D died on May 1, at the age of 55. He was survived by his wife, W (aged 52), a son s (age 32),

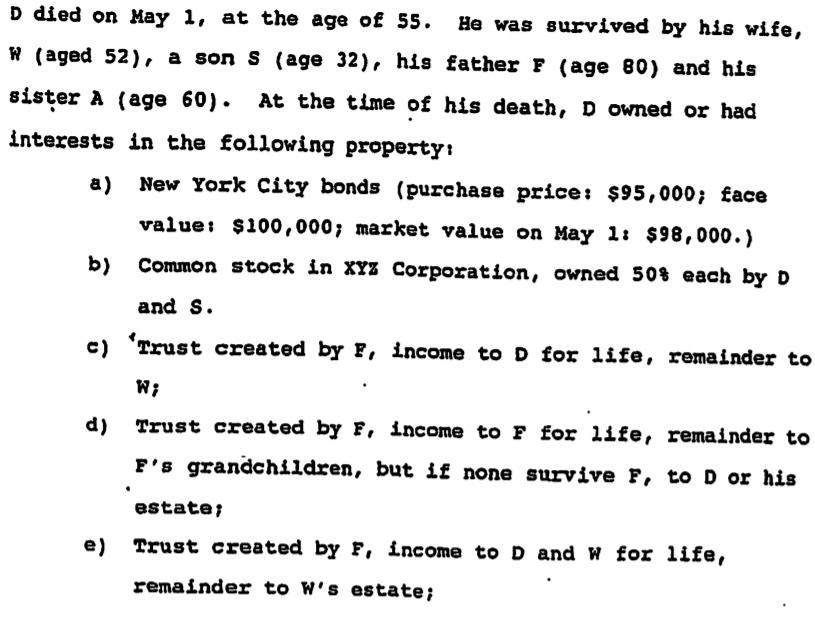

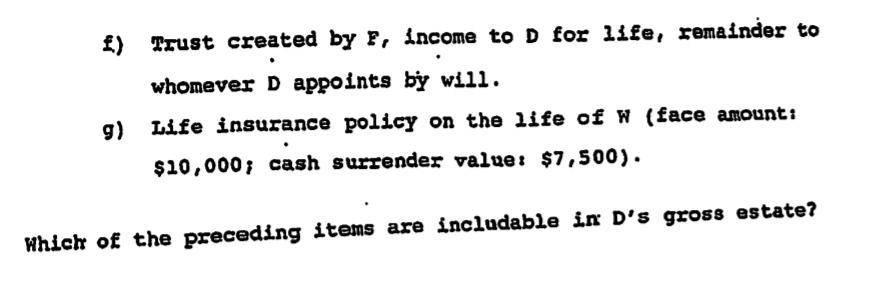

D died on May 1, at the age of 55. He was survived by his wife, W (aged 52), a son s (age 32), his father F (age 80) and his sister A (age 60). At the time of his death, D owned or had interests in the following property: a) New York City bonds (purchase price: $95,000; face value: $100,000; market value on May 1: $98,000.) b) Common stock in XYZ Corporation, owned 50% each by D and S. c) 'Trust created by F, income to D for life, remainder to W; d) Trust created by F, income to F for life, remainder to F's grandchildren, but if none survive F, toD or his estate; e) Trust created by F, income toD and W for life, remainder to W's estate; ) Trust created by F, income to D for life, remainder to whomever D appoints by will. 9) Life insurance policy on the life of W (face amount: $10,000; cash surrender value: $7,500). Which of the preceding items are includable in D's gross estate?

Step by Step Solution

3.42 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Items includable in Ds gross estate are as follows a Market Value Fair value of New york City bonds ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started