Answered step by step

Verified Expert Solution

Question

1 Approved Answer

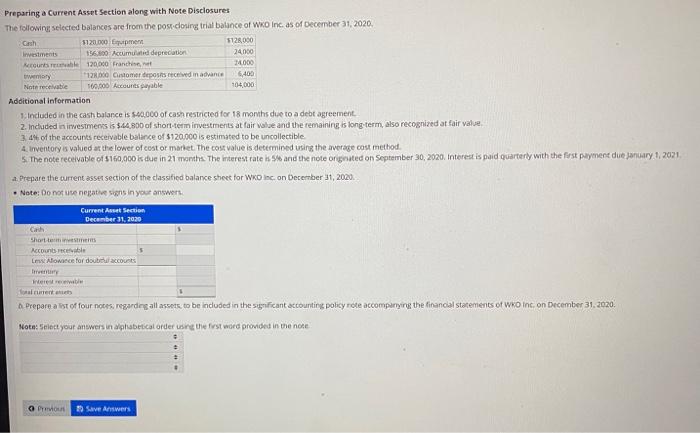

Preparing a Current Asset Section along with Note Disclosures The following selected balances are from the post-closing trial balance of WKO Inc. as of

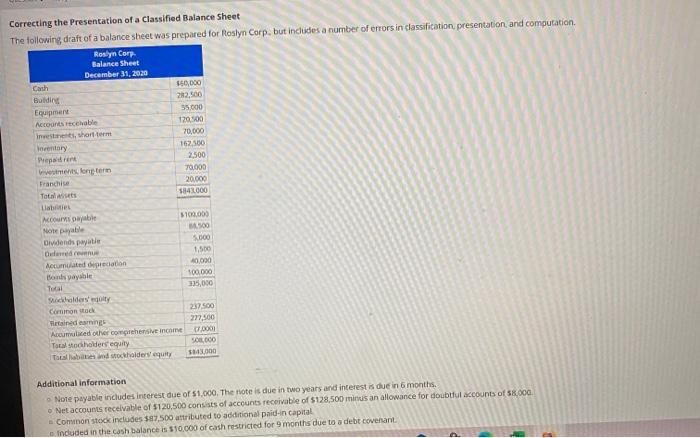

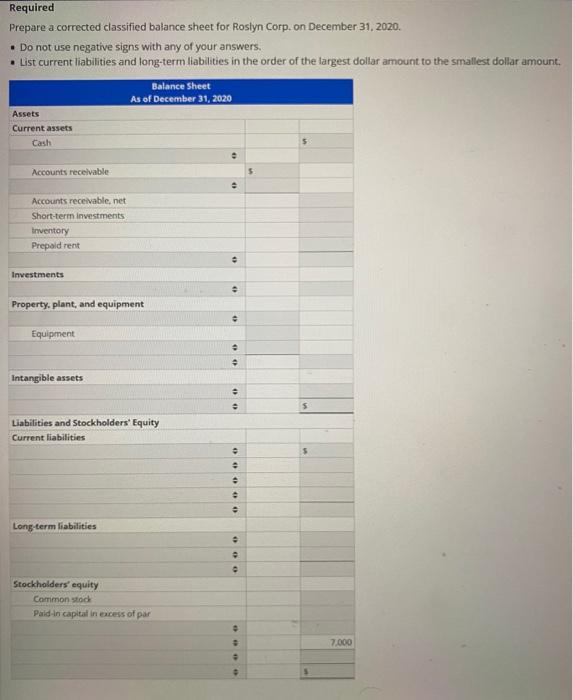

Preparing a Current Asset Section along with Note Disclosures The following selected balances are from the post-closing trial balance of WKO Inc. as of December 31, 2020. Cash Investments Accounts recevable twentory Note receivable $120,000 Equipment 156.800 Accumulated depreciation 120,000 Franchise, net 128,000 Customer deposits received in advance 160,000 Accounts payable Additional information 1. Included in the cash balance is $40,000 of cash restricted for 18 months due to a debt agreement. 2. Included in investments is $44,800 of short-term investments at fair value and the remaining is long-term, also recognized at fair value. 3 4% of the accounts receivable balance of $120,000 is estimated to be uncollectible. 4. Inventory is valued at the lower of cost or market. The cost value is determined using the average cost method. 5. The note receivable of $160,000 is due in 21 months. The interest rate is 5% and the note originated on September 30, 2020. Interest is paid quarterly with the first payment due January 1, 2021, a. Prepare the current asset section of the classified balance sheet for WKO Inc. on December 31, 2020. Note: Do not use negative signs in your answers. Current Asset Section December 31, 2020 Cah Short-term investments Accounts receivable Les Allowance for douteul accounts Inventary Interest recevable O Previous $128,000 24,000 24,000 6,400 104,000 fonal current assets A Prepare a list of four notes; regarding all assets to be included in the significant accounting policy note accompanying the financial statements of WKO Inc. on December 31, 2020. Note: Select your answers in alphabetical order using the first word provided in the note Save Answers Correcting the Presentation of a Classified Balance Sheet The following draft of a balance sheet was prepared for Roslyn Corp, but includes a number of errors in classification, presentation, and computation. Roslyn Corp. Balance Sheet December 31, 2020 Cash Building Equipment Accounts receivable investments, short-term Inventory Prepaid rent vestments, long-term Franchise Total assets Labrities Accounts payable Note payable Dividends payable Deferred revenue Accumulated depreciation Bonds payable Total $60,000 282,500 55,000 120,500 Total stockholders' equity Total habiles and stockholders' equity 70,000 162,500 2,500 70,000 20,000 $843.000 $100,000 4.500 5,000 1,500 40,000 100,000 335,000 Stockholders' equity Common stock Retained earnings Accumulated other comprehensive income 237.500 277,500 0,0001 500,000 $843,000 Additional information Note payable includes interest due of $1,000. The note is due in two years and interest is due in 6 months. Net accounts receivable of $120,500 consists of accounts receivable of $128,500 minus an allowance for doubtful accounts of $8,000 Common stock includes $87,500 attributed to additional paid-in capital Included in the cash balance is $10,000 of cash restricted for 9 months due to a debt covenant. Required Prepare a corrected classified balance sheet for Roslyn Corp. on December 31, 2020. Do not use negative signs with any of your answers. List current liabilities and long-term liabilities in the order of the largest dollar amount to the smallest dollar amount. Assets Current assets Cash Accounts receivable Accounts receivable, net Short-term investments Inventory Prepaid rent Investments Property, plant, and equipment Equipment Intangible assets Balance Sheet As of December 31, 2020 Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Stockholders' equity Common stock Paid-in capital in excess of par # " : 0000 9 0 9 OOOO $ S $ S 7,000

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

urrent asset Section December 31 2020 Cash 100000 Short term investment 140000 Account Rece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started