Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Charles and Joan Thompson file a joint return. In 2018, they had taxable income of $107440 and paid tax of $15,516. Charles is an

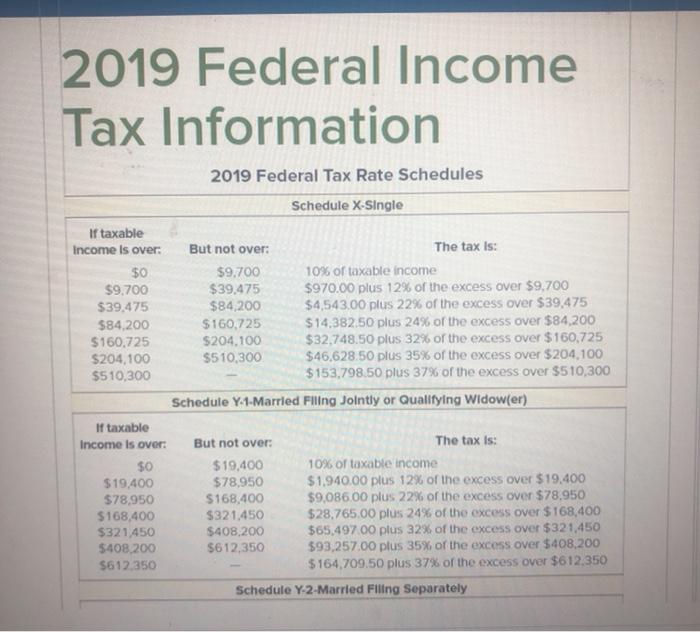

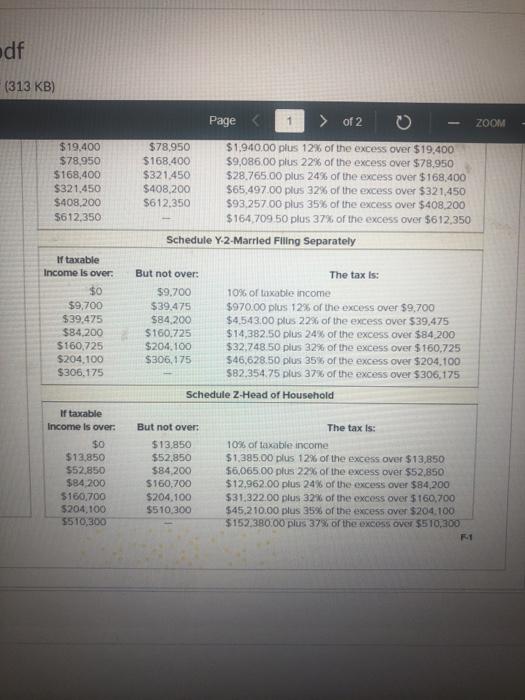

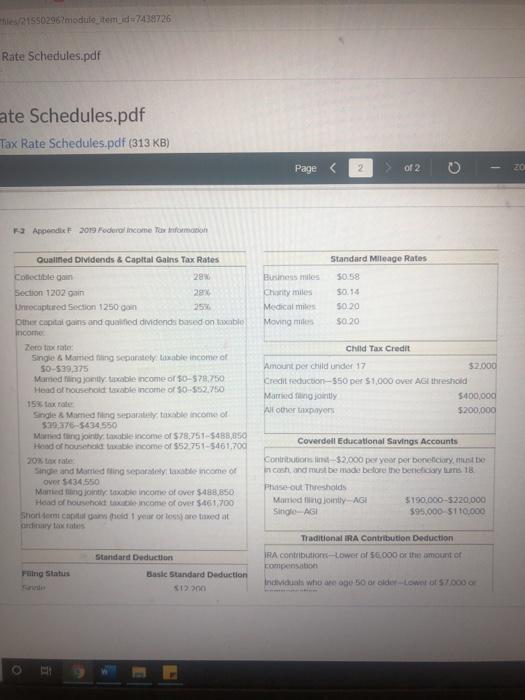

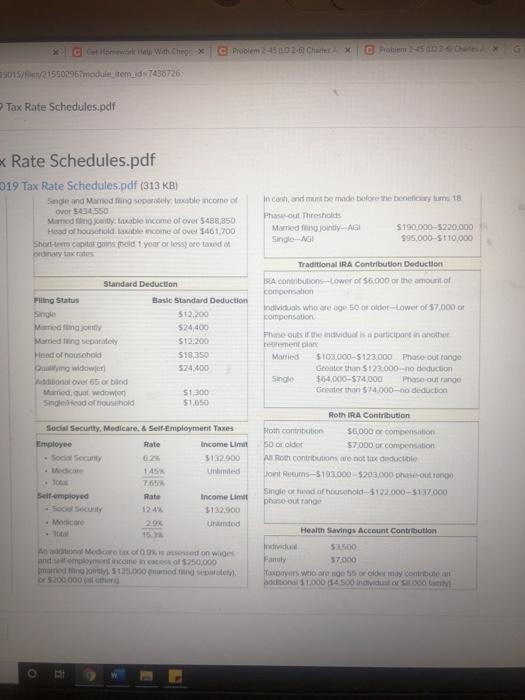

Charles and Joan Thompson file a joint return. In 2018, they had taxable income of $107440 and paid tax of $15,516. Charles is an advertising executive, and Joan is a college professor. During the fall 2019 semester, Joan is planning to take a leave of absence without pay. The Thompsons expect their taxable income to drop to $88.000 in 2019. They expect their 2019 tax liability will be S1,083, which will be the approximate amount of their withholding Joan anticipates that she will work on academic research during the fall semester. During September, Joan decides to perform consuiting services for some local businesses Charles and Joan had not anticipated this Schedules Required: a. What estimated tax payments are Charies and Joan required to make, if any. for tax year 2019? Estimated tuco paymonta roquired b. Do you anticipate that the Thompsons will be required to pay an underpayment penalty when they file their 2019 tax return? Assume that Charles and Joan made the estimated payment as determined in requirement a O No O Yes 2019 Federal Income Tax Information 2019 Federal Tax Rate Schedules Schedule X-Single If taxable Income Is over: But not over: The tax Is: $9.700 $39,475 10% of taxable income $970.00 plus 12% of the excess over $9,700 $4,543.00 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $153,798.50 plus 37% of the excess over $510,300 $9.700 $39,475 $84,200 $84,200 $160,725 $160,725 $204,100 $510,300 $204,100 $510,300 Schedule Y-1-Marrled Fillng Jolntly or Qualifying Widow(er) If taxable Income Is over: But not over: The tax Is: 10% of taxable income $19,400 $78,950 $168,400 $0 $1,940.00 plus 12% of the excess over $19.400 $9,086.00 plus 22% of the excess over $78,950 $28,765.00 plus 24% of the excess over $168,400 $65,497.00 plus 32% of the excess over $321,450 $93,257.00 plus 35% of the excess over $408,200 $164,709.50 plus 37% of the excess over $612.350 $19,400 $78,950 $168,400 $321,450 $408,200 $321,450 $408,200 $612,350 $612.350 Schedule Y-2-Married Fillng Separately df (313 KB) Page > of 2 ZOOM $19,400 $78,950 $168,400 $78,950 $168,400 $321,450 $408,200 $1,940.00 plus 12% of the excess over $19,400 $9,086.00 plus 22% of the excess over $78,950 $28.765.00 plus 24% of the excess over $168,400 $65,497.00 plus 32% of the excess over $321,450 $93.257.00 plus 35% of the excess over $408,200 $164,709.50 plus 37% of the excess over $612,350 $321,450 $408,200 $612.350 $612,350 Schedule Y-2-Marrled Filing Separately If taxable Income Is over: But not over: The tax Is: $0 $9.700 10% of taxable income $9,700 $39,475 $970.00 plus 12% of the excess over $9,700 $4.543.00 plus 22% of the eXcess over $39,475 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 pius 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $82,354.75 plus 37% of the excess over $306,175 $39,475 $84,200 $84,200 $160,725 $204.100 $306,175 $160,725 $204,100 $306,175 Schedule Z-Head of Household If taxable Income Is over: But not over: The tax Is: $0 $13,850 $13,850 $52,850 $84,200 10% of taxable income $1,385.00 plus 12% of the exXcess over $13,850 $6,065.00 plus 22% of the exXcess over $52,850 $12,962.00 plus 24% of the excess over $84,200 $31,322.00 plus 32% of the cexcoss over $160,700 $45,210.00 plus 35% of the excess over $204.100 $152,380.00 plus 37% of the excoss over $510,300 $52,850 $84,200 S160,700 $160,700 $204,100 $204,100 $510.300 $510,300 les/21550296?module itemd7438726 Rate Schedules.pdf ate Schedules.pdf Tax Rate Schedules.pdf (313 KB) Page < 2. of 2 ZO 3 Appendix P 2019 Foderal income Tax formation Qualifed Dividends & Capltal Galns Tax Rates Standard Mileage Rates Colectible gain 28% Business miles 50.58 Section 1202 oain Unrecaptured Section 1250 gain Diher capital gans and qualified dividends based on taable Income Charity miles S0.14 25% Medical miles 50 20 Moving miles $0.20 Zeto tax rate Single & Marred tiing seporately. taxable income of S0-539,375 Mamed fing jontly. taxabie income of $0-S78,750 Head of household table income of S0-$52.750 Chld Tax Credit Amount per child under 17 $2.000 Credit reduction550 per $1,000 over AGI threshold $400,000 $200,000 Married filing jointly 15% tax rate Single & Mamed fiing separately taxable income of $39376-$434,550 Mated ting jointly. tanable inconme of $78,751-S488,850 Hoad of householia taable income of $52,751-5461,700 Wi oter tpayers Coverdell Educational Savings Accounts Contributions list-$2,000 per year per boneficiory, must be in cosh, and must be made betore the beneticiary ns 18. 20% tax rate Singe and Married fing separately taxable income of over $434.550 Manied ing jointiy taxoble income of over $488,850 Head of bouseholt taeincome of over $461,700 Shori demi capital gani (held 1 yeur or lossy are taed at prdinary tax tates Phase-out Thresholds Marnied ling jointly-AGI Single-AGI $190,000-S220,000 $95,000-S110,000 Traditional IRA Contribution Deduction IRA contributionsLower of SE00 or the amount of compensabon Standard Deduction Filng Status Basic Standard Deduction Individuals who are oge 50 ar older-Lowet ot S700o or S12200 C Get Hom lei With Cheg x C Problem 245n0 2-6 Chae X C Probiem45 n0260aesX 9015/e15902967module itemds7438726 P Tax Rate Schedules.pdf x Rate Schedules.pdf 019 Tax Rate Schedules.pdf (313 KB) Snge and Mamed fing sepatitety: taxable ncome of In coh, and munt be made before e beneficary tums 18 ovor $434,550 Phasout Thresholds Married fengjointly AGI Mamed ing jotly: laable income of over 5488,850 Head of housetold. aible ncome ol over 3461.700 Shot-eem capitatgains eld 1 year or less oro tawed ot ordinary tax rates $190.000-5220.000 $95,000-S110,00 Single-AGI Traditional IRA Contribution Deduction RA contributions-Lower of $6.000 or the amount of compensation individuas who are age 50 or oldot-Lower of $7.000 or compensation Standard Deduction Filing Status Basic Standard Deduction Snge Maed ting jonty Married ting separatoty Hend of nouschold $12.200 $24,400 Fhne outs if the indvidual isa purticipant in ancither teement plan $12.200 S18,350 $103.000-S123,000 Phase out range Greater than $123.000-no deduction $64,000-$74,000 Greuter than $74.000-no deduction Married Duitymg widowjer) Adaional over 65 or bind Mamed, qual wdower) Sngetead of tiousehold $24,400 Single Phase-out range $1,300 $1.650 Roth IRA Contribution Social Securtty, Medicare. & Self-Employment Taxes Roth contribution S6.000 or compensation $7.000 or compensation Employee Rate Income Linit 50 or oldor Socia Secuty 6.2% $132900 AlRoth contributions are not tax deductible Medicare 145% Unlimted Jont Retums-S193.000-$203.000 phase-out ronge Tot 7.65% Self-employed Socia Secuity Single or head of household-$122000-S137.000 phase out range Rate Income Limit 12 4% $132.900 Modicare 29% Unimited tal 15. Health Savings Account Contribution An addn Modcare tax of 0s asessed on woges jand stemploynent income in cces of $250,000 mared hng joity. S15.000 utied fang separatety). or $200 000 at oer Famly $7000 Naxpavers wno are age 55 or older may contribute an addtonal s1.000 (14500 individul or So tM

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

aAnswer 4433 bNO Explanation As per estimated tax harbor rule Taxpayers with AGI less than 150k ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started