Accounts Receivable Allowance for Doubtful Accounts 850 $2,800. What is the amount of Bad Debts espense recogmized in Stan's income staiement for Drecember a. 53,680 h. $1,920 $2,240 d. $2,800 e. None of the above the estimated uncolle ectible portion to be $2,800. After the adjusting entry is made, the 30 Refer io the above data Stan ages the accounks receivable and devermines t net realizable value of Stan's accounts receivablk in the December 31 balance sheet is: $107200 b. $106,320 G. $108,080 d. $109,120 . None of the above S1. Refer to the above data Stan evimates had dehts espens to be 2S% of credik sales What is the amount of Bed Dehts expense recognized in Stan's income statement for December $1,520 h 52,200 . $3,000 d. $2,400 None of the above Refer in the above data. Stan estinates hd detes expense to be 2%ofcredit sales After the Njusting entry s marthe net rentable value of receivable in the December 31 balance shoot is 32 an account $106,720 b. $117,600 . $108,480 d $107,600 e. None of the ahove 33. Dunng a period of stradily rising prices, wlhich of the following cost fhow assumptions is likely to result in reporting the highest gross profit? a. LIFO b Specific identification c. Average cost d FIFO e. None of the alove 34 During a period of steadily falling prices, which of the following cst flow assumptioes is likely to result in reporting the highest wmeunt of incoeme taxes paid? a. Specific identification b. FIFO LIF d. Average cost c Nose of the ubove 35, A LIFO reserve refers to a An adjustment to comvert LIPO cost of inventory to an Average Cost basis. b. The amount of inventory available for immediate delivery c. The difTerence between the LIFO cost of an inventory and its current replacement cost tas savings resulting from the use of the LFO inventory method e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started