Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting Principles I (ACC 111) Bank Reconciliation (Chapter 7) Homework Problems Problem 7 - A Bank Reconciliation At September 30, of the current year, the

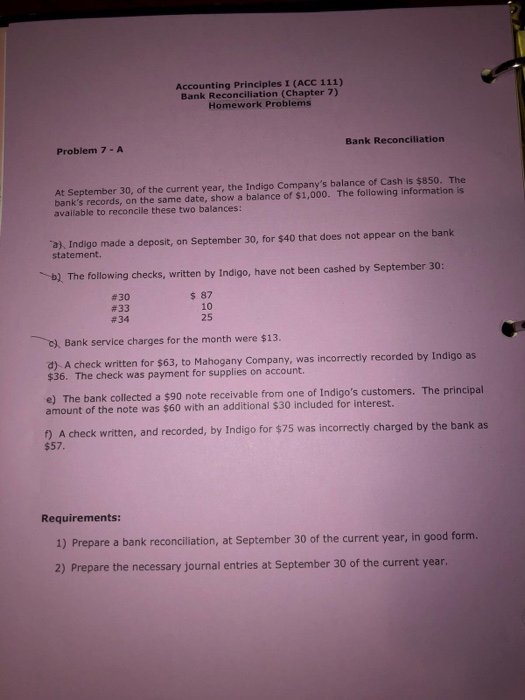

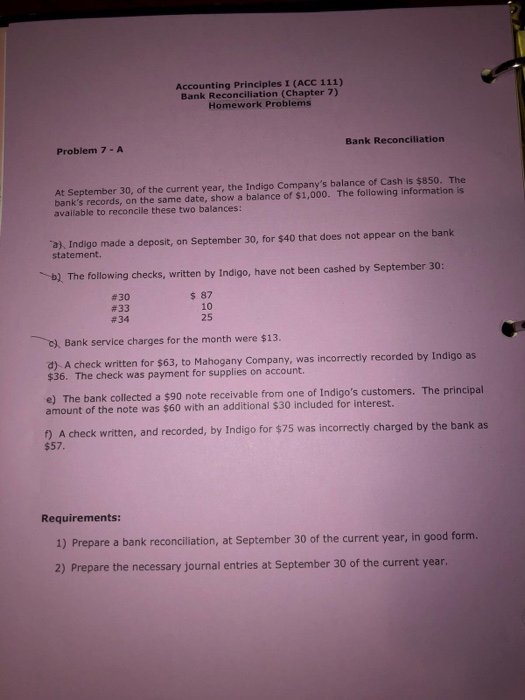

Accounting Principles I (ACC 111) Bank Reconciliation (Chapter 7) Homework Problems Problem 7 - A Bank Reconciliation At September 30, of the current year, the Indigo Company's balance of Cash is $850. The bank's records, on the same date, show a balance of $1,000. The following information is available to reconcile these two balances: a). Indigo made a deposit, on September 30, for $40 that does not appear on the bank statement. b) The following checks, written by Indigo, have not been cashed by September 30: $ 87 #30 #33 c) Bank service charges for the month were $13. d) A check written for $63, to Mahogany Company, was incorrectly recorded by Indigo as $36. The check was payment for supplies on account. e) The bank collected a $90 note receivable from one of Indigo's customers. The principal amount of the note was $60 with an additional $30 included for interest. f) A check written, and recorded, by Indigo for $75 was incorrectly charged by the bank as $57. Requirements: 1) Prepare a bank reconciliation, at September 30 of the current year, in good form. 2) Prepare the necessary journal entries at September 30 of the current year

Accounting Principles I (ACC 111) Bank Reconciliation (Chapter 7) Homework Problems Problem 7 - A Bank Reconciliation At September 30, of the current year, the Indigo Company's balance of Cash is $850. The bank's records, on the same date, show a balance of $1,000. The following information is available to reconcile these two balances: a). Indigo made a deposit, on September 30, for $40 that does not appear on the bank statement. b) The following checks, written by Indigo, have not been cashed by September 30: $ 87 #30 #33 c) Bank service charges for the month were $13. d) A check written for $63, to Mahogany Company, was incorrectly recorded by Indigo as $36. The check was payment for supplies on account. e) The bank collected a $90 note receivable from one of Indigo's customers. The principal amount of the note was $60 with an additional $30 included for interest. f) A check written, and recorded, by Indigo for $75 was incorrectly charged by the bank as $57. Requirements: 1) Prepare a bank reconciliation, at September 30 of the current year, in good form. 2) Prepare the necessary journal entries at September 30 of the current year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started